- United States

- /

- Specialty Stores

- /

- NasdaqGS:WOOF

Optimistic Investors Push Petco Health and Wellness Company, Inc. (NASDAQ:WOOF) Shares Up 126% But Growth Is Lacking

Petco Health and Wellness Company, Inc. (NASDAQ:WOOF) shares have had a really impressive month, gaining 126% after a shaky period beforehand. But the last month did very little to improve the 57% share price decline over the last year.

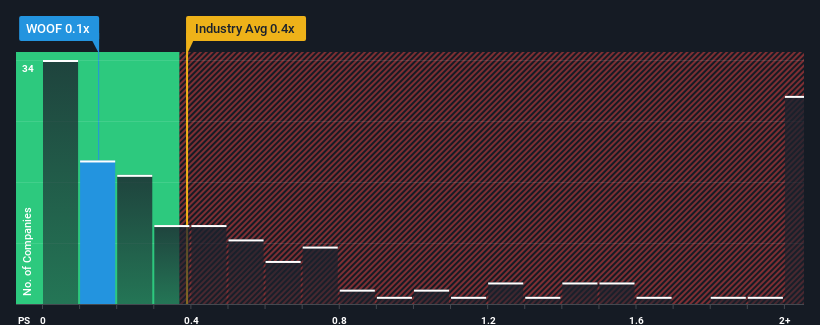

Even after such a large jump in price, it's still not a stretch to say that Petco Health and Wellness Company's price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in the United States, where the median P/S ratio is around 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Petco Health and Wellness Company

How Has Petco Health and Wellness Company Performed Recently?

Recent times haven't been great for Petco Health and Wellness Company as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Petco Health and Wellness Company will help you uncover what's on the horizon.How Is Petco Health and Wellness Company's Revenue Growth Trending?

In order to justify its P/S ratio, Petco Health and Wellness Company would need to produce growth that's similar to the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 19% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 1.2% per annum as estimated by the analysts watching the company. With the industry predicted to deliver 5.7% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's curious that Petco Health and Wellness Company's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Petco Health and Wellness Company appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that Petco Health and Wellness Company's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Petco Health and Wellness Company that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WOOF

Petco Health and Wellness Company

Operates as a health and wellness company, focuses on enhancing the lives of pets, pet parents, and its Petco partners in the United States, Mexico, and Puerto Rico.

Fair value with moderate growth potential.

Market Insights

Community Narratives