- United States

- /

- Specialty Stores

- /

- NasdaqGS:ULTA

Ulta Beauty (ULTA): Exploring Valuation as Shares Climb to New Highs

Reviewed by Kshitija Bhandaru

Ulta Beauty (ULTA) shares have been quietly trending higher over the past month, gaining 1%. The stock’s steady climb reflects ongoing confidence, with wider gains of 24% so far this year as the company maintains solid sales and earnings growth.

See our latest analysis for Ulta Beauty.

Momentum continues to build for Ulta Beauty, as its share price return has climbed more than 24% year-to-date. Even after a modest dip this week, long-term investors have seen a total shareholder return of nearly 45% over the past year. This underscores growing optimism around the company’s ability to sustain profitable growth.

If you’re looking to broaden your horizons beyond beauty retail, now’s the perfect moment to discover fast growing stocks with high insider ownership

But with shares trading near record highs, investors may wonder if Ulta Beauty remains undervalued, or if robust growth prospects are already fully reflected at current prices. Is there still a buying opportunity?

Most Popular Narrative: 7% Undervalued

According to the most widely followed narrative, Ulta Beauty's current share price sits below the calculated fair value, suggesting room for further upside if the company's strategy delivers as projected. This view weighs recent operational milestones and strategic moves against ongoing risks and intensified market competition.

Enhanced investment in digital infrastructure, including new personalization and automation tools, as well as omnichannel fulfillment with half of e-commerce orders being fulfilled by stores, supports increased e-commerce penetration and customer retention. These initiatives directly drive growth in revenue and improved operating leverage.

Want the real reason behind that higher price target? One central forecast about Ulta's expanding margins and future earnings potential explains how analysts reached this valuation. If you want specifics on the key growth factors that push fair value above today's price, you need the full story. The punchline may surprise you.

Result: Fair Value of $574.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cost pressures from wage inflation and potential fallout from the end of Target’s partnership could challenge Ulta’s earnings outlook in the future.

Find out about the key risks to this Ulta Beauty narrative.

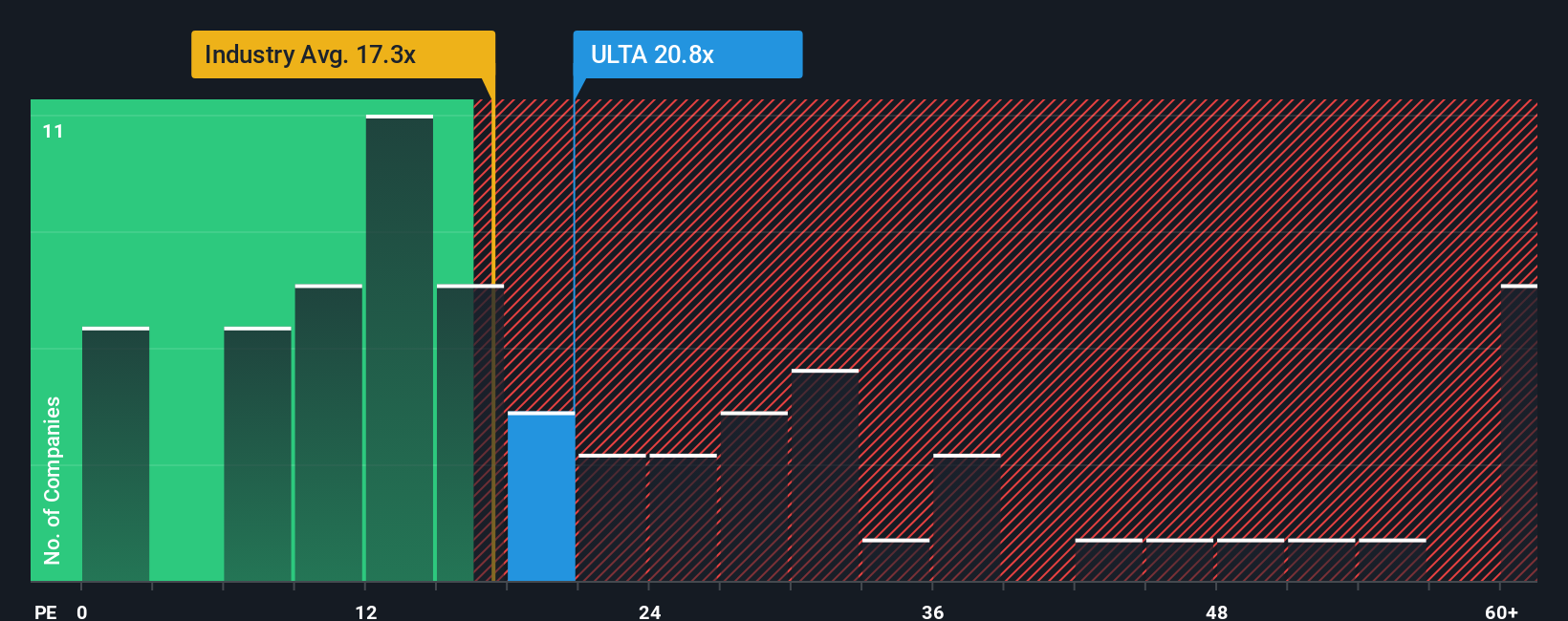

Another View: Market Multiples Challenge the Optimism

But if we measure Ulta Beauty by its current price-to-earnings ratio of 19.9x, the stock looks expensive versus the US Specialty Retail industry average of 16.1x. It also stands out compared to its own fair ratio of 17.2x. This suggests the market is already pricing in a lot of future growth and leaves less room for error. Could investors be overconfident, or is this premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ulta Beauty Narrative

If you see things differently or want to dig into the numbers yourself, you can create your own perspective in just a few minutes: Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Ulta Beauty.

Looking for More Investment Ideas?

Smart moves aren’t just about one company. Open new opportunities by scanning proven winners, innovative trends, and overlooked gems tailored for ambitious investors like you.

- Catch the next profit wave with high-yield picks by checking out these 18 dividend stocks with yields > 3%, which offers payouts above 3%.

- Uncover breakthrough potential in the future of medicine with these 33 healthcare AI stocks, positioned to transform patient care and diagnostics.

- Strengthen your strategy by acting early on these 878 undervalued stocks based on cash flows, trading below their fair value based on cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULTA

Ulta Beauty

Operates as a specialty beauty retailer in the United States and Mexico.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives