- United States

- /

- Specialty Stores

- /

- NasdaqGS:ULTA

Risks To Shareholder Returns Are Elevated At These Prices For Ulta Beauty, Inc. (NASDAQ:ULTA)

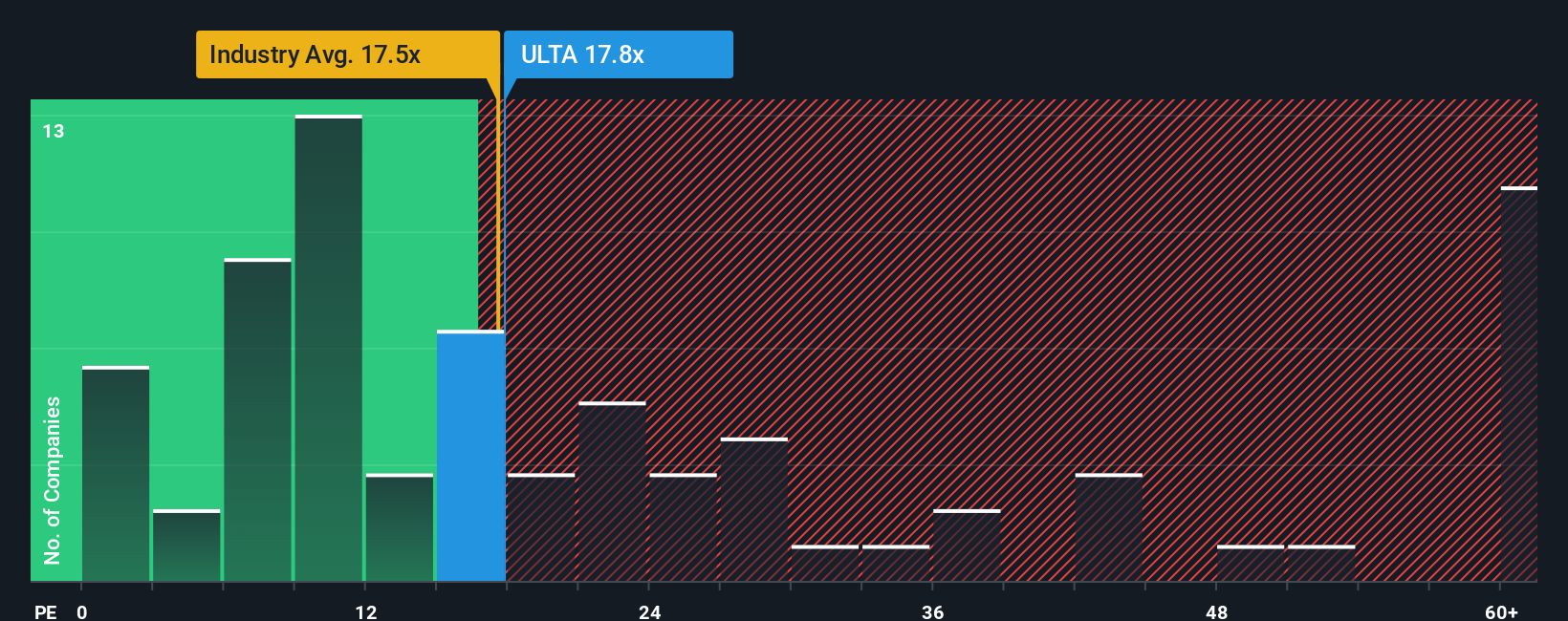

With a median price-to-earnings (or "P/E") ratio of close to 18x in the United States, you could be forgiven for feeling indifferent about Ulta Beauty, Inc.'s (NASDAQ:ULTA) P/E ratio of 17.8x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

While the market has experienced earnings growth lately, Ulta Beauty's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Ulta Beauty

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Ulta Beauty's is when the company's growth is tracking the market closely.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 31% overall rise in EPS, in spite of its uninspiring short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 4.6% per year over the next three years. With the market predicted to deliver 10% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's curious that Ulta Beauty's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From Ulta Beauty's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Ulta Beauty's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Ulta Beauty with six simple checks on some of these key factors.

You might be able to find a better investment than Ulta Beauty. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ULTA

Ulta Beauty

Operates as a specialty beauty retailer in the United States and Mexico.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives