- United States

- /

- Specialty Stores

- /

- NYSE:AZO

Is AutoZone’s (AZO) 3,000-Store Expansion Reshaping Its Capital Allocation Strategy?

Reviewed by Simply Wall St

- Recently, AutoZone announced plans to open nearly 3,000 new stores despite ongoing challenges from tariffs, inflation, and weak consumer confidence.

- This ambitious expansion may strain AutoZone’s capital resources and impact its share repurchase approach, highlighting concerns about maintaining growth under current economic headwinds.

- We’ll look at whether capital strain from large-scale expansion could reshape AutoZone’s investment narrative going forward.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

AutoZone Investment Narrative Recap

To be a shareholder in AutoZone, you need to believe in the company’s ability to grow its store network and maintain profitability even as tariffs, inflation, and cautious consumers weigh on results. The recent news of a planned 3,000-store expansion may impact short-term capital allocation, making the risk of margin pressures from higher SG&A expenses more important, while the main catalyst remains sales gains from commercial and mega-hub investments. If capital strain from growth plans proves immaterial, the overall narrative could remain unchanged.

Among the latest announcements, AutoZone’s ongoing share buybacks highlight its historic focus on returning value to shareholders. However, the expansion’s capital demands could limit future repurchases, reshaping the role buybacks play as a catalyst if the company must prioritize funding new store openings to drive growth.

By contrast, anyone looking at AutoZone should be aware that continued SG&A growth from aggressive expansion could lead to ...

Read the full narrative on AutoZone (it's free!)

AutoZone's outlook calls for $22.6 billion in revenue and $3.1 billion in earnings by 2028. This projection assumes a 6.1% annual revenue growth rate and a $0.5 billion earnings increase from the current earnings of $2.6 billion.

Uncover how AutoZone's forecasts yield a $4159 fair value, in line with its current price.

Exploring Other Perspectives

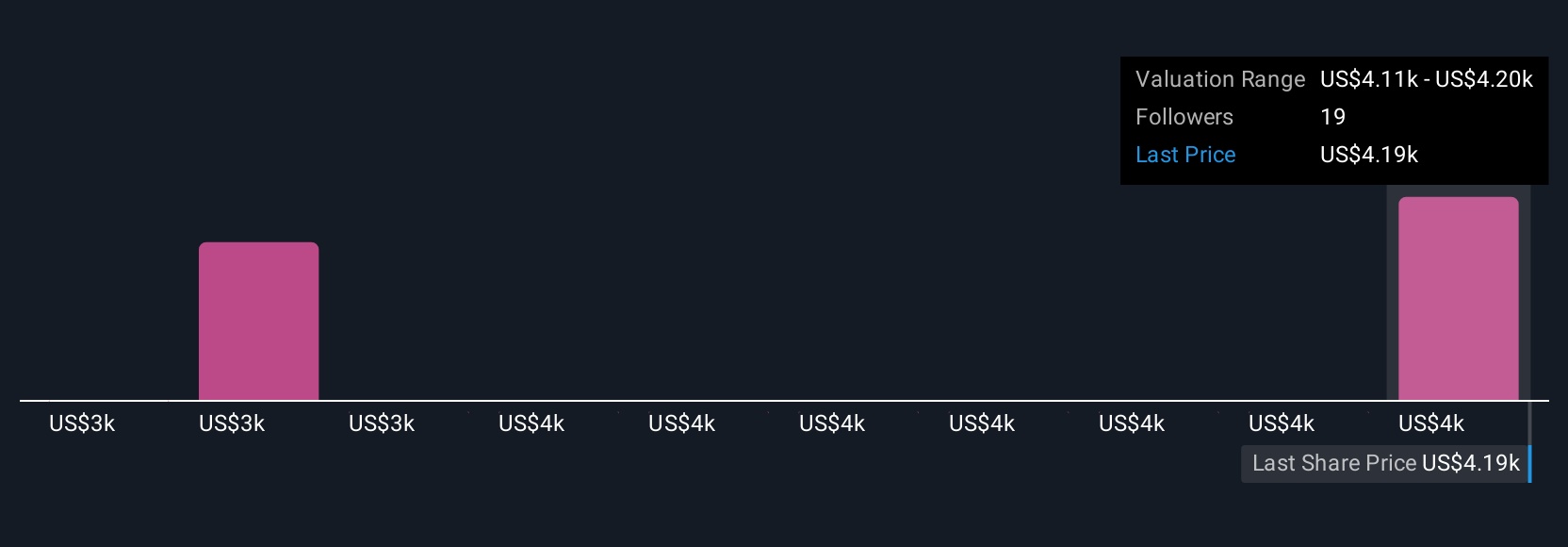

Simply Wall St Community members submitted fair value estimates for AutoZone ranging from US$3,065 to US$4,159 across four contributions. These varied assessments come as margin pressures from higher costs are an emerging risk that could influence future earnings and capital strategies, underscoring why exploring multiple viewpoints is essential.

Explore 4 other fair value estimates on AutoZone - why the stock might be worth 27% less than the current price!

Build Your Own AutoZone Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AutoZone research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free AutoZone research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AutoZone's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AZO

AutoZone

AutoZone, Inc. retails and distributes automotive replacement parts and accessories in the United States, Mexico, and Brazil.

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives