- United States

- /

- Specialty Stores

- /

- NYSE:AN

The Bull Case For AutoNation (AN) Could Change Following $599 Million Debt Offering - Learn Why

Reviewed by Sasha Jovanovic

- AutoNation, Inc. recently completed and announced a US$599.08 million fixed-income offering, issuing 4.450% senior subordinated unsecured notes due January 2029 at a slight discount and with callable features.

- This substantial capital raise signals a deliberate shift in AutoNation's funding strategy, potentially impacting both its balance sheet flexibility and future interest obligations.

- We'll examine how AutoNation's new debt offering could influence its investment narrative and capital allocation priorities moving forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

AutoNation Investment Narrative Recap

AutoNation shareholders need to be confident in the company's ability to grow high-margin after-sales and expand its used vehicle business, core to its investment case. The recently completed US$599.08 million unsecured notes offering does not appear to materially alter the key short-term catalyst of recurring after-sales growth, nor does it immediately mitigate the most pressing risk from margin pressure as digital-first competitors expand their reach.

Among recent announcements, AutoNation's continued share repurchase activity, over US$1 billion in new authorizations, stands out. This directly relates to capital allocation priorities, as the proceeds from new debt can support buybacks and growth initiatives, even as underlying industry risks persist.

Yet, in contrast, investors should absolutely pay attention to the risk posed by rapid shifts toward online auto retail models, as...

Read the full narrative on AutoNation (it's free!)

AutoNation's outlook projects $29.9 billion in revenue and $871.6 million in earnings by 2028. Achieving this would require 2.9% annual revenue growth and a $237.8 million increase in earnings from the current $633.8 million.

Uncover how AutoNation's forecasts yield a $233.00 fair value, a 19% upside to its current price.

Exploring Other Perspectives

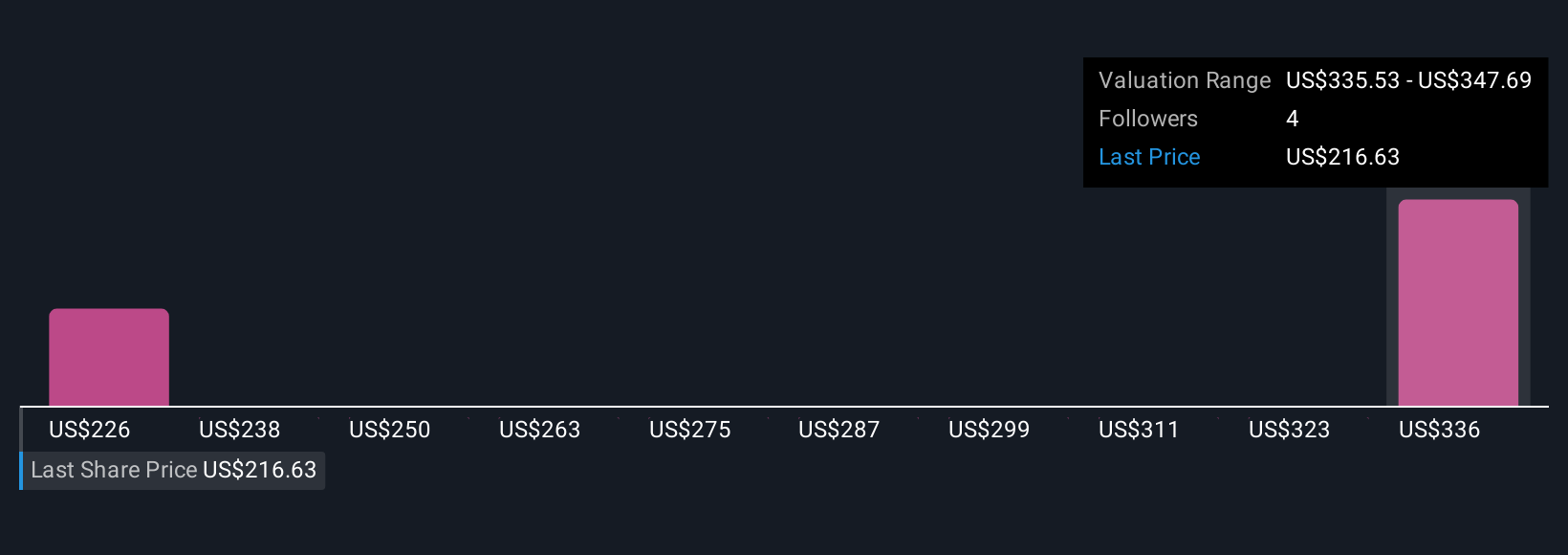

Simply Wall St Community members estimate AutoNation’s fair value from US$233 to US$323 per share, with two different projections. Growth in after-sales remains a sticking point for many, and a look at several perspectives may reveal reasons for strong differences in outlook.

Explore 2 other fair value estimates on AutoNation - why the stock might be worth just $233.00!

Build Your Own AutoNation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AutoNation research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AutoNation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AutoNation's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AN

AutoNation

Through its subsidiaries, operates as an automotive retailer in the United States.

Good value with limited growth.

Similar Companies

Market Insights

Community Narratives