Alibaba (NYSE:BABA): Assessing Valuation Following US National Security Allegations and Renewed Investor Scrutiny

Reviewed by Simply Wall St

Shares of Alibaba Group Holding (NYSE:BABA) came under pressure after a White House national security memo alleged the company provided the Chinese government, including the military, access to customer data and AI-related services. The company has strongly denied these claims, but the controversy has prompted heightened scrutiny and has weighed on investor sentiment this week.

See our latest analysis for Alibaba Group Holding.

Just as Alibaba was generating buzz for its bold AI revamp and strong performance in cloud services, the security controversy reignited volatility, pushing the share price down 7.9% over the past month. That said, momentum is still in play as the stock has climbed more than 81% year-to-date, with a 75% total shareholder return in the last twelve months. This suggests that long-term confidence isn't fading even amid headline risk.

If recent tech sector shakeups have you rethinking what's next, this could be the perfect moment to discover See the full list for free.

With investors weighing both renewed regulatory risks and the company’s strong AI momentum, a crucial question emerges: is Alibaba’s sharp pullback a rare bargain in the making, or are markets already factoring in its growth prospects?

Most Popular Narrative: 43.6% Overvalued

According to StefanoF, the most widely followed narrative places Alibaba's fair value at $107.09 per share, compared to its recent close of $153.80. This sizable premium suggests the narrative questions whether current prices justify the outlook, considering company-specific growth and broader macroeconomic pressures.

While Alibaba shows strong operational momentum, particularly in AI and cloud services, the current stock price appears to fully reflect near-term growth prospects given macro headwinds and geopolitical risks. In the end, I still wonder why Michael Burry sold all his shares.

Do you want the inside scoop on what powers this bold fair value? One key financial forecast drives the narrative’s calculation, and the assumptions may surprise you. Wondering just how aggressive future cash flow projections have to be to reach that figure? Find out what makes this valuation tick and whether the risks and rewards are really priced in.

Result: Fair Value of $107.09 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent US-China tensions and growing regulatory scrutiny could quickly reshape the outlook. This may potentially challenge assumptions behind the current valuation narrative.

Find out about the key risks to this Alibaba Group Holding narrative.

Another View: Multiple-Based Value Paints a Different Picture

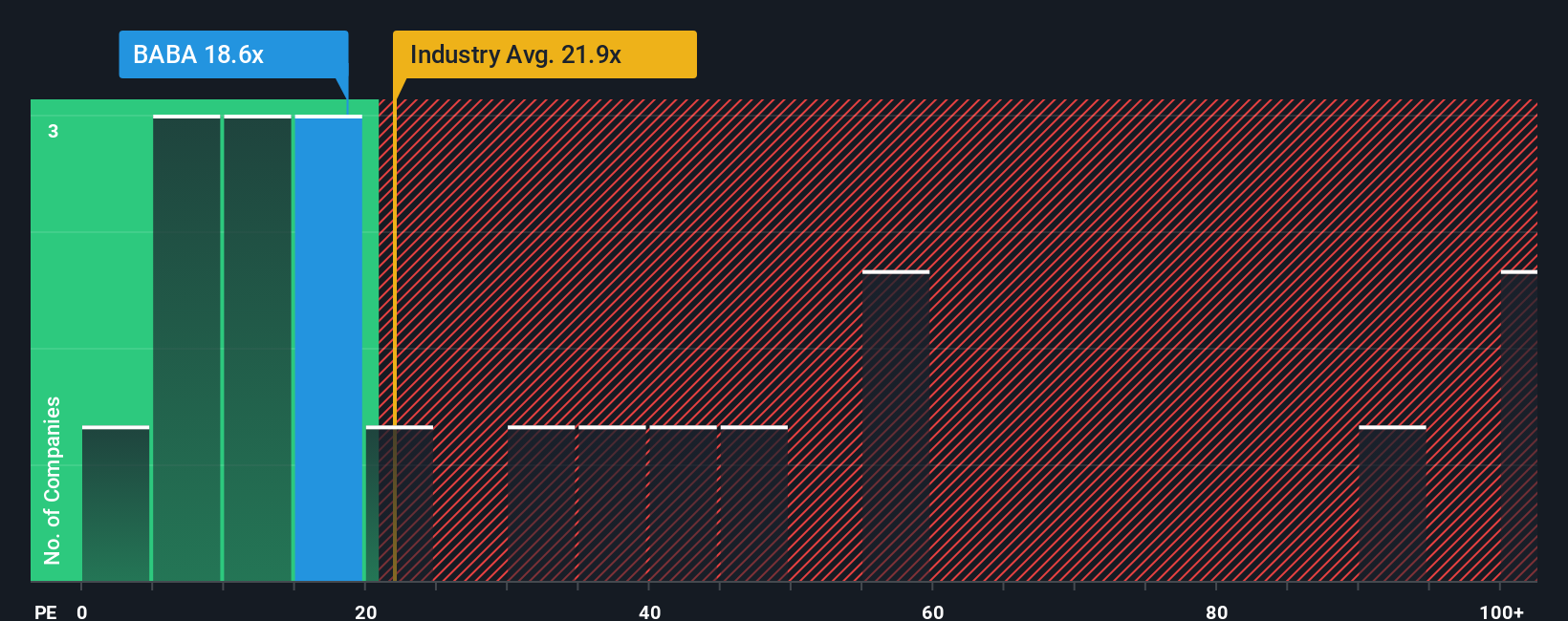

While the narrative points to overvaluation, a look at how the company's price compares to earnings, peers, and industry tells another story. Alibaba's price-to-earnings ratio of 16.4 is far lower than the industry average of 20.3 and its peer average of 38.8. It also sits well below the SWS fair ratio of 27.3. This gap suggests the market could be overlooking potential value, or is it a sign of caution about the future?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alibaba Group Holding Narrative

If you see the story differently or trust your own analysis, dive into the numbers and shape your own Alibaba narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Alibaba Group Holding.

Looking for More Investment Ideas?

Expand your investment horizons and sharpen your edge with ideas you might not have considered. Let the Simply Wall Street Screener guide you toward smart opportunities.

- Capture income potential with stocks offering strong yields by checking out these 16 dividend stocks with yields > 3% before they get priced up.

- Take advantage of the AI momentum and position your portfolio for tomorrow’s leaders with a look at these 25 AI penny stocks.

- Find compelling value on overlooked opportunities by using these 897 undervalued stocks based on cash flows that could be flying under most investors' radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives