- United States

- /

- Specialty Stores

- /

- NYSE:AEO

American Eagle Outfitters (AEO): Evaluating Valuation After Q2 Earnings Beat and Rising Optimism

Reviewed by Simply Wall St

If you have been watching American Eagle Outfitters (AEO) lately, you know there's plenty for investors to consider after its latest quarterly update. The company just delivered second-quarter results that topped expectations, with revenue coming in above estimates and earnings per share beating what most were looking for. What’s driving this? Improvements in the Aerie brand, sharper promotional tactics, and tighter spending controls, all of which have injected a fresh wave of optimism into the company’s outlook.

The recent earnings beat pushed shares higher and is part of a broader trend that has seen American Eagle Outfitters climb over the past three months, with the stock more than doubling during that time. Year to date, the stock is up about 16%, and over the past year, returns remain positive, although momentum has clearly accelerated in the shorter term. Alongside this earnings surprise, recent share buybacks and a continued dividend, as well as upbeat management guidance, have reinforced the sense that the company is actively working to boost shareholder value and build on recent gains.

After such a strong run on positive news, investors may be wondering if there is still room for American Eagle Outfitters to surprise on the upside or if the market is already factoring in the next phase of growth.

Most Popular Narrative: 31% Overvalued

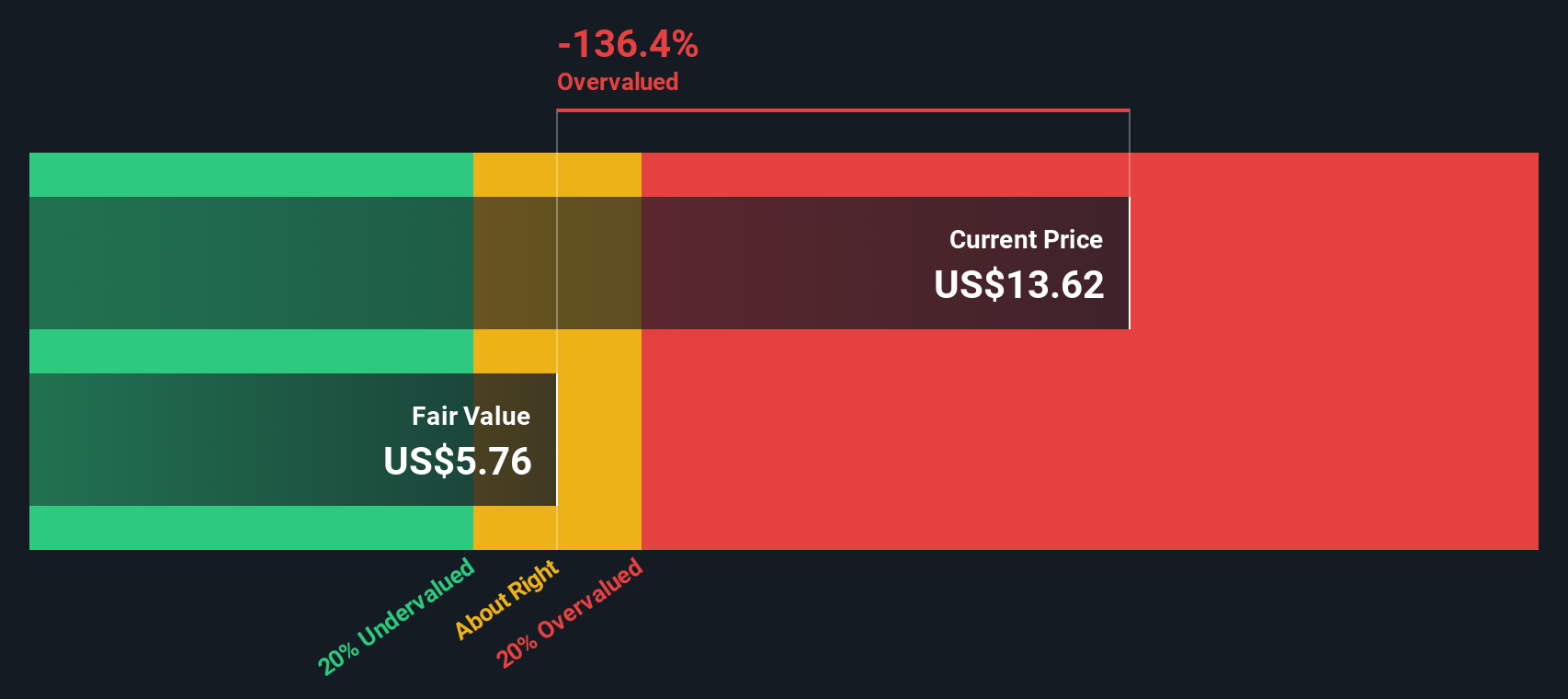

The most popular narrative views American Eagle Outfitters as significantly overvalued relative to its estimated fair value, given the market’s optimistic expectations for near-term performance and growth.

American Eagle Outfitters is expanding brand awareness and strengthening customer engagement with targeted strategies, particularly for Aerie and OFFLINE. By increasing brand visibility and expanding collections, they aim to drive strong revenue growth.

Curious why the market is getting so bullish? The current fair value calculation relies heavily on bold financial forecasts and aggressive profit multiples. Are you ready to uncover the high-stakes expectations built into this overvaluation? Want to know which future figures would justify today’s price? Consider looking deeper before making your next move.

Result: Fair Value of $15.17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing consumer uncertainty and higher tariffs could pressure earnings and margins. This may challenge the positive momentum seen in recent quarters.

Find out about the key risks to this American Eagle Outfitters narrative.Another View: Discounted Cash Flow Perspective

Looking through the lens of our SWS DCF model, a different outcome emerges. This approach offers a detailed analysis of underlying cash flows and indicates that the current share price may not be supported. Which story feels closer to reality for you?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own American Eagle Outfitters Narrative

If these viewpoints do not fully align with your own thinking, you can dive into the numbers, explore the insights for yourself, and quickly build your own narrative. Do it your way

A great starting point for your American Eagle Outfitters research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ready to elevate your strategy? Leap ahead by focusing on companies using AI in healthcare, tapping into undervalued opportunities, or spotting tomorrow's tech giants before the crowd does. Don’t let industry-shaping trends pass you by. These ideas could redefine your portfolio’s future.

- Boost your portfolio’s growth momentum by tapping into innovation in clinics and labs with our selection of healthcare AI stocks.

- Capitalize on hidden gems trading below their true value. Get started with our latest collection of undervalued stocks based on cash flows.

- Catch fast movers in tech early by targeting future industry leaders in the world of quantum breakthroughs. Browse the standout names in quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEO

American Eagle Outfitters

Operates as a multi-brand specialty retailer in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives