- United States

- /

- Specialty Stores

- /

- NYSE:AKA

Revenues Not Telling The Story For a.k.a. Brands Holding Corp. (NYSE:AKA) After Shares Rise 32%

Those holding a.k.a. Brands Holding Corp. (NYSE:AKA) shares would be relieved that the share price has rebounded 32% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. This latest share price bounce rounds out a remarkable 391% gain over the last twelve months.

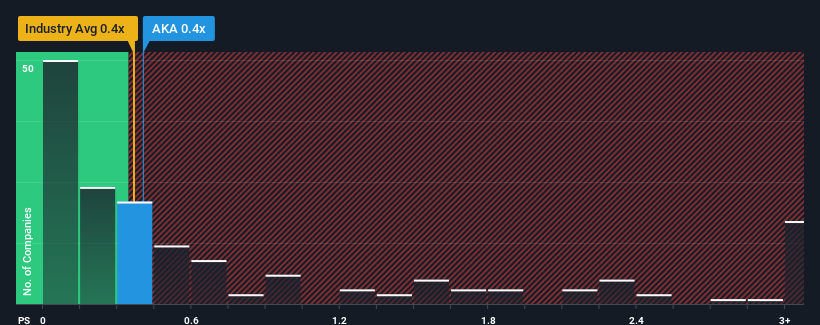

In spite of the firm bounce in price, it's still not a stretch to say that a.k.a. Brands Holding's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in the United States, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for a.k.a. Brands Holding

How a.k.a. Brands Holding Has Been Performing

While the industry has experienced revenue growth lately, a.k.a. Brands Holding's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on a.k.a. Brands Holding will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For a.k.a. Brands Holding?

In order to justify its P/S ratio, a.k.a. Brands Holding would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.1%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 58% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 2.7% each year as estimated by the five analysts watching the company. With the industry predicted to deliver 5.5% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that a.k.a. Brands Holding is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On a.k.a. Brands Holding's P/S

a.k.a. Brands Holding's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that a.k.a. Brands Holding's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with a.k.a. Brands Holding, and understanding should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade a.k.a. Brands Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AKA

a.k.a. Brands Holding

Operates a portfolio of online fashion brands in the United States, Australia, New Zealand, and internationally.

Good value low.

Market Insights

Community Narratives