- United States

- /

- Specialty Stores

- /

- NYSE:BBWI

What Bath & Body Works (BBWI)'s 2025 Holiday Collection Reveal Means for Shareholders

Reviewed by Sasha Jovanovic

- Bath & Body Works recently released the first part of its 2025 holiday collection, showcasing popular returning products along with two new seasonal scents and confirming that further holiday offerings will be introduced in the coming months.

- This annual launch is a cornerstone for the company, as it often drives elevated store traffic and renewed consumer engagement leading into the critical holiday sales period.

- Next, we assess how this new holiday collection, arriving just before peak shopping season, could influence Bath & Body Works' existing investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Bath & Body Works Investment Narrative Recap

The core story for Bath & Body Works centers on its ability to turn seasonal and trend-driven releases into consistent store traffic and customer loyalty, even as it faces weak same-store sales trends and slowing demand growth in its core markets. The early release of the 2025 holiday collection might help support store visits and consumer engagement near-term, but it does not materially shift the biggest catalyst, expanding the brand's reach to new and younger consumers, or ease ongoing pressures from digital underperformance and margin risk.

Of the company’s recent announcements, the entry into over 600 college campus stores stands out for its relevance to both the holiday collection launch and longer-term growth drivers. This expansion goes directly to the key catalyst of reaching new customer demographics, particularly Gen Z, reinforcing efforts to diversify sales beyond legacy store formats just as new seasonal products are rolling out.

However, investors should also be aware that, in contrast, persistent digital sales weakness and margin pressure continue to pose risks that could limit any boost from even a strong seasonal launch…

Read the full narrative on Bath & Body Works (it's free!)

Bath & Body Works' outlook anticipates $8.1 billion in revenue and $860.7 million in earnings by 2028. Achieving these targets implies a 3.1% annual revenue growth rate and a $132.7 million increase in earnings from the current level of $728.0 million.

Uncover how Bath & Body Works' forecasts yield a $40.73 fair value, a 57% upside to its current price.

Exploring Other Perspectives

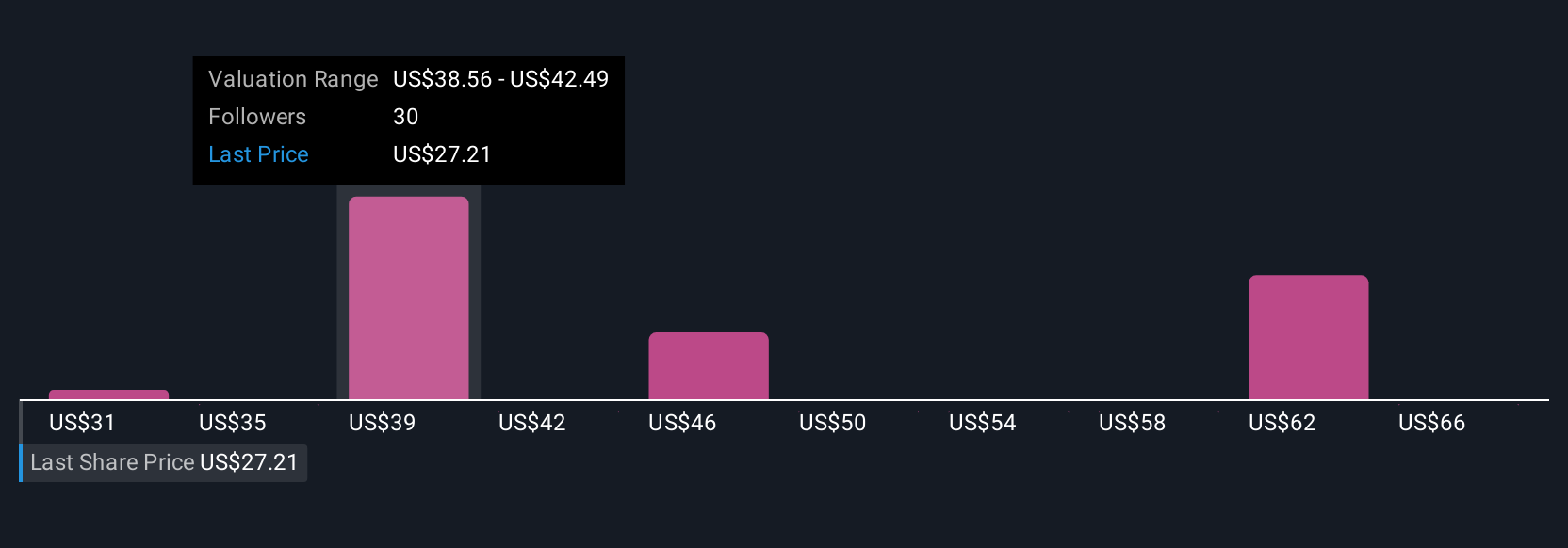

Ten private investors in the Simply Wall St Community estimate fair values for Bath & Body Works between US$30.70 and US$70, spanning a broad range. While opinions differ, many are watching closely whether customer base expansion materializes as a lasting growth engine.

Explore 10 other fair value estimates on Bath & Body Works - why the stock might be worth over 2x more than the current price!

Build Your Own Bath & Body Works Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bath & Body Works research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bath & Body Works research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bath & Body Works' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bath & Body Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBWI

Bath & Body Works

Operates as a specialty retailer of home fragrance, personal and body care, soaps, and sanitizer products.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives