Does Alibaba’s Recent 8% Pullback Signal Opportunity After Regulatory Headlines?

Reviewed by Bailey Pemberton

- Wondering if Alibaba Group Holding is a bargain or overpriced? You are not alone; the stock’s value has been a hot topic among investors lately.

- After a sizzling 94.0% year-to-date rally and a 73.2% gain over the last 12 months, Alibaba’s shares have cooled off with an 8.4% drop in the past week and 12.0% over the last month, which shows that volatility is still in play.

- Recent headlines have focused on Chinese regulatory updates and evolving e-commerce trends, helping to explain some of the recent swings in the stock price. With attention shifting to how Alibaba can navigate competitive pressures and policy changes, investors are watching closely for signs of stability or renewed risk.

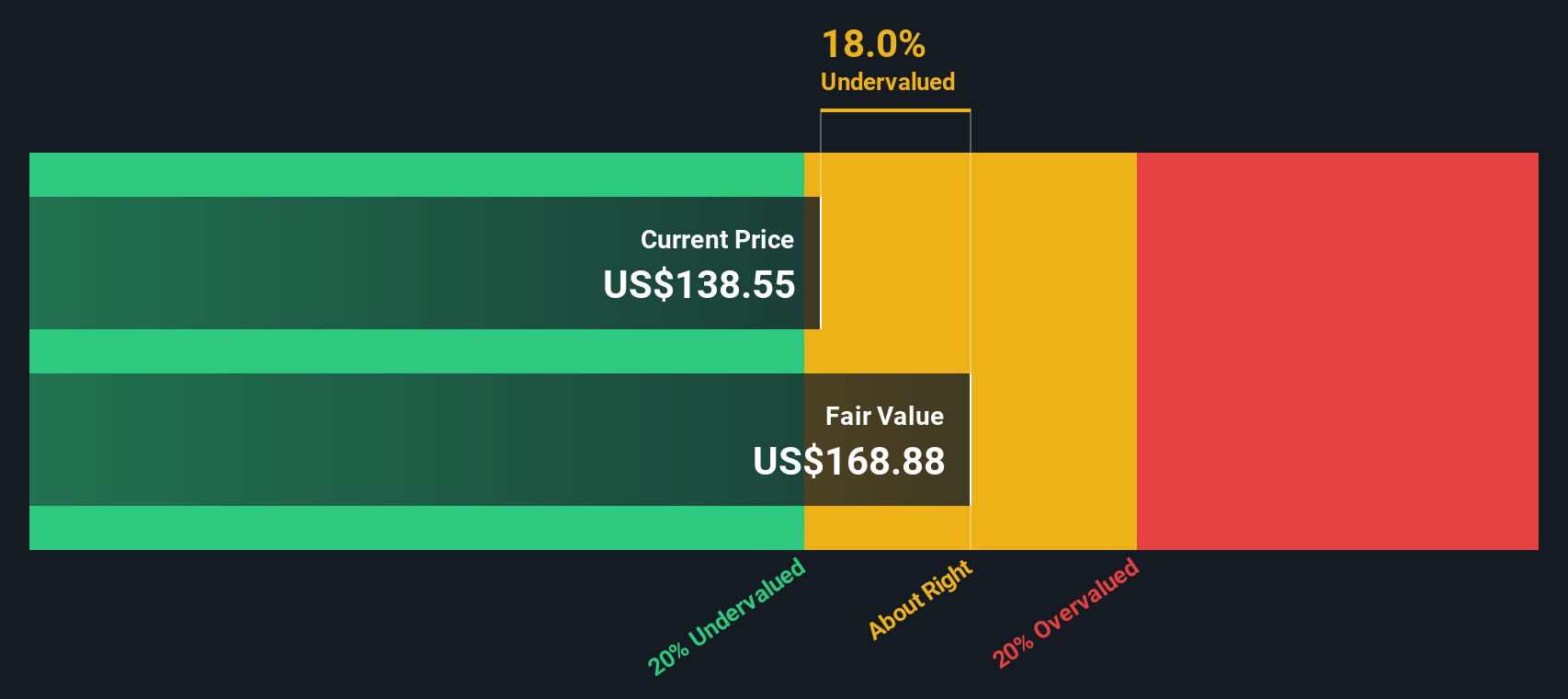

- On our valuation scorecard, Alibaba checks the “undervalued” box in 5 out of 6 categories, earning a 5/6 overall. We will break down the numbers using several valuation strategies. Stay tuned, as we will also explore another way to think about what Alibaba is truly worth.

Approach 1: Alibaba Group Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and discounting them back to the present value. For Alibaba Group Holding, this approach uses cash flow projections over the coming years to arrive at a fair valuation, with the model expressed in the company’s reporting currency, CN¥.

Alibaba’s latest twelve months Free Cash Flow stands at approximately CN¥83.1 Billion. Analysts predict strong growth, with projected Free Cash Flow rising substantially and reaching over CN¥189.3 Billion by the end of 2029. After analysts’ reported estimates, Simply Wall St extrapolates further and suggests Alibaba’s annual Free Cash Flow could continue to expand into the next decade, potentially topping CN¥393.4 Billion by 2035. All these future cash flows are discounted to their present value using market-appropriate rates.

According to the DCF model, the estimated intrinsic value for Alibaba Group Holding is $262.24 per share. This is 37.1% higher than its current market price, which implies that the stock is significantly undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alibaba Group Holding is undervalued by 37.1%. Track this in your watchlist or portfolio, or discover 850 more undervalued stocks based on cash flows.

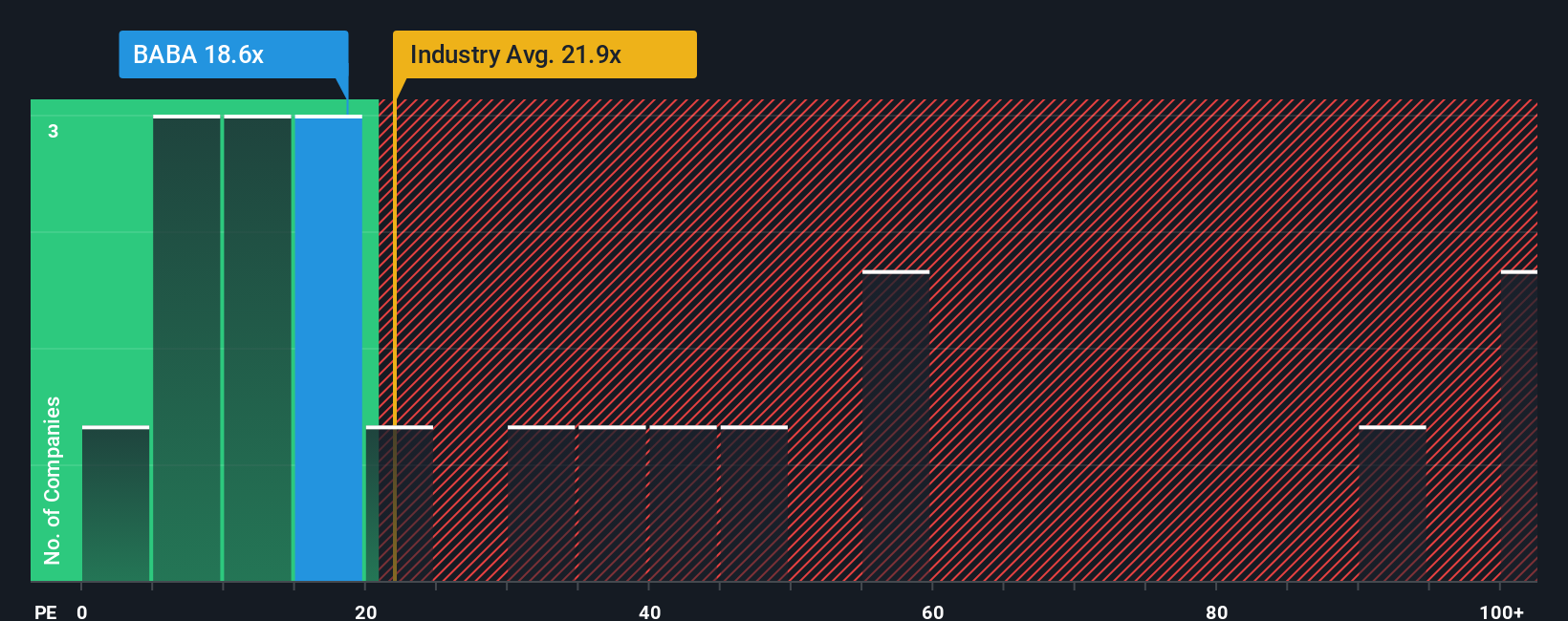

Approach 2: Alibaba Group Holding Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Alibaba Group Holding. It provides a straightforward way to compare how much investors are willing to pay today for a dollar of earnings, making it particularly useful for businesses with consistent profitability.

A company’s “normal” or “fair” PE ratio depends on factors like expected growth and risk. Higher expected growth or lower risk can justify higher PE ratios, while slow-growing or riskier businesses typically trade at lower multiples.

Alibaba currently trades at a PE ratio of 17.7x. For context, the average PE for the Multiline Retail industry is 19.9x, and the average among Alibaba’s peers is a much higher 45.8x. This suggests Alibaba is trading below both its industry and peer averages, potentially signaling a conservative market view of its growth or risk profile.

Simply Wall St’s proprietary Fair Ratio metric helps refine this comparison by factoring in more than just industry norms. It considers multiple elements, including Alibaba’s earnings growth, profit margin, industry, market capitalization, and risk factors, offering a tailored benchmark for what the company’s multiple should be. This makes it a more reliable valuation reference than a simple industry or peer comparison.

Alibaba’s Fair PE Ratio is 27.6x, notably higher than the current market multiple of 17.7x. This gap suggests investors may be underestimating the value of Alibaba’s future earnings potential when compared against its fundamentals and growth prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

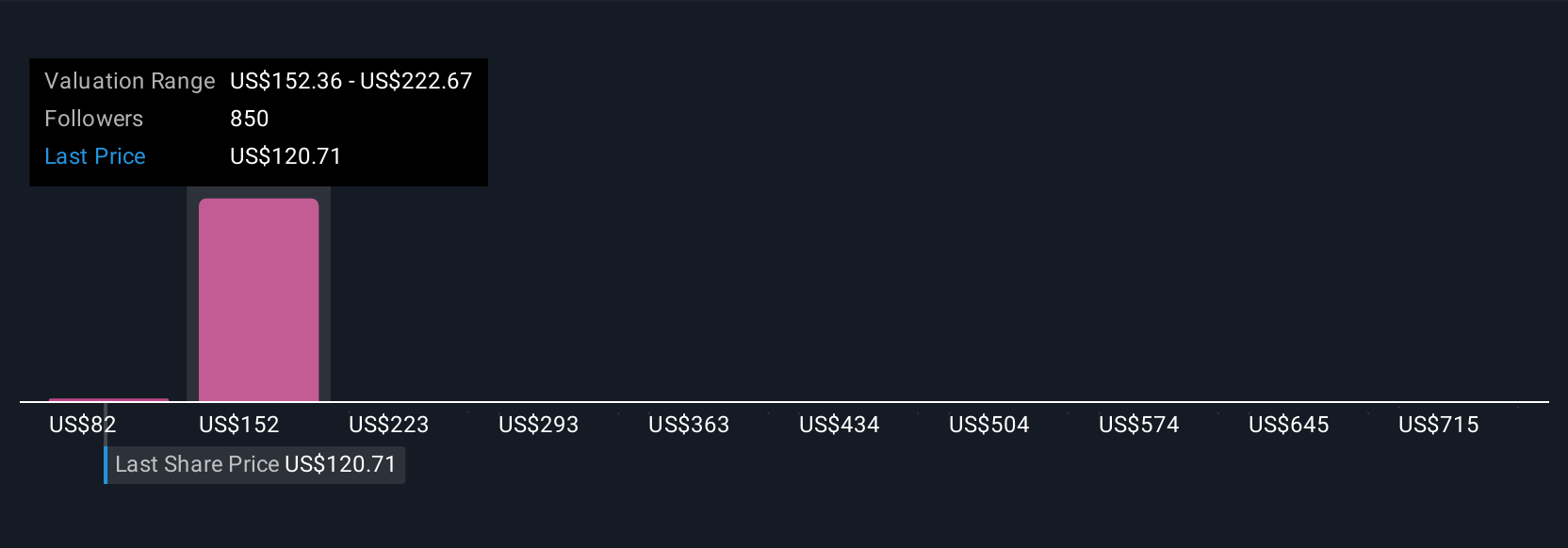

Upgrade Your Decision Making: Choose your Alibaba Group Holding Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story or perspective about a company, combining both the numbers such as your assumed fair value, revenue, earnings, and margin estimates along with the reasoning behind them.

Narratives are powerful because they link a company’s unique story to a financial forecast, which then connects directly to a fair value for the stock. On Simply Wall St's Community page, millions of investors use Narratives as an easy and accessible tool to clarify their investment thesis and see it quantified in real time.

By comparing your chosen Fair Value to the current price, Narratives help you decide whether it’s time to buy, hold, or sell based on your outlook. They update dynamically with new information, reflecting the impact of news or earnings immediately so your investment view stays current.

For Alibaba Group Holding, different investors may see very different opportunities or risks: while some forecast fair values close to $195.74 based on aggressive cloud and AI growth, others think $107.09 is more realistic, prioritizing trade headwinds and regulatory risks.

For Alibaba Group Holding, we’ll make it really easy for you with previews of two leading Alibaba Group Holding Narratives:

- 🐂 Alibaba Group Holding Bull Case

Fair Value: $195.74

Current Discount: 15.8% undervalued

Forecast Revenue Growth: 8.8%

- Massive investments in AI, cloud, and quick commerce are poised to drive long-term revenue and margin growth. This creates a stronger enterprise and digital ecosystem.

- Integration across business units and technological partnerships enhance user engagement, competitive positioning, and market share, especially in high-value cloud services.

- Short-term margin pressure is expected due to heavy spending. However, analysts see long-term earnings and pricing power improving as new business lines reach scale.

- 🐻 Alibaba Group Holding Bear Case

Fair Value: $107.09

Current Premium: 53.9% overvalued

Forecast Revenue Growth: 14.1%

- Recent growth in AI and cloud services, while impressive, is fully priced in and faces competitive, regulatory, and geopolitical headwinds.

- DCF analysis using conservative long-term growth and discount rates shows the stock price trades at a significant premium to intrinsic value.

- Risks include trade tensions, possible regulatory crackdowns in China, and uncertainties around global adoption and sustained profit margins.

Do you think there's more to the story for Alibaba Group Holding? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion