- United States

- /

- Specialty Stores

- /

- NasdaqGS:UXIN

Investors Appear Satisfied With Uxin Limited's (NASDAQ:UXIN) Prospects As Shares Rocket 47%

Uxin Limited (NASDAQ:UXIN) shares have had a really impressive month, gaining 47% after a shaky period beforehand. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 85% share price drop in the last twelve months.

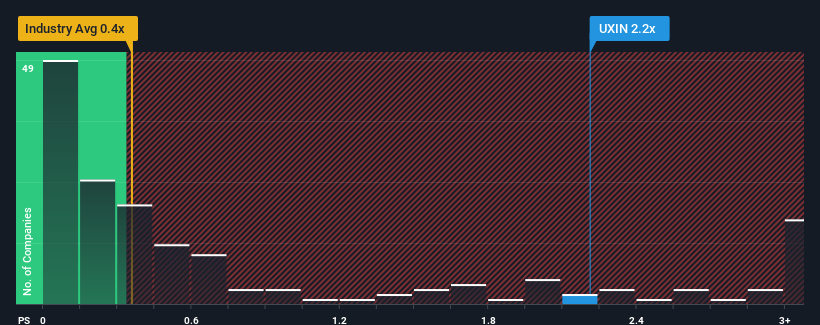

After such a large jump in price, when almost half of the companies in the United States' Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.4x, you may consider Uxin as a stock probably not worth researching with its 2.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Uxin

What Does Uxin's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Uxin over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Uxin, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

Uxin's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. Even so, admirably revenue has lifted 70% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 3.7% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why Uxin's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Uxin's P/S?

Uxin shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Uxin maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 4 warning signs we've spotted with Uxin.

If you're unsure about the strength of Uxin's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:UXIN

Uxin

An investment holding company, engages in the retail sale of vehicles in China.

Imperfect balance sheet very low.

Similar Companies

Market Insights

Community Narratives