- United States

- /

- Specialty Stores

- /

- NYSE:BBWI

Taking Stock of Bath & Body Works’s Valuation Following New Disney Villains Collection Launch

Reviewed by Simply Wall St

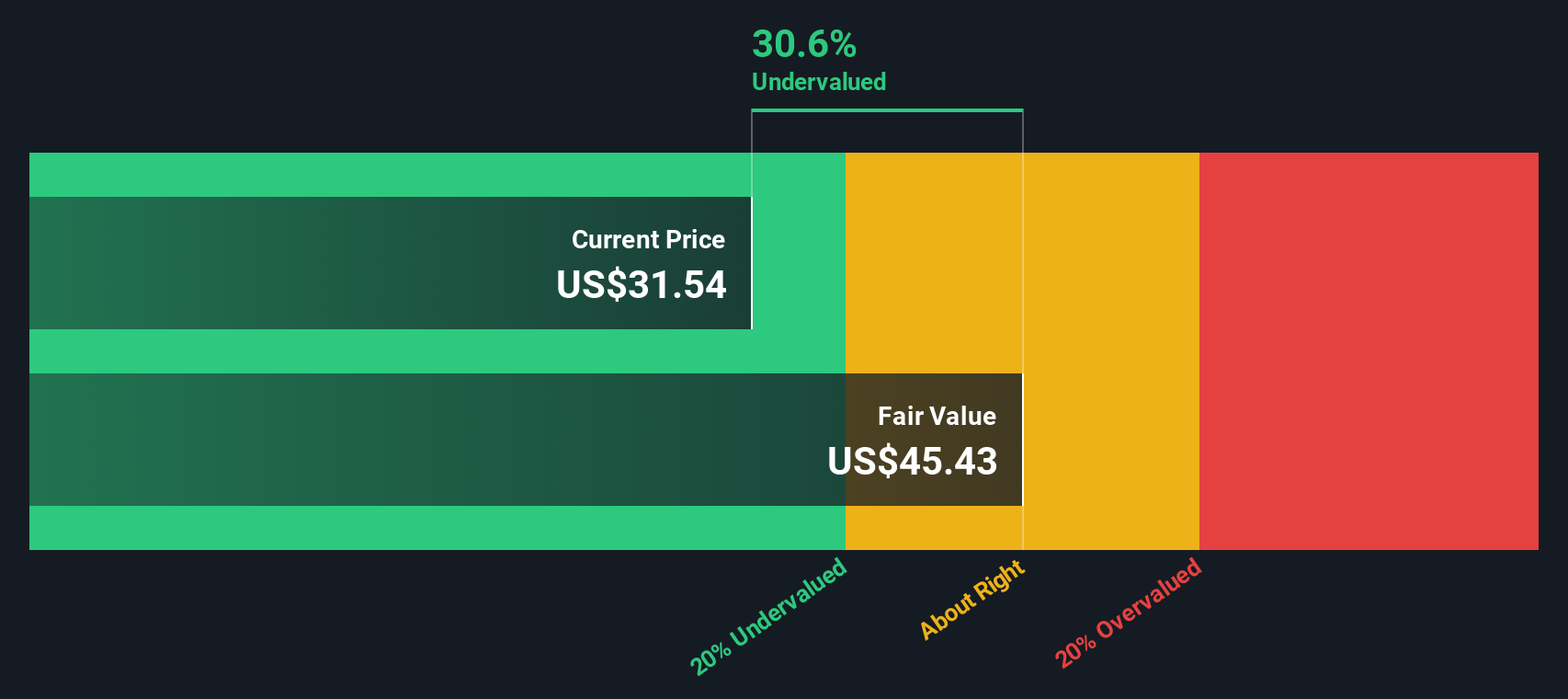

Most Popular Narrative: 23.7% Undervalued

According to the narrative by Zwfis, the current valuation pegs Bath & Body Works as notably undervalued compared to its fair value estimate, with a substantial discount rate factored in.

If they can hit these new target markets that I definitely believe they can hit these numbers. As of this moment I am willing to pay up to $33.95 assuming that they can hit my current 1 year projection and a 20% ROR.

Want the inside story behind this bold valuation? The narrative is driven by aggressive profit growth projections, ambitious market expansion strategies, and crucial margin assumptions. Curious what happens when the math goes beyond dividends and bets on debt paydown and untapped markets? Find out which overlooked financial signals point to a much higher target. According to this narrative, the market is missing something significant.

Result: Fair Value of $40.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing debt levels and slower than expected international or male market expansion could challenge this optimistic outlook and delay meaningful gains.

Find out about the key risks to this Bath & Body Works narrative.Another View: Discounted Cash Flow Perspective

Looking at Bath & Body Works from the perspective of our DCF model presents a story similar to the user narrative. The DCF approach also indicates that the stock is undervalued, though it relies on its own set of assumptions regarding future cash flows. Is the market overlooking insights that the numbers suggest, or is there additional risk incorporated that is not immediately apparent?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bath & Body Works Narrative

If you see the numbers differently or want to test your own thesis, you can dive into the details and build a custom narrative in just minutes. Alternatively, you can do it your way.

A great starting point for your Bath & Body Works research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Do not limit your strategy to just one stock when there is a world of distinctive investment ideas ready to be seized. Take charge of your portfolio's future with these timely opportunities uniquely surfaced by Simply Wall Street. You will not want to overlook what’s next in these fast-moving sectors:

- Capitalize on the future of healthcare by targeting companies pioneering artificial intelligence solutions in the medical field. Check out healthcare AI stocks.

- Unlock the potential of value by searching for stocks trading below their intrinsic cash flow estimates with undervalued stocks based on cash flows.

- Boost your income streams with steady picks offering yields above 3 percent. See the possibilities with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bath & Body Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBWI

Bath & Body Works

Operates as a specialty retailer of home fragrance, personal and body care, soaps, and sanitizer products.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives