- United States

- /

- Specialty Stores

- /

- NYSE:BBWI

Could Recent Bounce Signal a Turning Point for Bath & Body Works Stock in 2025?

Reviewed by Bailey Pemberton

If you're looking at Bath & Body Works and wondering whether to buy, hold, or sell, you're not alone. It’s a name many retail investors recognize, especially with the store’s signature scents lining mall corridors. But with the stock recently closing at $26.5 and posting a 5.9% gain over the past week, things are starting to get interesting. Zooming out, the past year hasn’t been rosy. The stock is down 14.9%, and the year so far has been more challenging, with a 30.1% decline. Those numbers might make some investors uneasy, but they also spark curiosity among value seekers. After all, volatility can create opportunities.

What’s behind this rollercoaster? Part of it comes from shifting investor sentiment in the retail sector and broader market reactions to changes in consumer spending. While Bath & Body Works hasn’t been grabbing headlines with dramatic news, the ongoing chatter about changing mall traffic and evolving shopper habits remains part of the backdrop. That said, the stock’s recent bounce suggests that the market may be recalibrating its expectations or catching on to the company’s underlying strengths.

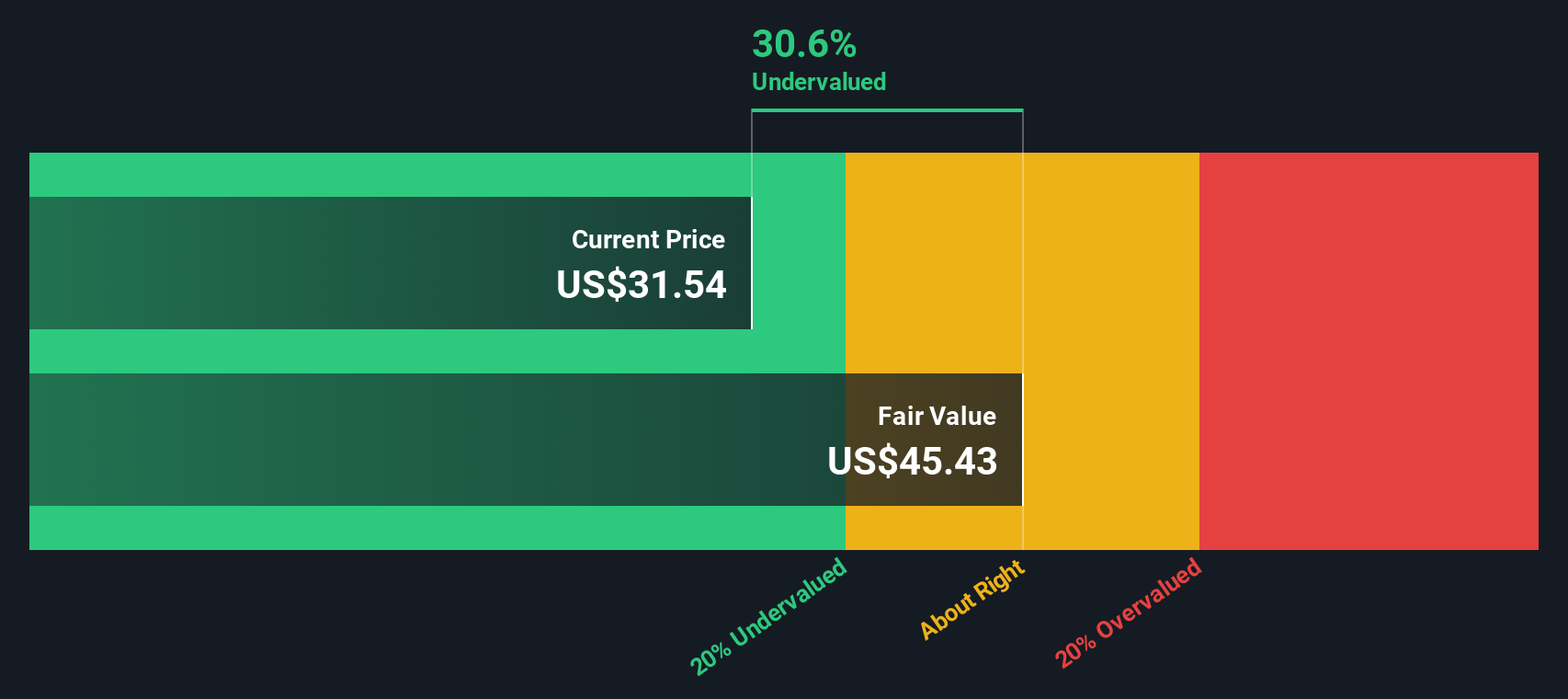

Curious how Bath & Body Works actually stacks up on valuation? It currently notches a value score of 5 out of 6, which means it’s undervalued on five different checks. We’ll walk through what those checks are and how they point to potential upside for investors. But before you make a call on the company’s future, let’s look at how analysts measure valuation and why there might be an even more insightful way to size up the stock at the end of this article.

Why Bath & Body Works is lagging behind its peers

Approach 1: Bath & Body Works Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and then discounting them back to their present value. This method is a staple of serious valuation analysis because it helps isolate the underlying value of a business by focusing on cash profit, rather than just earnings or revenue.

For Bath & Body Works, current Free Cash Flow (FCF) stands at $740.88 million. Analyst forecasts project modest growth, with FCF expected to reach $791.9 million by 2027. Beyond that, with some extrapolation, estimates see annual FCF crossing $998 million by 2035. Most cash flow forecasts are based on analysts’ five-year outlooks, while longer-term projections rely on trend-based estimates.

Based on this methodology, the DCF model calculates an intrinsic value for Bath & Body Works of $49.29 per share. With the stock currently trading at $26.50, the DCF analysis suggests the shares are 46.2% undervalued compared to their estimated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bath & Body Works is undervalued by 46.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bath & Body Works Price vs Earnings

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies like Bath & Body Works because it shows how much investors are willing to pay for each dollar of the company’s earnings. It is especially useful in the retail sector, where consistent profitability and straightforward earnings reporting make the PE ratio a reliable gauge of value.

A company’s “normal” or fair PE ratio is not fixed. Investors typically pay a higher multiple for companies expected to grow faster or with lower risks, and a lower multiple when growth is uncertain or risks are high.

Bath & Body Works is trading at a PE ratio of 7.5x, which is much lower than the Specialty Retail industry average of 16.1x and even further below the peer group average of 27.6x. This suggests the market is pricing in more caution or sees less growth compared to its peers and the sector as a whole.

The “Fair Ratio,” developed by Simply Wall St, offers a more tailored benchmark. Unlike industry averages or peer comparisons, the Fair Ratio considers Bath & Body Works’ specific growth outlook, risk profile, profit margins, market cap, and other company-specific factors. This approach gives a more accurate sense of where the stock’s valuation should sit relative to its actual fundamentals.

For Bath & Body Works, the Fair PE Ratio stands at 16.4x, which means the current PE multiple of 7.5x is significantly lower. This suggests the stock is undervalued, as the market is pricing the company below what would be justified by its risks and growth prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bath & Body Works Narrative

Earlier we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. Simply put, a Narrative is your unique story or perspective on a company’s future. It connects the dots between how you think Bath & Body Works will grow, your assumptions about revenue, profit margins, and risk, and what you believe its fair value should be.

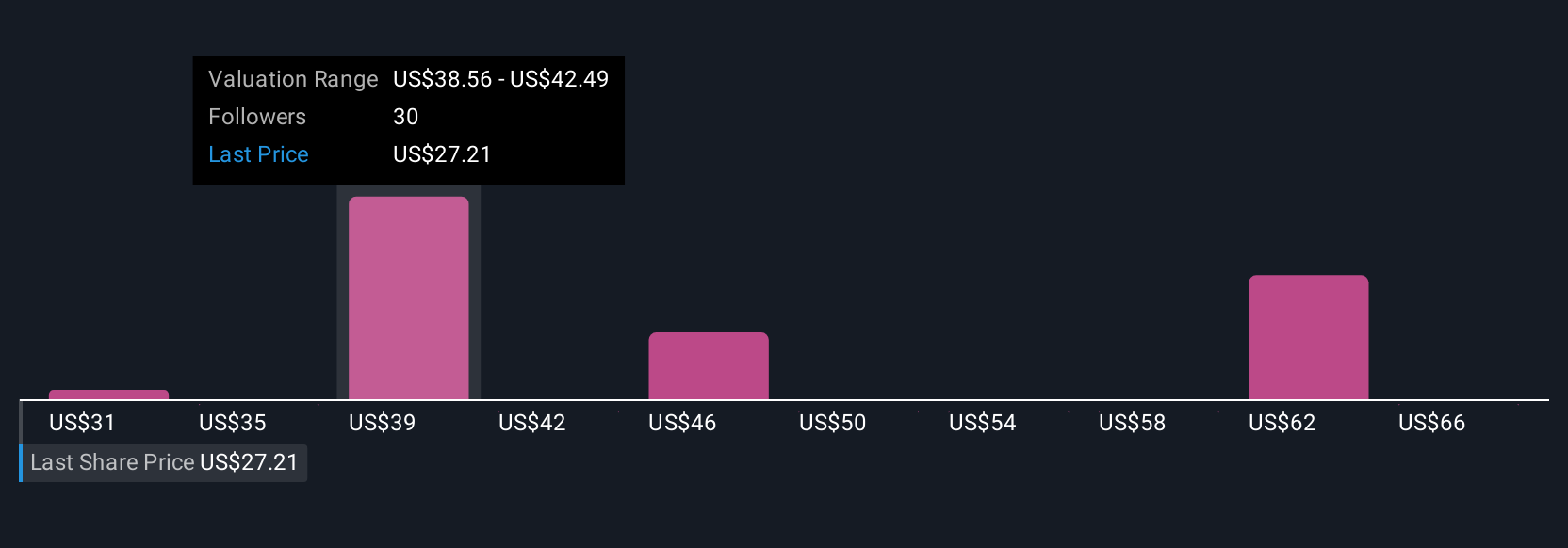

Unlike just looking at a PE ratio or industry average, Narratives let you link the company’s story, including its strategy, strengths, and challenges, to a financial forecast and ultimately to a fair value estimate that updates as new data comes in. On Simply Wall St’s platform, millions of investors use Narratives in the Community page to explore scenarios, stress test their thinking, and see how fair value compares to the latest stock price. This makes it easy to decide when to buy, hold, or sell.

Narratives refresh automatically as news or earnings are released, so your outlook always reflects the most current developments. For example, with Bath & Body Works, one investor may see the company’s loyalty program and expansion driving a fair value as high as $64.56, while another takes a more cautious view by factoring in debt and competitive pressures and arrives at $39.33. Narratives capture these differing expectations, empowering you to make investment decisions that fit your outlook with transparency and confidence.

Do you think there's more to the story for Bath & Body Works? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bath & Body Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBWI

Bath & Body Works

Operates as a specialty retailer of home fragrance, personal and body care, soaps, and sanitizer products.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives