- United States

- /

- Specialty Stores

- /

- NYSE:BARK

Shareholders in BARK (NYSE:BARK) have lost 56%, as stock drops 29% this past week

The nature of investing is that you win some, and you lose some. Unfortunately, shareholders of BARK, Inc. (NYSE:BARK) have suffered share price declines over the last year. To wit the share price is down 56% in that time. We wouldn't rush to judgement on BARK because we don't have a long term history to look at. More recently, the share price has dropped a further 29% in a month. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Since BARK has shed US$107m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for BARK

Given that BARK didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year BARK saw its revenue grow by 9.6%. While that may seem decent it isn't great considering the company is still making a loss. It's likely this muted growth has contributed to the share price decline of 56% in the last year. Like many holders, we really want to see better revenue growth in companies that lose money. When a stock falls hard like this, it can signal an over-reaction. Our preference is to wait for a fundamental improvements before buying, but now could be a good time for some research.

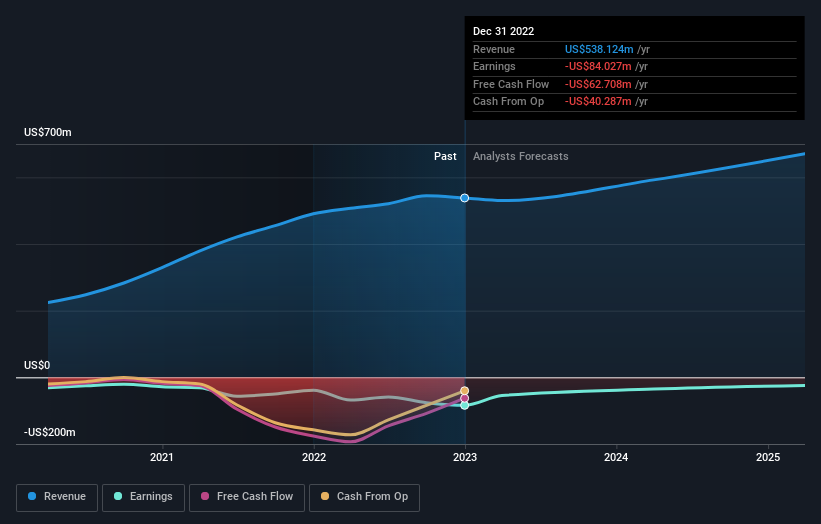

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

BARK shareholders are down 56% for the year, even worse than the market loss of 8.4%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 7.3%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand BARK better, we need to consider many other factors. Even so, be aware that BARK is showing 3 warning signs in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BARK might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BARK

BARK

A dog-centric company, provides products, services, and content for dogs.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion