- United States

- /

- Specialty Stores

- /

- NasdaqGM:WINA

Winmark (WINA): Assessing Valuation After Special Dividend and Stable Q3 Earnings

Reviewed by Simply Wall St

Winmark (WINA) caught the market’s attention after announcing a special dividend of $10.00 per share and confirming its regular $0.96 quarterly dividend, both payable in December. This move highlights the company’s commitment to rewarding shareholders while maintaining solid financial performance.

See our latest analysis for Winmark.

Winmark’s special and regular dividend announcements, paired with stable third-quarter earnings, have certainly caught investors’ attention. The company’s 1-year total shareholder return sits at 12.4%, while a more impressive 172% five-year total return reveals long-term strength. However, momentum has moderated recently, with a one-month share price decline of nearly 18%.

If big dividend moves and steady profits have you exploring other standout companies, now’s a great time to check out fast growing stocks with high insider ownership.

With shares down nearly 18% over the last month and trading at a sizable discount to analyst targets, investors are left wondering if this is a clear buying opportunity or if markets are already accounting for Winmark’s future growth.

Price-to-Earnings of 35.6x: Is it justified?

Winmark trades at a price-to-earnings (P/E) ratio of 35.6x, which stands significantly above both the industry and peer averages. With the last close price at $412.39, the market is assigning Winmark a premium compared to its specialty retail counterparts.

The price-to-earnings ratio represents how much investors are willing to pay today for a dollar of the company’s current earnings. For a mature, highly profitable retail franchisor like Winmark, a high P/E suggests the market expects sustained growth and strong profit quality. However, it also raises questions about whether future earnings can justify this elevated valuation.

Compared to the US Specialty Retail industry average of 16.9x and a peer average of 12.4x, the valuation gap is stark. The fair price-to-earnings ratio for Winmark is estimated at 12.7x. This implies that the market could adjust closer to this level if expectations recalibrate.

Explore the SWS fair ratio for Winmark

Result: Price-to-Earnings of 35.6x (OVERVALUED)

However, slower revenue growth and the recent steep share price decline could signal underlying headwinds. These factors may challenge Winmark’s premium valuation going forward.

Find out about the key risks to this Winmark narrative.

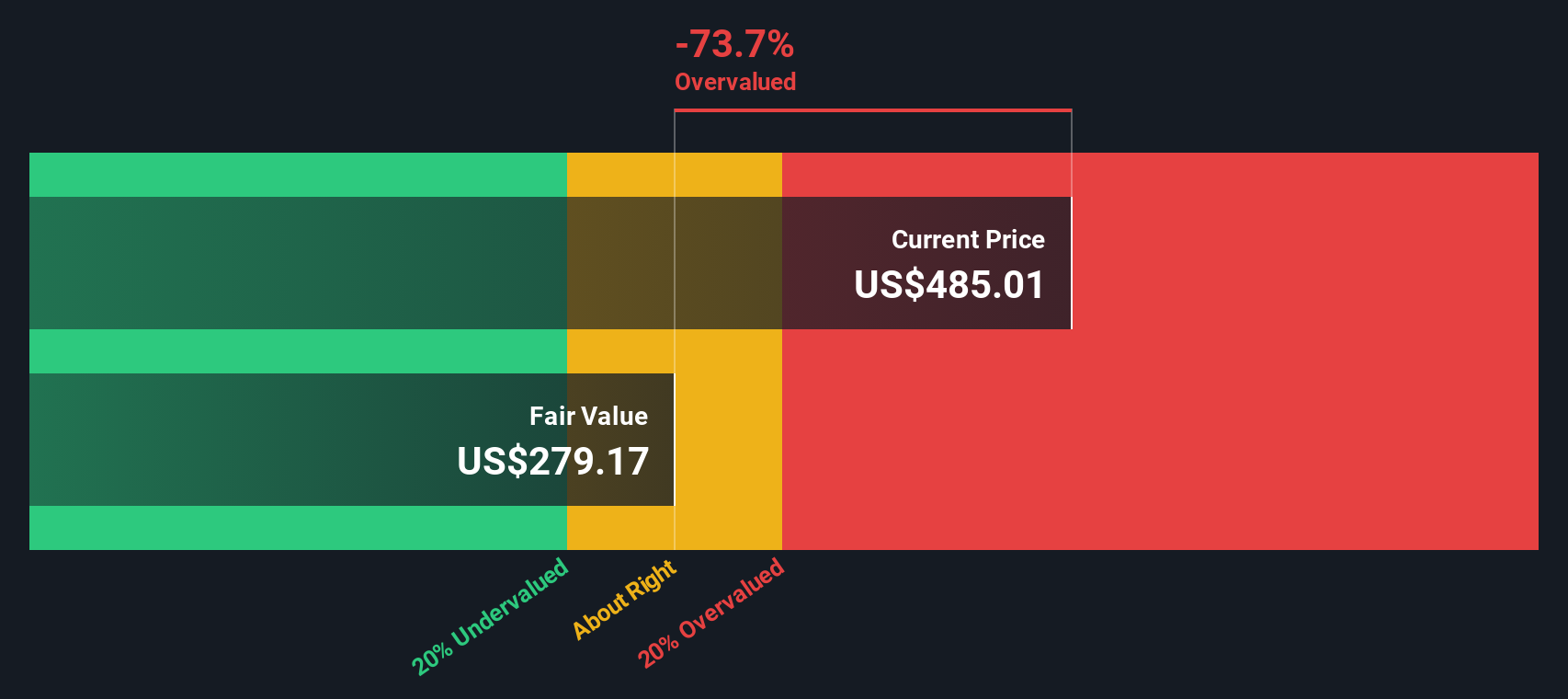

Another View: Discounted Cash Flow Perspective

Switching gears from multiples, the SWS DCF model looks at Winmark’s future cash flows to estimate value. This method suggests Winmark is trading well above its fair value, with a price of $412.39 per share compared to a fair value estimate of $307.37. Are investors overlooking this potential downside, or is the premium justified?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Winmark for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Winmark Narrative

If this perspective isn't quite your style, or you’d rather dig into the numbers yourself, you can shape your own view quickly and easily by using Do it your way.

A great starting point for your Winmark research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock opportunities by using the Simply Wall Street Screener. This tool is your shortcut to stocks with hidden value, future growth, and industry breakthroughs you won’t want to miss.

- Boost your returns by targeting these 873 undervalued stocks based on cash flows packed with strong cash flow potential before the crowd catches on.

- Tap into income growth by selecting these 17 dividend stocks with yields > 3% that consistently deliver reliable yields above 3% for long-term wealth building.

- Seize the trend in artificial intelligence by reviewing these 27 AI penny stocks designed to empower the next generation of innovation leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winmark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WINA

Winmark

A resale company, operates as a franchisor for small business in the United States and Canada.

Slight risk with acceptable track record.

Similar Companies

Market Insights

Community Narratives