- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Abercrombie & Fitch (NYSE:ANF) Surges 16.99% In Past Week

Reviewed by Simply Wall St

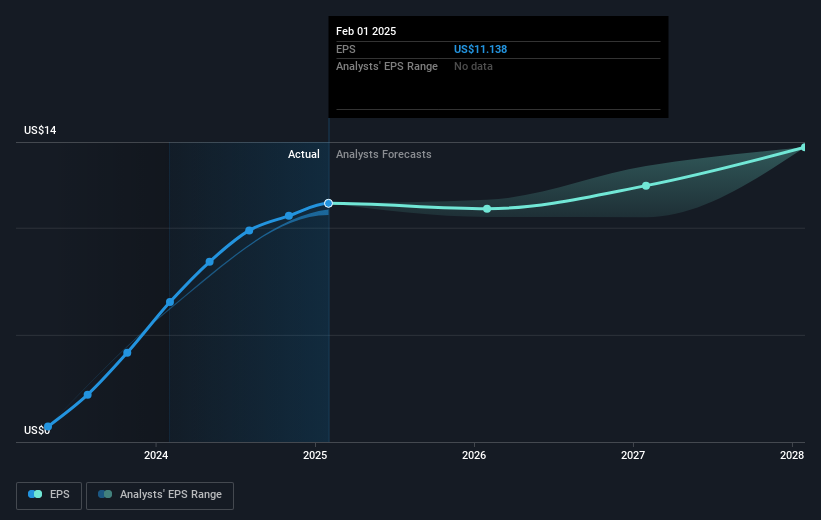

Abercrombie & Fitch (NYSE:ANF) saw a 16.99% increase in its share price over the past week. This significant movement may have been influenced by recent company events, although no specific news items are directly provided here. It's important to note that during the same period, the broader market rose by 3.9%, indicating that ANF's performance was robust compared to the overall market trend. With expectations for earnings to grow at 14% per annum, the stock's performance could suggest investor optimism. Any additional corporate developments during the week might have further supported or countered this upward trajectory.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent increase in Abercrombie & Fitch's share price by 16.99% over the past week may reflect the market's anticipation of future growth strategies, such as enhancing the digital shopping experience and expanding international presence. This movement comes despite a forecasted average annual earnings decline of 1.5% over the next three years, highlighting optimism in the company's longer-term growth prospects.

Over the past five years, ANF's total return, including share price appreciation and dividends, reached a very large percentage, underscoring substantial long-term value creation. Comparatively, ANF's stock underperformed over the past year against the broader US Specialty Retail industry, which saw a 14% return, emphasizing recent challenges faced by the company.

The recent share price movement might further influence revenue and earnings expectations, particularly with digital and international growth strategies. However, challenges such as rising shipping costs and inventory management pose risks. Currently trading at US$69.59, the stock is considerably below the consensus target price of US$121.47, indicating potential long-term appreciation if the company successfully executes its strategic plans and navigates inherent risks. Investors should continue to evaluate the alignment of these projections with actual performance as ANF continues its growth journey.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives