Two Observations From Alibaba's (NYSE:BABA) Decline

It is fascinating that even after months of steady declines, Alibaba Group Holding Limited ( NYSE: BABA ) still trades at a price-to-earnings (P/E) ratio of close to 30.

Yet, there are 2 interesting developments to follow. First, the stock doesn't have a significant short interest, and second – institutional investors are slowly stepping away.

See our latest analysis for Alibaba Group Holding

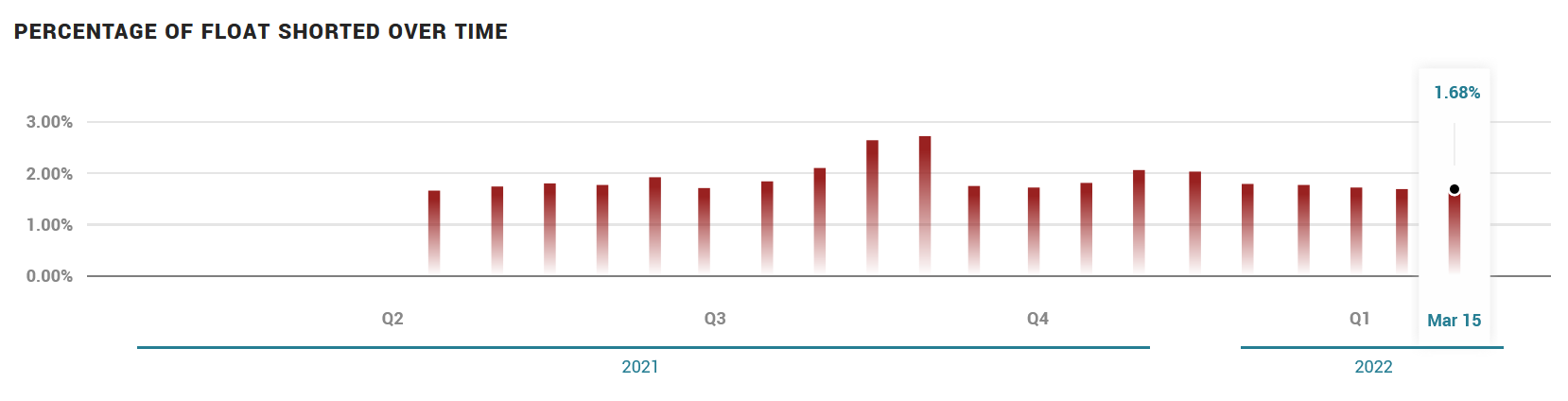

Lack of Short Interest

When we research the companies that experienced substantial declines, we often see high short interests, sometimes well into double-digits.

Yet, we cannot say the same for Alibaba. The stock lost over 65% from the peak, but short interest never went over 3%. Thus, we can conclude that this decline was not speculative but rather due to deteriorating investors' confidence to accept higher valuation.

Tracking the Ownership Change Over the Months

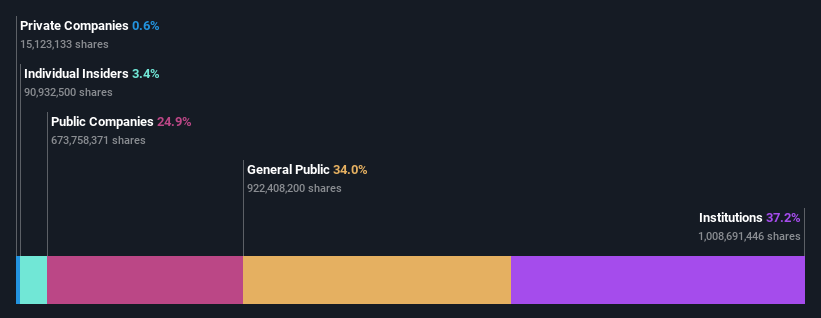

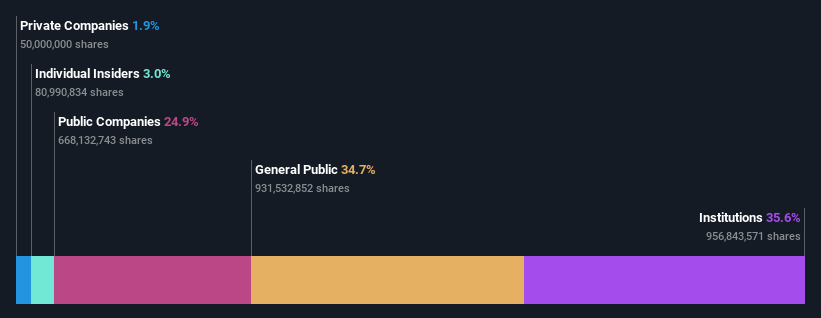

As we periodically track the ownership changes of the stock over the months, here are 3 snapshots from the last few quarters.

1. August 2021

2. December 2021

3. April 2022

As you can see from the trend, individual insiders have trimmed their stake while private companies boosted it.

However, the most significant change is the decline of institutional interest as they dropped about the same size of shares that retail investors picked up.

What Does This Mean for Investors?

All of the retail investors' favorite stocks that experienced significant rallies in the short term did so because of short-squeezes. These were stocks with exceptionally high short interest, usually deep into double-digits.

Yet, at the moment, Alibaba has a short interest of 1.68%. While this doesn't mean a short-term rally cannot occur. As recently as one month ago, the stock rallied over 50%. A retail-driven short-squeeze is unlikely due to a lack of short-sellers.

As for the ownership changes, there are 2 observations – both of which are negative. The first one is the lack of insider buying after a significant decline. If anything, insiders decreased their stake from 3.3% to 3%. The second one is a gradual decrease of interest from institutional investors, who slowly reduced their stake by over 5%. While institutions make mistakes like everyone else, their decisions are generally classified as informed.

While it is well worth considering the different groups that own a company, other factors are even more important. You should be aware of the 3 warning signs we've spotted with Alibaba Group Holding. But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives