- United States

- /

- Specialty Stores

- /

- NYSE:AZO

AutoZone (AZO): Evaluating Valuation After $1.5 Billion Share Buyback Boost and Growth Momentum

Reviewed by Kshitija Bhandaru

AutoZone (AZO) just announced a $1.5 billion increase to its buyback program, a move that points to management's confidence in the company's financial health and its existing momentum.

See our latest analysis for AutoZone.

In the bigger picture, AutoZone’s buyback boost arrives after a robust year. Its share price is up 24% year-to-date and the total shareholder return has reached an impressive 26.7% over the last twelve months. That is on top of recent board updates and continued growth moves, hinting that momentum is most definitely building for the retailer.

If this kind of steady growth sparks your curiosity, it is a perfect time to see what other companies in the auto retail space are up to and check out See the full list for free.

With performance metrics at all-time highs and an increased buyback signaling confidence, the real question is whether investors are catching AutoZone at a bargain, or if recent gains mean the market has already factored in the company’s future growth.

Most Popular Narrative: 11.8% Undervalued

With the most widely followed narrative putting fair value at $4,570, AutoZone's last close price of $4,030.17 trades well below that level. The setup suggests there are significant drivers that could explain this upside, and the narrative spells them out directly.

The expansion of Mega-Hub locations, with an aim to open at least 19 more in the next two quarters, will enhance inventory availability and support both retail and Commercial growth, potentially improving sales and operating margins.

Want to discover what’s really powering this optimistic outlook? The boldest assumption isn’t just about adding stores or boosting revenue. It’s about sustaining profit margins and applying a rare future earnings multiple usually reserved for sector leaders. See the details that back up this surprising fair value; there’s more to this story than meets the eye.

Result: Fair Value of $4,570 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation and higher operating costs remain real threats. These factors could pressure margins and challenge bullish assumptions for AutoZone’s growth ahead.

Find out about the key risks to this AutoZone narrative.

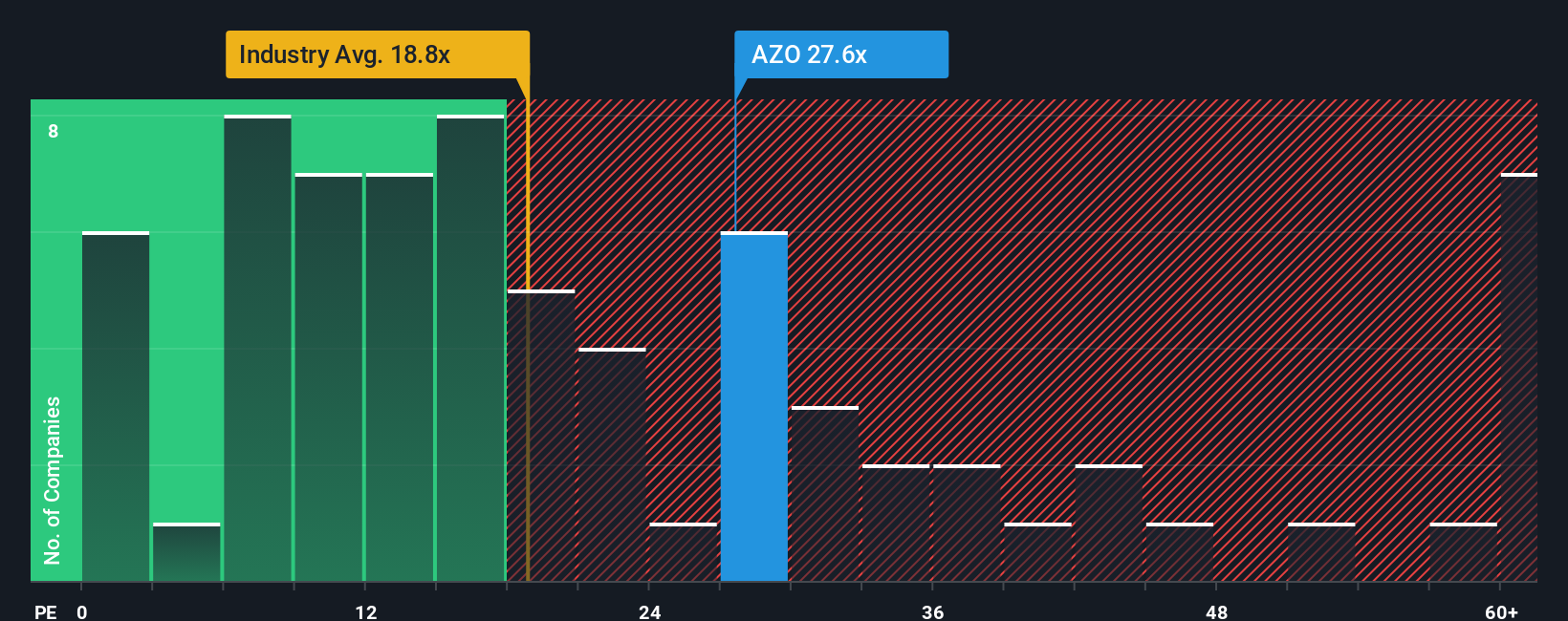

Another View: Assessing Value Using Multiples

Looking at valuation through the lens of the current price-to-earnings ratio tells a different story. AutoZone trades at 26.9x earnings, which is noticeably higher than both the industry average of 16.1x and the fair ratio of 19.2x. This premium suggests investors are paying up for future growth, but it also raises the bar for what AutoZone needs to deliver. Is the optimism justified, or are expectations running a little too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AutoZone Narrative

If you like to get hands-on and draw your own conclusions, you can dive into the numbers and craft your personal take in just a few minutes, or simply Do it your way.

A great starting point for your AutoZone research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Your next standout investment could be just a click away, so don’t miss out on the opportunity to uncover companies with breakthrough potential, robust dividends, or ground-breaking tech innovation.

- Unearth potential big winners by tapping into these 3596 penny stocks with strong financials. See which up-and-comers have financial strength to surprise the market.

- Boost your cash flow with income-focused picks by checking out these 18 dividend stocks with yields > 3% featuring stocks offering yields above 3%.

- Ride the wave of artificial intelligence momentum by targeting leaders poised to shape the future. Explore these 24 AI penny stocks now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AZO

AutoZone

AutoZone, Inc. retails and distributes automotive replacement parts and accessories in the United States, Mexico, and Brazil.

Limited growth with questionable track record.

Similar Companies

Market Insights

Community Narratives