Alibaba (NYSE:BABA) Valuation: Weighing AI Innovations and Singles’ Day Momentum

Reviewed by Simply Wall St

Alibaba Group Holding (NYSE:BABA) is making fresh headlines after unveiling new AI-powered features in its Quark app and introducing the Quark AI Glasses. These advances highlight the company’s commitment to artificial intelligence aimed at everyday users.

At the same time, the company is seeing improved sales figures during China’s annual Singles’ Day shopping festival. This combination of tech innovation and consumer demand is bringing renewed investor attention to Alibaba’s stock.

See our latest analysis for Alibaba Group Holding.

Alibaba’s rapid stream of AI launches and impressive Singles’ Day sales have only amplified its recent surge, with a 105.7% share price return so far in 2025 and an 82.3% total return over the past year. Momentum is clearly building, driven by optimism around innovation, the company’s rebound from regulatory headwinds, and its bold investments in technology and real estate.

If Alibaba’s turnaround has you wondering what else is catching investors’ attention, now is the perfect moment to explore opportunities in tech and AI. See the full list here: See the full list for free.

With Alibaba’s impressive rally and strong analyst support, the debate now turns to valuation. Is the recent surge an indicator of more upside to come, or has the market already factored in Alibaba’s future growth potential?

Most Popular Narrative: 63.1% Overvalued

According to StefanoF, Alibaba’s current share price sits well above the narrative’s estimated fair value. This perspective is rooted in a detailed discounted cash flow analysis with specific growth and risk assumptions underlying the calculation.

"While Alibaba shows strong operational momentum, particularly in AI and cloud services, the current stock price appears to fully reflect near-term growth prospects given macro headwinds and geopolitical risks. Just in the end I put my doubt, why has Michael Burry sold all?"

Curious about the bold revenue forecasts and the precise growth expectations driving this below-fair-value call? Uncover the critical assumptions, see which business segment takes center stage, and find out what causes that big valuation gap. Dive in to discover the surprising factors powering this narrative’s fair value math.

Result: Fair Value of $107.09 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential regulatory pressure or heightened US-China tensions could quickly shift sentiment and challenge the current view that Alibaba is overvalued.

Find out about the key risks to this Alibaba Group Holding narrative.

Another View: What Do Market Ratios Say?

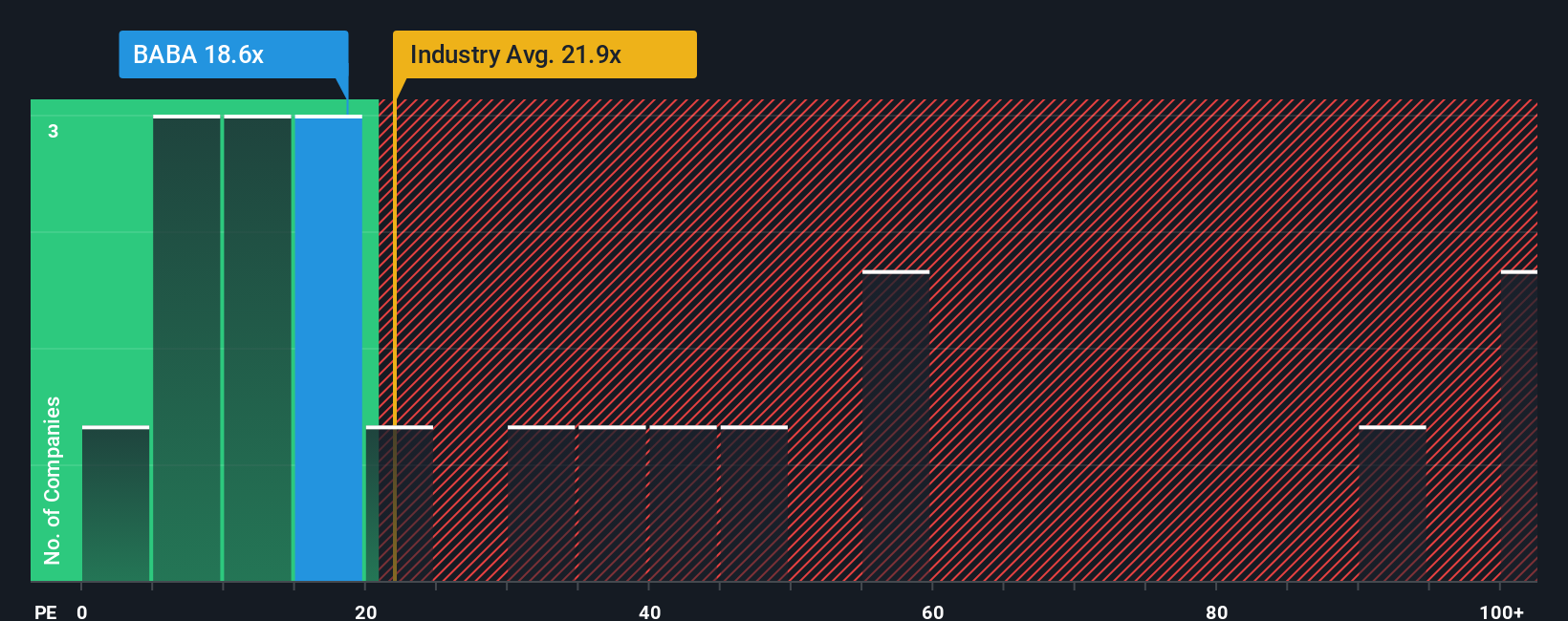

While the discounted cash flow analysis paints Alibaba as overvalued, its market ratio tells a different story. The company’s price-to-earnings ratio is just 18.7x, much lower than the industry average of 21.3x and significantly lower than peer averages at 44.4x. The fair ratio suggests a market shift toward 29.2x. Does this relative discount signal overlooked value, or is caution still warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alibaba Group Holding Narrative

If you have a different perspective or want to chart your own course, you can quickly build your own interpretation using our tools in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Alibaba Group Holding.

Looking for More Investment Ideas?

Why stop at Alibaba? The market is full of untapped opportunities you can identify before everyone else. Get ahead by using these specialized tools:

- Unlock steady income potential when you target these 17 dividend stocks with yields > 3% offering yields over 3% and robust fundamentals.

- Tap into the explosive potential of artificial intelligence with these 27 AI penny stocks spotlighting companies at the forefront of machine learning and automation.

- Accelerate your portfolio’s growth by zooming in on these 877 undervalued stocks based on cash flows, packed with stocks trading below their intrinsic value based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives