Alibaba (BABA) Is Down 7.5% After Reports of Data Access Allegations – Has Regulatory Risk Shifted?

Reviewed by Sasha Jovanovic

- In recent days, reports surfaced alleging that Alibaba Group Holding provided access to customer data and AI-related services to the Chinese military, as cited in a White House memo and reported by the Financial Times. Alibaba has denied the allegations, but the serious national security concerns have prompted heightened market scrutiny and questions about potential regulatory consequences for the company's global operations.

- The controversy highlights the complexity of operating international technology platforms amid rising geopolitical tensions and underscores the increased sensitivity investors and regulators have toward data privacy and cross-border technology governance.

- We'll explore the impact of these high-profile data access allegations on Alibaba’s investment narrative, particularly regarding regulatory risk.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Alibaba Group Holding Investment Narrative Recap

To own shares of Alibaba today, you need to believe in the company’s ability to turn heavy AI and cloud investments, and strength in e-commerce, into sustainable growth and improving profitability over time, despite ongoing regulatory and geopolitical uncertainties. The recent allegations regarding data access to the Chinese military have increased short-term regulatory scrutiny, which could affect sentiment, but the core near-term catalyst remains the pace and payoff of Alibaba’s AI and cloud expansion. At this stage, the immediate material impact appears limited, but investor sensitivity to governance and regulatory risk is elevated.

Amid these concerns, Alibaba’s planned rebranding and AI upgrade of its ‘Tongyi’ app to ‘Qwen’, envisioned as a global rollout to compete with ChatGPT, highlights the group’s aggressive pursuit of generative AI as a business catalyst. This move sits at the heart of Alibaba’s investment narrative, intersecting directly with questions about regulatory oversight and international acceptance, especially as advanced AI technologies become more heavily scrutinized across markets.

In sharp contrast, investors should also be aware that mounting regulatory risk could suddenly become more than just...

Read the full narrative on Alibaba Group Holding (it's free!)

Alibaba Group Holding's outlook anticipates CN¥1,260.3 billion in revenue and CN¥171.1 billion in earnings by 2028. This projection is based on an annual revenue growth rate of 8.0% and an earnings increase of CN¥22.8 billion from current earnings of CN¥148.3 billion.

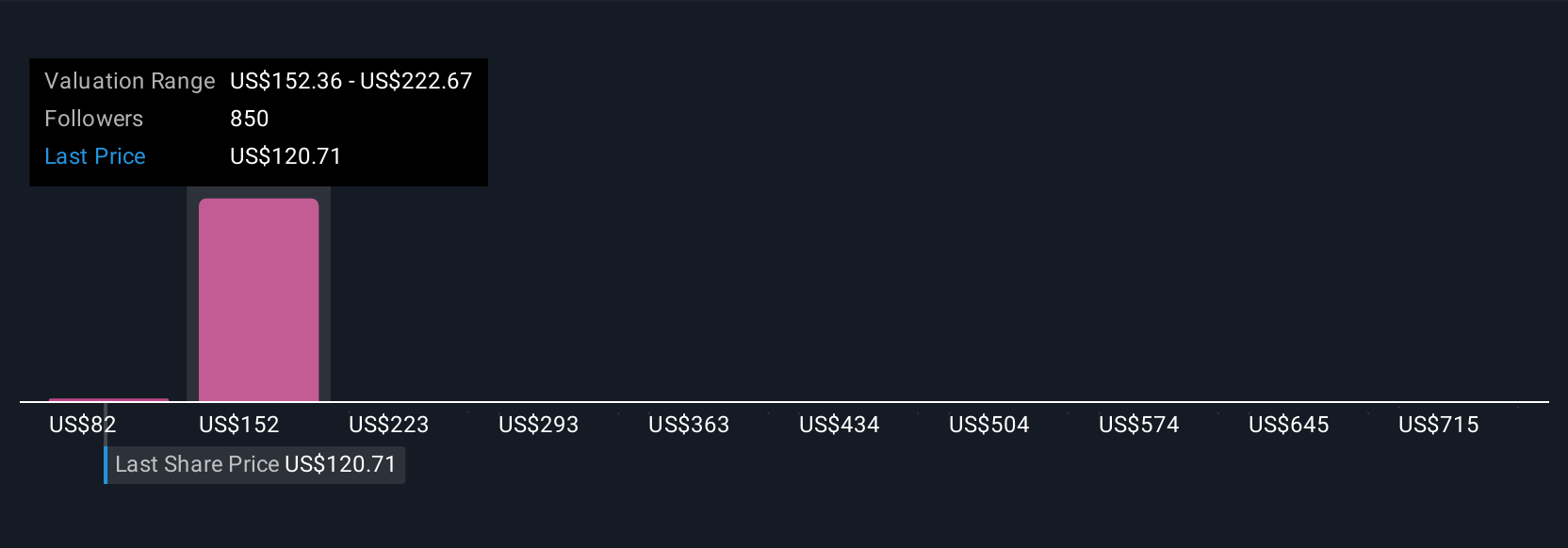

Uncover how Alibaba Group Holding's forecasts yield a $196.82 fair value, a 28% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community produced 69 fair value estimates for Alibaba, ranging widely from CN¥107.09 to CN¥261.82. As you explore this diversity of opinion, remember that heightened regulatory risk remains a central challenge affecting how Alibaba’s future performance is viewed across the market.

Explore 69 other fair value estimates on Alibaba Group Holding - why the stock might be worth 30% less than the current price!

Build Your Own Alibaba Group Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alibaba Group Holding research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Alibaba Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alibaba Group Holding's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives