- United States

- /

- Specialty Stores

- /

- NYSE:AAP

These 4 Measures Indicate That Advance Auto Parts (NYSE:AAP) Is Using Debt Reasonably Well

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Advance Auto Parts, Inc. (NYSE:AAP) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Advance Auto Parts

What Is Advance Auto Parts's Debt?

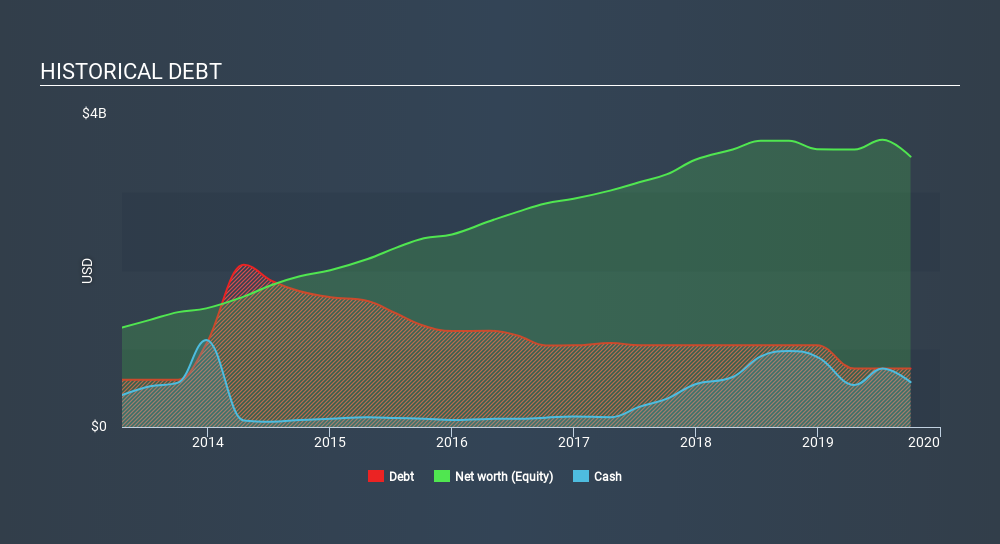

As you can see below, at the end of October 2019, Advance Auto Parts had US$747.1m of debt, up from US$1.0k a year ago. Click the image for more detail. However, it also had US$573.7m in cash, and so its net debt is US$173.4m.

A Look At Advance Auto Parts's Liabilities

Zooming in on the latest balance sheet data, we can see that Advance Auto Parts had liabilities of US$4.46b due within 12 months and liabilities of US$3.19b due beyond that. On the other hand, it had cash of US$573.7m and US$721.3m worth of receivables due within a year. So it has liabilities totalling US$6.36b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its very significant market capitalization of US$10.0b, so it does suggest shareholders should keep an eye on Advance Auto Parts's use of debt. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Advance Auto Parts has a low net debt to EBITDA ratio of only 0.18. And its EBIT covers its interest expense a whopping 16.2 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Fortunately, Advance Auto Parts grew its EBIT by 3.5% in the last year, making that debt load look even more manageable. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Advance Auto Parts can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, Advance Auto Parts recorded free cash flow worth 77% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Advance Auto Parts's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But, on a more sombre note, we are a little concerned by its level of total liabilities. All these things considered, it appears that Advance Auto Parts can comfortably handle its current debt levels. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Advance Auto Parts's earnings per share history for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:AAP

Advance Auto Parts

Engages in the provision of automotive aftermarket parts in the United States and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives