- United States

- /

- Specialty Stores

- /

- NasdaqGS:URBN

Is Urban Outfitters Stock Still Attractive After a 92.6% Jump This Year?

Reviewed by Bailey Pemberton

Thinking about what to do with Urban Outfitters stock? You are not alone, especially with the company popping up on more radars lately. Over the past year, shares have soared an eye-catching 92.6%, and even more impressively, they are up nearly 200% over the past five years. While the past month has seen a moderate slide of 5.9%, the stock still boasts a robust year-to-date return of 19.4%. Many investors, like you, are wondering if this major run-up signals continued upside or a risk of correction looming on the horizon.

Some of the recent moves and buzz around Urban Outfitters come after a series of brand expansion initiatives and positive developments in retail sector sentiment. The market seems to be recalibrating its view of the company, perhaps sensing that its portfolio of brands and digital-forward strategies have more room to grow. Combined with the recent headline-grabbing performance, these factors make it a great moment to ask if the stock is undervalued or overpriced.

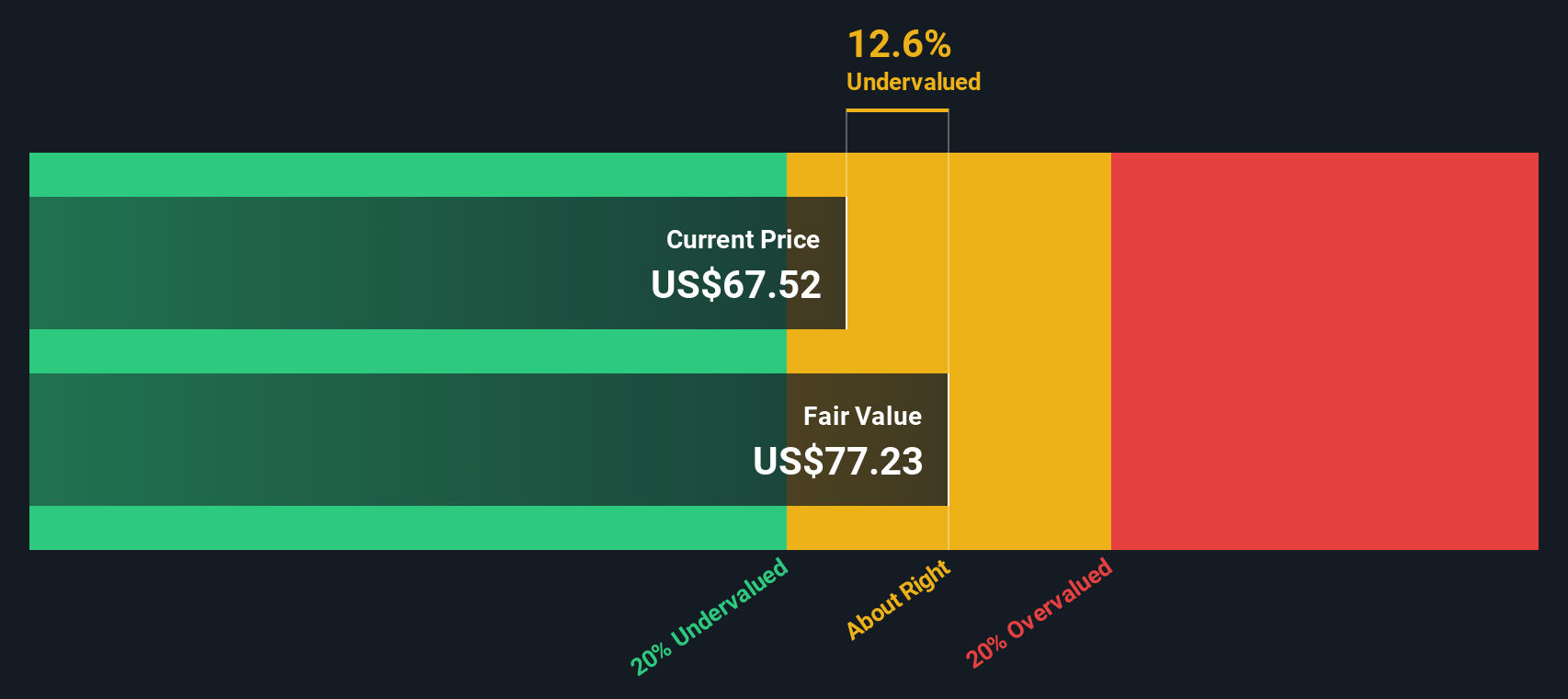

According to our multi-pronged valuation assessment, Urban Outfitters scores a 5 out of 6 on our undervaluation checklist, meaning it is undervalued in five of the six measures we track. Still, not all valuation methods are created equal. In the next section, we will look at some of the most common approaches to valuing the company, and why readers like you might want to pay special attention to an even more insightful method we will cover at the end of the article.

Approach 1: Urban Outfitters Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by forecasting its future cash flows and discounting them back to their present value. This method is especially useful because it is based on real operational performance, not just market sentiment.

For Urban Outfitters, the DCF model uses a two-stage approach focusing on Free Cash Flow to Equity. The latest reported Free Cash Flow stands at $378.6 million, and analysts anticipate steady growth over the years. According to projections, Free Cash Flow could reach approximately $771 million by 2035. It is worth noting that analyst estimates only extend about five years ahead, after which forecasts are extrapolated based on recent trends.

Applying these cash flow projections, the model arrives at an intrinsic fair value of $111.30 per share. This figure suggests that Urban Outfitters stock is currently trading at a 39.0% discount to its intrinsic value. Based on the DCF approach, the shares appear significantly undervalued compared to what the business is fundamentally worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Urban Outfitters is undervalued by 39.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Urban Outfitters Price vs Earnings

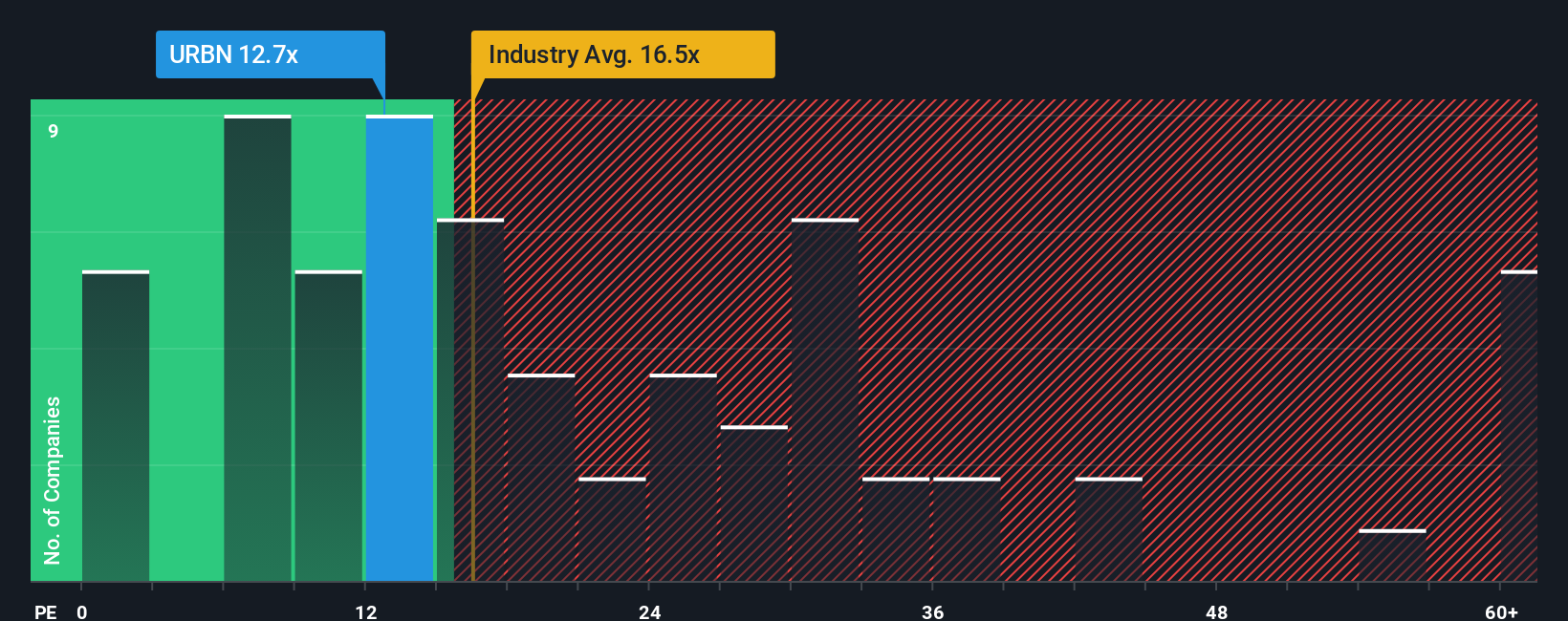

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Urban Outfitters. It helps investors understand how much they are paying for a dollar of the company’s earnings. A low PE may signal undervaluation, but it is important to recognize that growth prospects and risk also play key roles in determining what a "normal" or "fair" PE should be. Companies expected to grow faster typically warrant a higher PE, while riskier or stagnant businesses may trade at a discount.

Urban Outfitters currently trades at a PE ratio of 12.8x. For context, the average PE for its Specialty Retail peers is 14.5x, and the wider industry sits at 16.7x. At face value, this suggests the stock is valued more conservatively than both its closest competitors and the broader market. However, simply comparing to these averages can overlook important company-specific factors.

This is where Simply Wall St’s proprietary "Fair Ratio" comes into play. The Fair Ratio, calculated to be 16.33x for Urban Outfitters, reflects what is considered a reasonable PE when taking into account the company’s earnings growth outlook, profitability, size, risks, and its position within the industry. Unlike standard peer or industry comparisons, this approach offers a more tailored benchmark that aligns with Urban Outfitters’ unique profile.

Given that Urban Outfitters’ current PE of 12.8x sits well below the calculated Fair Ratio of 16.33x, the stock appears undervalued based on this methodology.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Urban Outfitters Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful concept where you outline your personal story or perspective on a company, like Urban Outfitters, including your estimates for its future revenue, earnings, and profitability. This approach brings the numbers to life with your investment thesis.

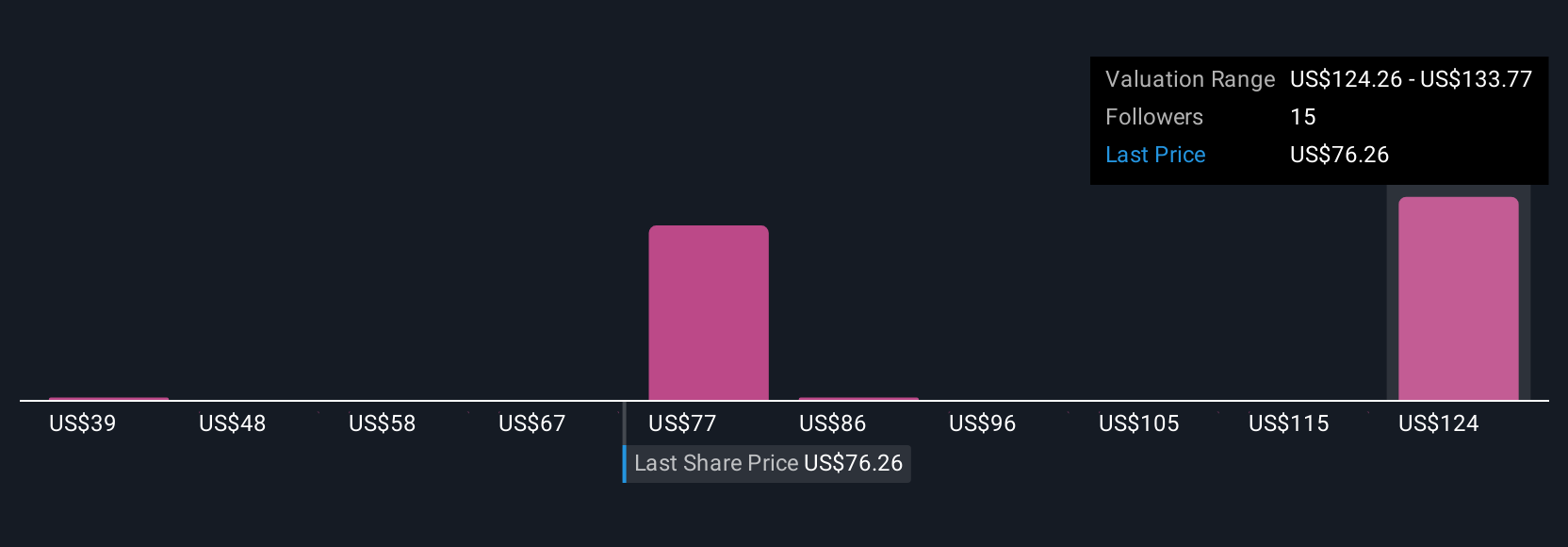

Narratives bridge the gap between what you believe about a company’s future and a clear, data-driven financial forecast, connecting your outlook to an estimated fair value. They are an easy and accessible tool available on Simply Wall St’s Community page, used by millions of investors to share and compare perspectives.

By creating or following Narratives, you can quickly see whether Urban Outfitters’ current share price is above or below its fair value based on your assumptions, empowering you to decide when it may be time to buy, sell, or hold. Narratives automatically update as new information such as news, earnings, or major announcements emerges, so your analysis stays fresh and relevant.

For example, some investors believe Urban Outfitters will capitalize on e-commerce and youthful spending for top-line growth, targeting a fair value as high as $93 per share. More cautious outlooks, focused on margin pressures and industry risks, propose a fair value closer to $52. This demonstrates how Narratives capture diverse but equally informed investment viewpoints.

Do you think there's more to the story for Urban Outfitters? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:URBN

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives