- United States

- /

- Specialty Stores

- /

- NYSE:AAP

Advance Auto Parts (AAP): Assessing Valuation After Sector Optimism Rises on Rival's Strong Sales Report

Reviewed by Simply Wall St

Advance Auto Parts (AAP) saw its stock climb 5.5% after competitor Genuine Parts Company reported stronger than expected third-quarter sales. The upbeat results lifted sentiment for the entire auto parts retail sector ahead of Advance Auto Parts' own earnings release.

See our latest analysis for Advance Auto Parts.

Advance Auto Parts’ share price has been on a bumpy ride recently, with a quick 5.5% rally sparked by strong results from Genuine Parts Company, a key competitor. Despite that pop and a solid 14.25% year-to-date share price return, the company’s one-year total shareholder return of 50.89% masks a much tougher three- and five-year performance. Short-term momentum has returned somewhat, but longer-term investors are still underwater. As a result, the market is paying close attention to signs of a broader turnaround.

This sector is in the spotlight, so if you’re looking for more investment opportunities, now is the perfect time to explore See the full list for free.

With shares rallying despite modest analyst expectations and a mixed longer-term track record, the key question facing investors is whether Advance Auto Parts is trading at a bargain or if the market has already priced in a turnaround.

Most Popular Narrative: 3% Overvalued

Advance Auto Parts’ last close at $55.00 stands just above the most widely followed narrative’s fair value estimate of $53.20. This close gap has market watchers scrutinizing the catalysts and assumptions powering these expectations for the coming years.

The consolidation of distribution centers from 38 to 12 by 2026 aims to enhance supply chain efficiency. This reorganization, along with new market hub stores, is projected to reduce supply chain costs and improve gross margins, which may impact earnings positively.

Want to know what key changes are set to shape the next three years for Advance Auto Parts? The narrative includes bold efficiency moves, razor-focused cost targets, and big margin ambitions. Wondering how these operational bets unlock a higher valuation? See which numbers are driving this provocative view right now.

Result: Fair Value of $53.20 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing store closures and volatile consumer spending trends could derail margin improvement. This leaves Advance Auto Parts’s turnaround far from certain.

Find out about the key risks to this Advance Auto Parts narrative.

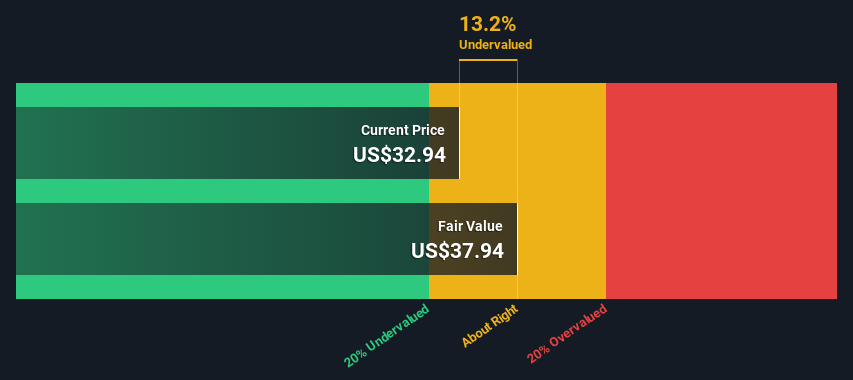

Another View: Discounted Cash Flow Model

Taking a step back from analyst price targets, our DCF model paints a very different picture for Advance Auto Parts. Based on projected cash flows, the shares appear to be trading roughly 31% below fair value, which suggests potential undervaluation. Is the market missing something, or are there hidden risks in those forecasts?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Advance Auto Parts Narrative

If you see the story differently or want to dig into the numbers on your own, you can build your personal narrative in just a few minutes. Do it your way

A great starting point for your Advance Auto Parts research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take the lead on your investment journey and spot tomorrow’s winners early. Don’t let these opportunities pass you by. Make your next smart move now.

- Supercharge your growth strategy by targeting these 27 AI penny stocks positioned at the forefront of artificial intelligence innovation and disruption.

- Boost your portfolio’s income potential by jumping into these 17 dividend stocks with yields > 3% that offer strong yields and proven financial health for steady returns.

- Seize undervalued opportunities with these 876 undervalued stocks based on cash flows that are primed for a comeback, based on robust cash flow and favorable price points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAP

Advance Auto Parts

Engages in the provision of automotive aftermarket parts in the United States and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives