- United States

- /

- Specialty Stores

- /

- NasdaqGS:URBN

Why Urban Outfitters (URBN) Is Up 5.5% After Record Q2 Results and Rosy Sales Outlook

Reviewed by Simply Wall St

- Urban Outfitters recently reported record second-quarter fiscal 2026 results, with all brands achieving positive comparable sales and most reaching record revenues, and presented these achievements at the Goldman Sachs 32nd Annual Global Retailing Conference in New York.

- This performance, paired with management’s confidence in high-single-digit third-quarter sales growth and gross margin expansion despite tariff challenges, highlights the company’s emphasis on diversified growth strategies and sustained momentum across both digital and physical channels.

- We'll explore how Urban Outfitters' record-breaking quarter and optimistic outlook may influence key assumptions in its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Urban Outfitters Investment Narrative Recap

To be a shareholder in Urban Outfitters right now, you need to believe in the company’s ability to grow through both digital and physical channels, maintaining relevant brands and customer engagement despite industry shifts. The record Q2 results and strong sales growth reinforce the optimism around short-term revenue momentum, but while this momentum supports the key catalyst of expanding omnichannel reach, ongoing tariff pressures remain a meaningful risk to margin improvement in the near term. The latest results have not materially changed this risk profile but add confidence behind current initiatives.

Among recent announcements, the company’s update that it completed its long-term share buyback program stands out. While no new shares were repurchased during the latest tranche, finalizing the repurchase of over 5.3 million shares since June 2019 demonstrates financial discipline and may enhance shareholder value in periods when revenue growth is robust, as seen this quarter.

In contrast, investors should be alert to ongoing margin pressures from tariffs as these tailwinds face persistent headwinds from...

Read the full narrative on Urban Outfitters (it's free!)

Urban Outfitters' outlook forecasts $7.2 billion in revenue and $508.4 million in earnings by 2028. This is based on a projected annual revenue growth rate of 7.1% and a $33 million increase in earnings from the current $475.4 million.

Uncover how Urban Outfitters' forecasts yield a $79.67 fair value, a 13% upside to its current price.

Exploring Other Perspectives

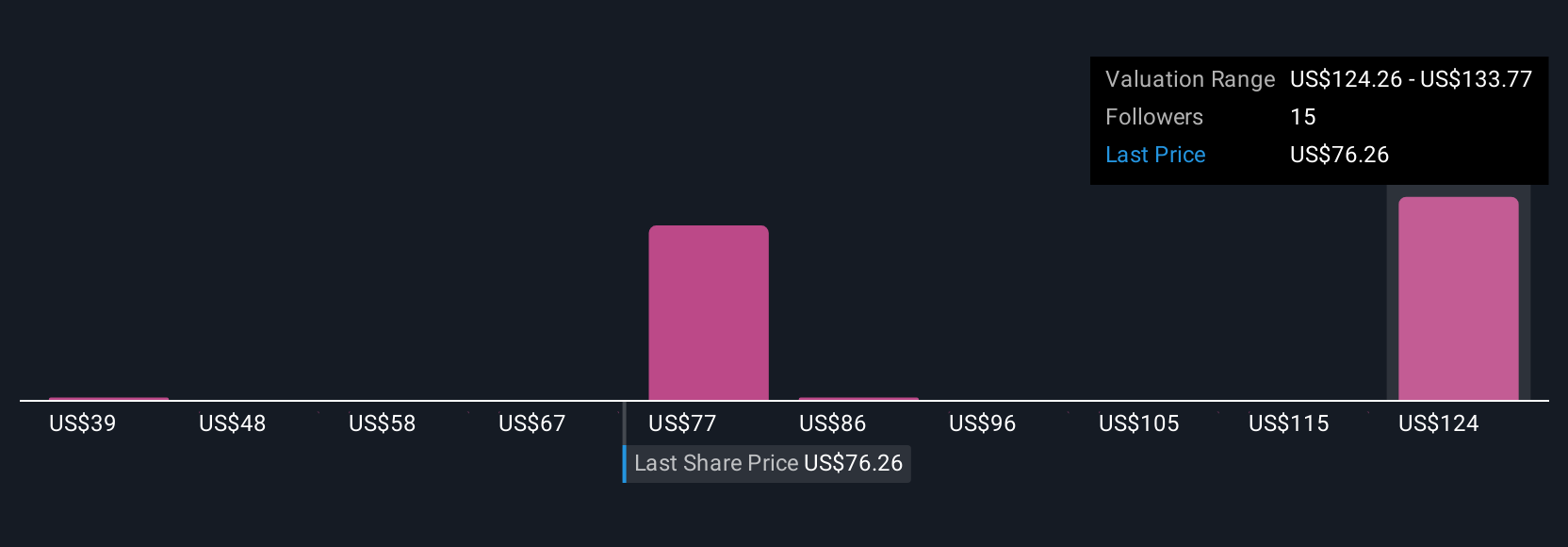

Four fair value estimates from the Simply Wall St Community range widely, from US$38.76 to US$109.11 per share. While some investors see strong upside, ongoing tariff headwinds could make profitability less predictable in the coming quarters.

Explore 4 other fair value estimates on Urban Outfitters - why the stock might be worth as much as 55% more than the current price!

Build Your Own Urban Outfitters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Urban Outfitters research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Urban Outfitters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Urban Outfitters' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:URBN

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives