- United States

- /

- Specialty Stores

- /

- NasdaqGS:ULTA

Ulta Beauty (ULTA): Assessing Valuation After Strong Sales Growth, Margin Gains, and New Expansion Initiatives

Reviewed by Kshitija Bhandaru

Ulta Beauty (ULTA) has attracted fresh attention after reporting comparable sales growth and improved margins last quarter, with management raising full-year sales and earnings guidance. Recent new brand launches and international expansion contribute to the excitement.

See our latest analysis for Ulta Beauty.

Ulta Beauty’s latest run of new brand launches and a high-profile international expansion is stoking optimism, and investors are taking notice. After a lift from its strong quarterly report and improved margin outlook, the stock has gathered momentum, with a 1-year total shareholder return of nearly 50% reflecting both near-term execution and long-term growth potential.

If Ulta’s growth story has you curious about standout performers, now is a great moment to discover fast growing stocks with high insider ownership.

With shares surging nearly 50% over the past year and the latest quarter exceeding expectations, investors now face a pivotal question: Is Ulta Beauty’s current price a launching pad for further gains, or is all the upside already reflected in the stock?

Most Popular Narrative: 2.9% Undervalued

Ulta Beauty's closing price remains just shy of the most widely followed narrative's fair value estimate, suggesting modest potential upside if bullish assumptions play out. With the price target set higher than the current share price, this framework supports recent market optimism and provides a basis for deeper analysis.

Enhanced investment in digital infrastructure, including new personalization and automation tools, as well as omnichannel fulfillment with half of e-commerce orders being fulfilled by stores, supports increased e-commerce penetration and customer retention, directly driving growth in revenue and improved operating leverage.

Want to know what powers this bullish price target? The narrative highlights a digital-first strategy and omnichannel engagement as the secret sauce. Get the inside track on the unconventional assumptions and bold projections fueling this valuation. The real story might surprise you.

Result: Fair Value of $574.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising store costs and the potential conclusion of Ulta’s Target partnership could challenge both profit margins and the current growth narrative.

Find out about the key risks to this Ulta Beauty narrative.

Another View: What About Earnings Multiples?

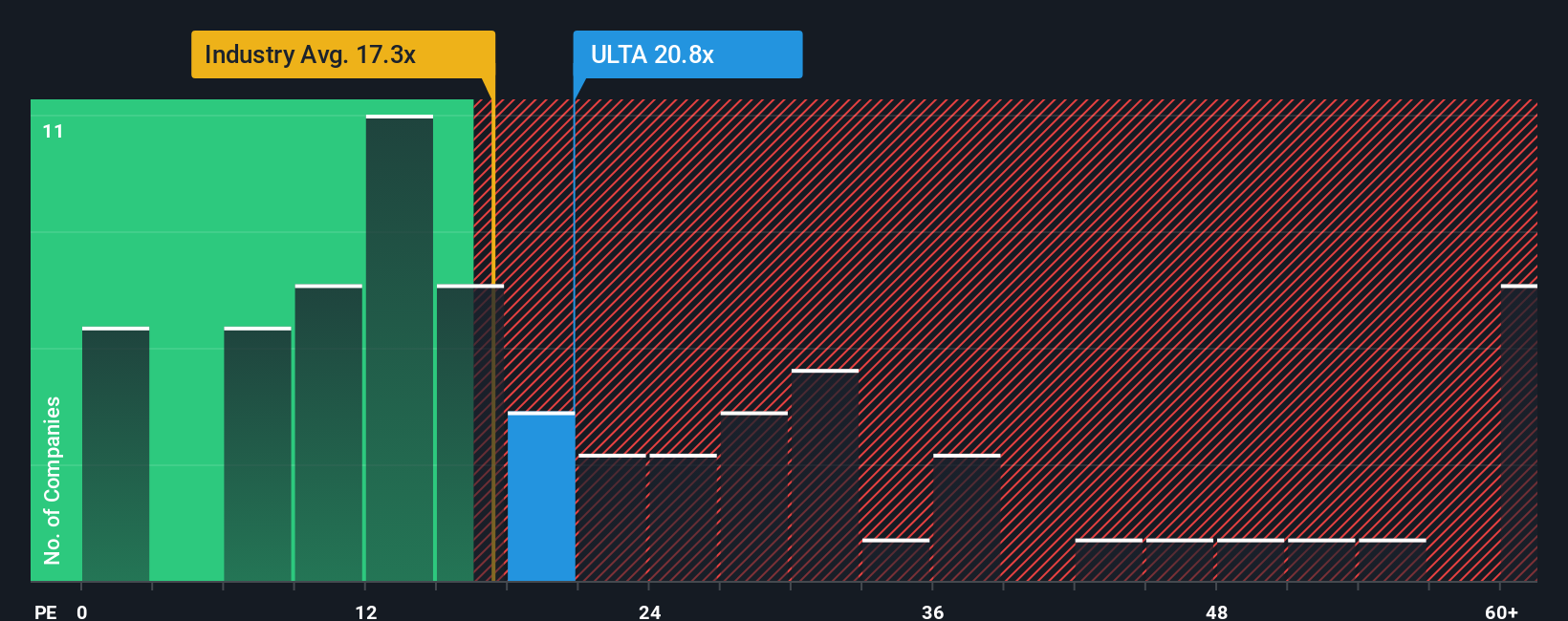

Switching gears to compare Ulta Beauty's price-to-earnings ratio, we find the stock trading at 20.8x, which is higher than both the US Specialty Retail industry average of 17.3x and its own fair ratio of 17.3x. This gap suggests investors are paying a premium, which raises questions about the margin of safety if growth cools. Is this justified optimism, or could it signal valuation risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ulta Beauty Narrative

If you see things differently or want to dig deeper into Ulta Beauty’s data, you can craft and share your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Ulta Beauty.

Looking for More Ways to Get Ahead?

Seize new opportunities today and level up your investing by accessing handpicked stock ideas that target innovation, value, and powerful long-term returns.

- Capitalize on undervalued gems by tapping into these 916 undervalued stocks based on cash flows that have the numbers to back their potential for outsized gains.

- Catch the momentum of emerging technology by checking out these 23 AI penny stocks with real promise in artificial intelligence and robotics.

- Build reliable income by reviewing these 19 dividend stocks with yields > 3% boasting yields greater than 3% and solid financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULTA

Ulta Beauty

Operates as a specialty beauty retailer in the United States and Mexico.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives