- United States

- /

- Leisure

- /

- NasdaqGS:SWBI

Three Undiscovered Gems in the United States Market

Reviewed by Simply Wall St

The United States market has experienced a flat performance over the past week, yet it has risen by 21% in the last year with earnings anticipated to grow by 14% annually in the coming years. In this environment, identifying stocks that combine strong fundamentals with growth potential can uncover hidden opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Smith & Wesson Brands (NasdaqGS:SWBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Smith & Wesson Brands, Inc. is a global company that designs, manufactures, and sells firearms, with a market cap of approximately $479.19 million.

Operations: The company generates revenue primarily from its firearms segment, amounting to $514.65 million.

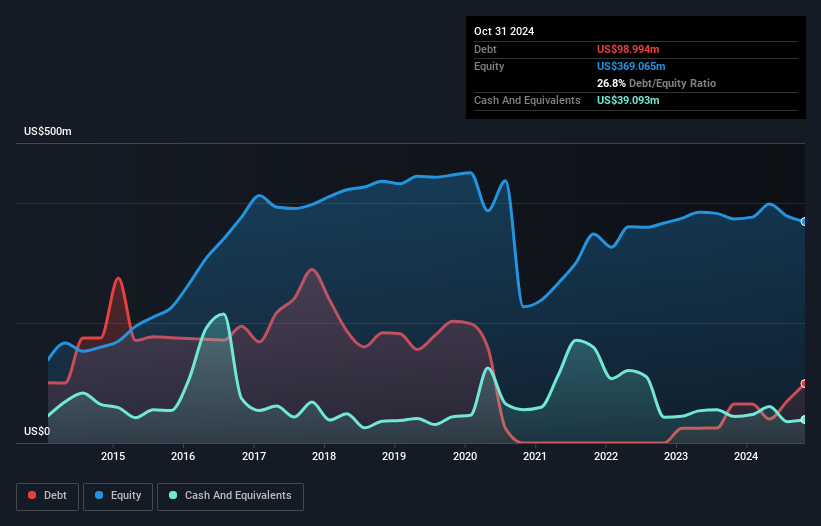

Smith & Wesson Brands, a notable player in the firearms industry, has shown resilience with a 22% earnings growth over the past year, outpacing the Leisure industry's -31.6%. The company sports a favorable price-to-earnings ratio of 13.2x compared to the US market's 18.6x. Over five years, its debt to equity ratio improved from 45.4% to 26.8%, indicating strong financial management. Recent earnings for Q2 showed sales of US$129 million and net income of US$4 million, up from last year’s figures. Despite challenges like inflation and competition, strategic share repurchases worth US$32 million aim to enhance shareholder value amidst fluctuating market conditions.

Weyco Group (NasdaqGS:WEYS)

Simply Wall St Value Rating: ★★★★★★

Overview: Weyco Group, Inc. designs and distributes footwear for men, women, and children, with a market capitalization of $347.51 million.

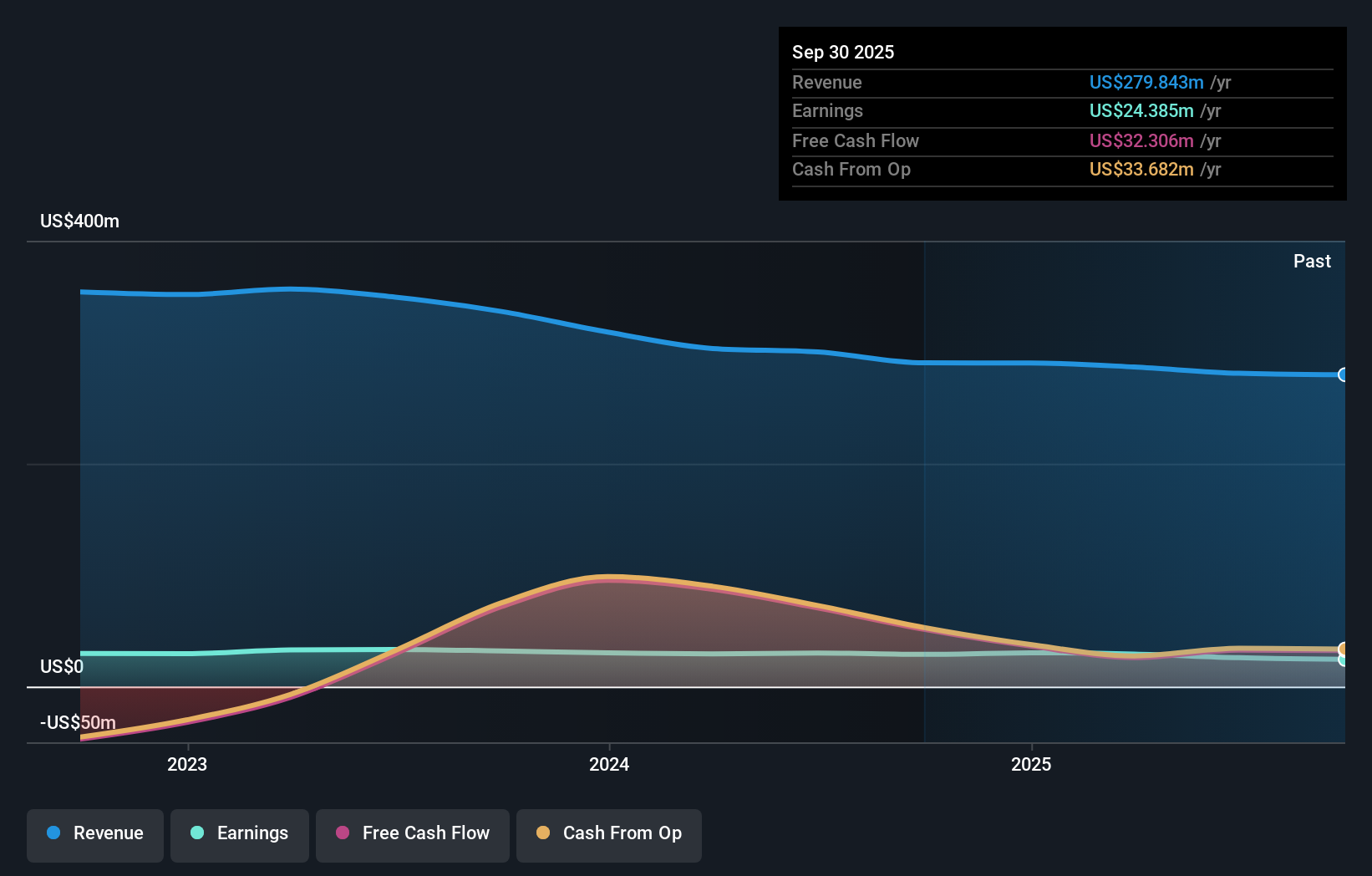

Operations: Weyco Group generates revenue primarily through its wholesale and retail segments, with wholesale contributing $227.14 million and retail adding $38.52 million.

Weyco Group, a notable player in the footwear sector, is currently trading at 43.9% below its estimated fair value, indicating potential undervaluation. Despite experiencing a negative earnings growth of 9.4% over the past year, it outperformed the broader Retail Distributors industry average of 24.1%. The company operates without debt now, contrasting with a debt to equity ratio of 8.1% five years ago. Although significant insider selling occurred recently, Weyco remains free cash flow positive and boasts high-quality earnings, suggesting financial stability and operational efficiency amidst market challenges.

- Navigate through the intricacies of Weyco Group with our comprehensive health report here.

-

Assess Weyco Group's past performance with our detailed historical performance reports.

Oil-Dri Corporation of America (NYSE:ODC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Oil-Dri Corporation of America, along with its subsidiaries, specializes in developing, manufacturing, and marketing sorbent products both domestically and internationally, with a market cap of approximately $629.61 million.

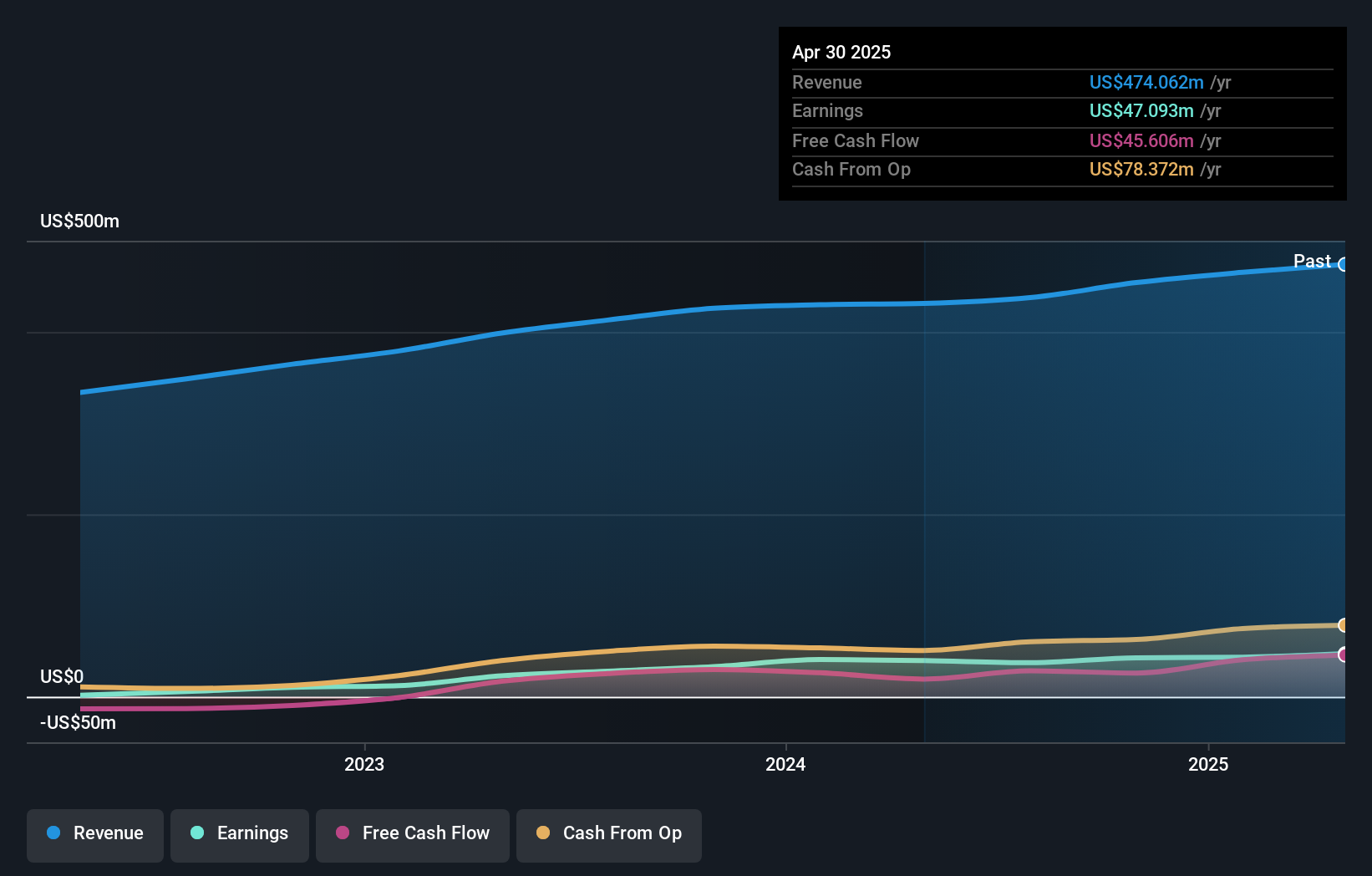

Operations: Oil-Dri generates revenue primarily through its Retail and Wholesale Products segment, which accounts for $294.37 million, followed by the Business to Business Products segment at $159.73 million.

Oil-Dri Corporation of America seems to be making waves with a notable earnings growth of 29.4% over the past year, outpacing the Household Products industry at 4.9%. The company reported net income for Q1 2025 at US$16.38 million, up from US$10.74 million a year ago, showcasing strong financial health with high-quality earnings and positive free cash flow. Despite an increase in debt to equity ratio from 2.2% to 20.4% over five years, its interest payments are well covered by EBIT (44.9x). Recent amendments for a two-for-one stock split highlight strategic moves aimed at enhancing shareholder value amidst significant insider selling recently observed.

- Dive into the specifics of Oil-Dri Corporation of America here with our thorough health report.

-

Understand Oil-Dri Corporation of America's track record by examining our Past report.

Taking Advantage

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 285 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SWBI

Smith & Wesson Brands

Designs, manufactures, and sells firearms worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives