- United States

- /

- Specialty Stores

- /

- NYSE:AZO

AutoZone (AZO): Exploring Valuation as Shares Hold Near Record Highs

Reviewed by Kshitija Bhandaru

AutoZone (AZO) shares showed modest movement this session, closing at $4,253.71 and continuing their steady climb over the past month. Investors seem to be monitoring the company’s recent performance data for fresh clues about future trends.

See our latest analysis for AutoZone.

Looking beyond today’s modest move, AutoZone’s share price has been quietly building momentum this year. Its steady 1-year total shareholder return of 39% hints at consistent long-term strength and has outpaced many peers in the retail sector.

If you’re interested in opportunities across the auto sector, now could be the perfect moment to discover See the full list for free.

With shares trading near their all-time highs and solid performance data in hand, the question now is whether AutoZone is truly undervalued or if investors have already priced in all future growth, leaving little room for upside.

Most Popular Narrative: 3.8% Undervalued

With AutoZone’s fair value from the most closely followed narrative at $4,420, which is above its last close of $4,253.71, the narrative suggests untapped upside that could matter for forward-looking investors.

The expansion of Mega-Hub locations, with an aim to open at least 19 more in the next two quarters, will enhance inventory availability and support both retail and Commercial growth, potentially improving sales and operating margins.

Curious what powers this value call? The narrative is built around impressive growth assumptions for the next several years, with forecasts that rival some of the most ambitious specialty retailers. Surprised by the confidence in margin improvement and expanding reach? Click through and unpack the bold projections, underlying profit expectations and what has to happen for AutoZone to live up to this higher price tag.

Result: Fair Value of $4,420 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation and foreign exchange headwinds could challenge margins and revenue expectations. This may possibly shift AutoZone’s growth story in the coming quarters.

Find out about the key risks to this AutoZone narrative.

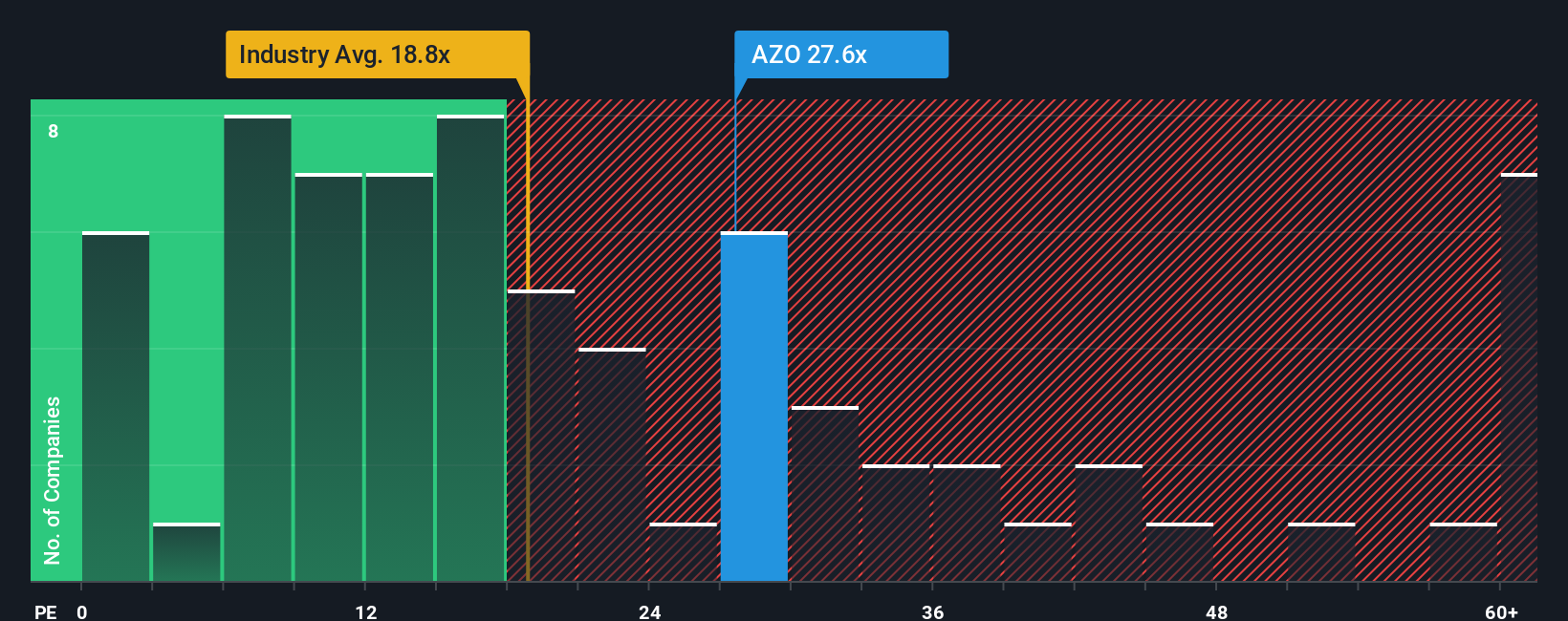

Another View: Valuation Through Market Multiples

Stepping away from fair value estimates, a look at AutoZone’s price-to-earnings ratio shows the stock trading at 28.4 times earnings. That is noticeably pricier than the US Specialty Retail industry’s 17.3 times, and also above AutoZone’s fair ratio of 19.4. This gap signals investors may be paying a premium for anticipated growth, but it also raises questions about valuation risk if those expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AutoZone Narrative

If you have a different take or want to dig into the numbers yourself, you can easily craft your own narrative for AutoZone in just a few minutes. Do it your way

A great starting point for your AutoZone research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Don’t miss your chance to get ahead of the market. There is a powerful lineup of investment ideas you can explore right now using Simply Wall Street’s free tools.

- Start building long-term wealth and put your money to work with these 19 dividend stocks with yields > 3%, which offers stable returns from leading income-generating companies.

- Stay ahead of global technology trends and position yourself for tomorrow’s gains by tapping into these 24 AI penny stocks, which are transforming industries with advances in artificial intelligence.

- Boost your portfolio with serious growth potential by targeting value opportunities among these 904 undervalued stocks based on cash flows, which are still trading below fair price expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AZO

AutoZone

AutoZone, Inc. retails and distributes automotive replacement parts and accessories in the United States, Mexico, and Brazil.

Limited growth with questionable track record.

Similar Companies

Market Insights

Community Narratives