- United States

- /

- Specialty Stores

- /

- NYSE:AAP

Advance Auto Parts Insiders Added US$1.08m Of Stock To Their Holdings

Generally, when a single insider buys stock, it is usually not a big deal. However, when several insiders are buying, like in the case of Advance Auto Parts, Inc. (NYSE:AAP), it sends a favourable message to the company's shareholders.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

View our latest analysis for Advance Auto Parts

Advance Auto Parts Insider Transactions Over The Last Year

In the last twelve months, the biggest single purchase by an insider was when Independent Director Brent Windom bought US$401k worth of shares at a price of US$85.34 per share. So it's clear an insider wanted to buy, even at a higher price than the current share price (being US$44.44). It's very possible they regret the purchase, but it's more likely they are bullish about the company. In our view, the price an insider pays for shares is very important. As a general rule, we feel more positive about a stock if insiders have bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price.

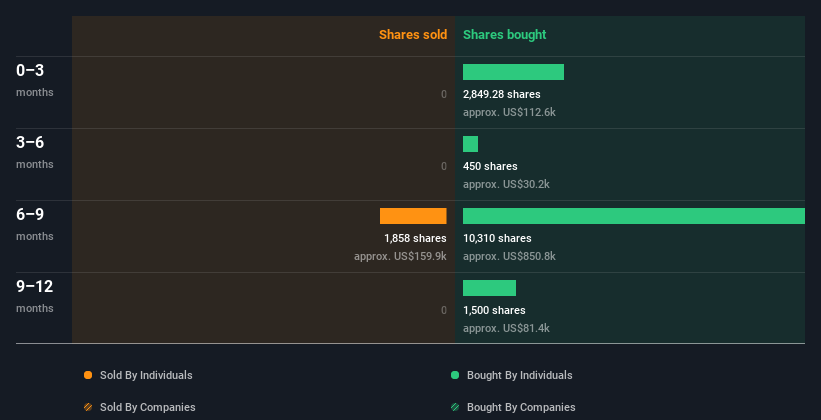

Happily, we note that in the last year insiders paid US$1.1m for 15.11k shares. On the other hand they divested 1.86k shares, for US$160k. In total, Advance Auto Parts insiders bought more than they sold over the last year. Their average price was about US$71.53. I'd consider this a positive as it suggests insiders see value at around the current price. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

Advance Auto Parts is not the only stock insiders are buying. So take a peek at this free list of under-the-radar companies with insider buying.

Advance Auto Parts Insiders Bought Stock Recently

Over the last quarter, Advance Auto Parts insiders have spent a meaningful amount on shares. Not only was there no selling that we can see, but they collectively bought US$110k worth of shares. That shows some optimism about the company's future.

Insider Ownership Of Advance Auto Parts

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Advance Auto Parts insiders own about US$17m worth of shares. That equates to 0.6% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

What Might The Insider Transactions At Advance Auto Parts Tell Us?

The recent insider purchases are heartening. And the longer term insider transactions also give us confidence. When combined with notable insider ownership, these factors suggest Advance Auto Parts insiders are well aligned, and that they may think the share price is too low. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Be aware that Advance Auto Parts is showing 3 warning signs in our investment analysis, and 1 of those shouldn't be ignored...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AAP

Advance Auto Parts

Provides automotive replacement parts, accessories, batteries, and maintenance items for domestic and imported cars, vans, sport utility vehicles, and light and heavy duty trucks.

Moderate growth potential with mediocre balance sheet.