- United States

- /

- Specialty Stores

- /

- NasdaqGS:ULTA

Does Ulta Still Offer Upside After Its 2025 Rally and Momentum in Beauty Stocks?

Reviewed by Bailey Pemberton

Thinking about what to do with Ulta Beauty stock right now? You are not alone. After a strong multi-year run and a sharp 29.7% gain year-to-date, many investors are wondering if Ulta has more room to climb or if it is time to take profits off the table. Over just the past month, shares have gained another 8.1%, and if you had bought five years ago, you would be looking at a remarkable 133.9% total return. These moves have not happened in a vacuum. Rising momentum in consumer discretionary sectors and bullish sentiment toward beauty and wellness brands have certainly helped lift Ulta’s profile in the market.

Yet, for all that price appreciation, the big question is whether Ulta’s current share price fairly reflects its actual value. Investors constantly debate whether recent growth is already "baked into" the stock, or if there is still hidden upside, especially as risk appetite shifts alongside changing economic conditions. On a value score basis, Ulta currently earns just a 1 out of 6. This means the company screens as undervalued by only one of the typical metrics analysts watch most closely.

So, is Ulta Beauty’s stock a hidden gem or starting to look a little expensive? Let’s break down the different ways to value a fast-growing company like Ulta. At the end, I will share a perspective that can help you see valuation in a whole new light.

Ulta Beauty scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ulta Beauty Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those amounts back to today. This approach focuses on Ulta Beauty’s ability to generate cash across several years, making it a key tool for assessing value independent of market mood swings.

For Ulta Beauty, the latest twelve months (LTM) Free Cash Flow (FCF) stands at $895.8 Million. Analyst estimates extend through 2027, with projected FCF growth leading to $958.3 Million in that year. Beyond this, Simply Wall St extrapolates cash flow figures further, projecting moderate, steady increases into the next decade, still in the hundreds of millions rather than billions.

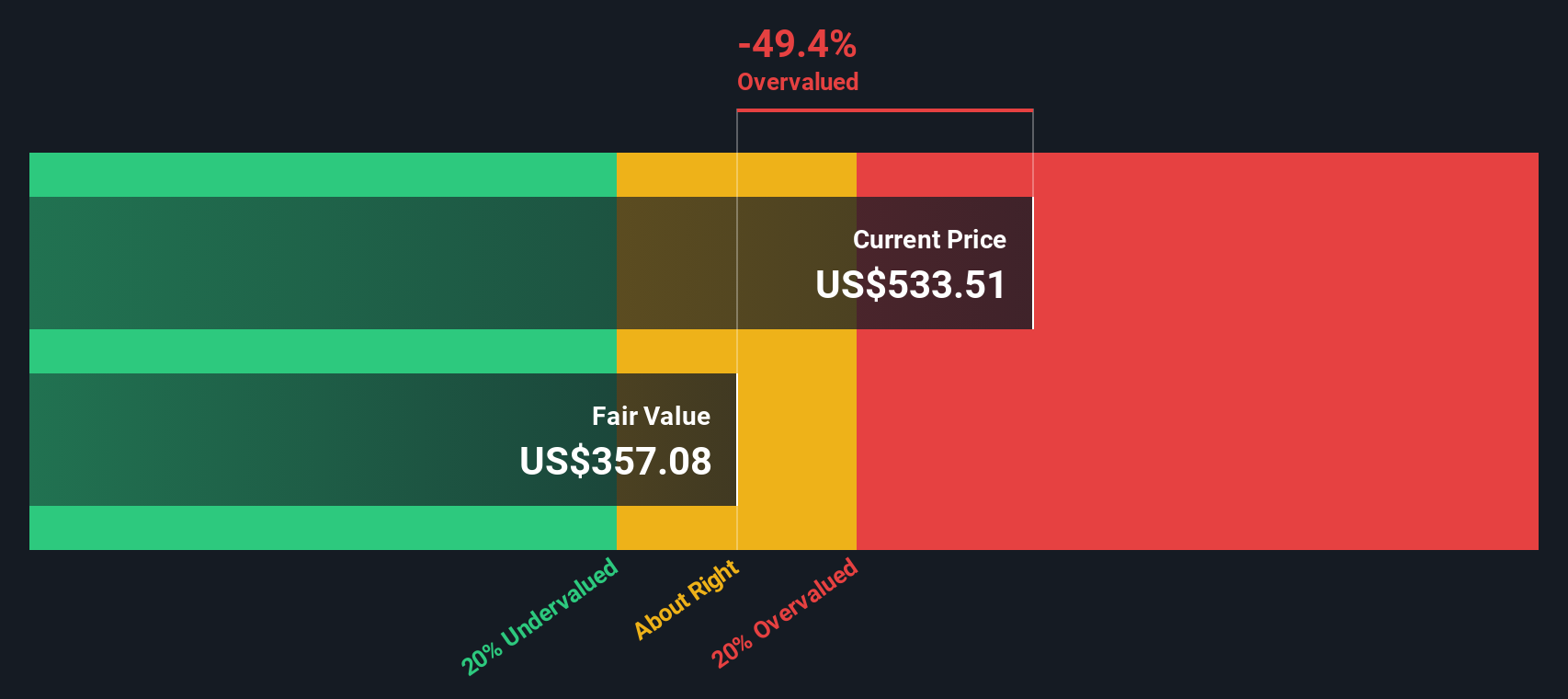

Using these cash flow projections and discounting them appropriately, the DCF model arrives at an intrinsic value of $354.22 per share. When compared to Ulta’s current market price, this implies the stock is 57.1% overvalued based on this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ulta Beauty may be overvalued by 57.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ulta Beauty Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used tool for valuing profitable companies like Ulta Beauty because it connects a company’s market price directly to its actual earnings. For businesses with consistent profitability, the PE ratio provides a straightforward way to gauge investor expectations for future growth and risk, helping investors see whether a stock is priced low relative to its potential.

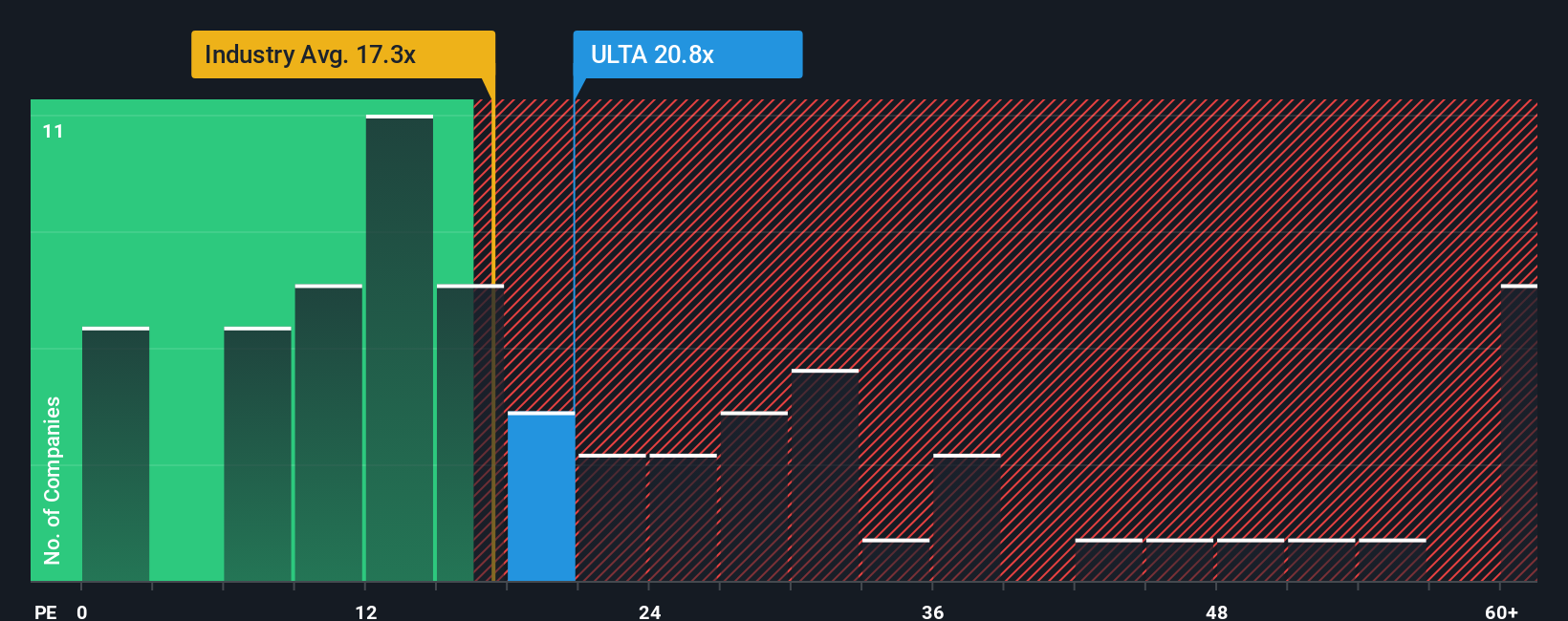

It is important to understand that a "fair" PE ratio is influenced by several factors, including expected earnings growth, profitability, and risk profile. Companies with higher growth prospects and lower risks typically command a higher PE ratio, while slower-growing or riskier businesses tend to trade at lower multiples. For Ulta Beauty, the current PE ratio sits at 20.77x, which is above the Specialty Retail industry average of 17.32x and well below the average for its peer group at 44.38x.

Simply Wall St goes a step further by introducing the "Fair Ratio," a proprietary measure that calculates the PE multiple an investor might reasonably pay for a company, factoring in Ulta Beauty’s earnings growth, industry dynamics, profit margins, market cap, and risk. This approach is more tailored than simply comparing to industry or peers, as it accounts for the specific qualities of Ulta. For Ulta Beauty, the Fair Ratio comes in at 17.28x, just slightly below where the stock is currently trading. Since the difference between the Fair Ratio and the actual PE ratio is relatively small, Ulta’s valuation by this method looks about right.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

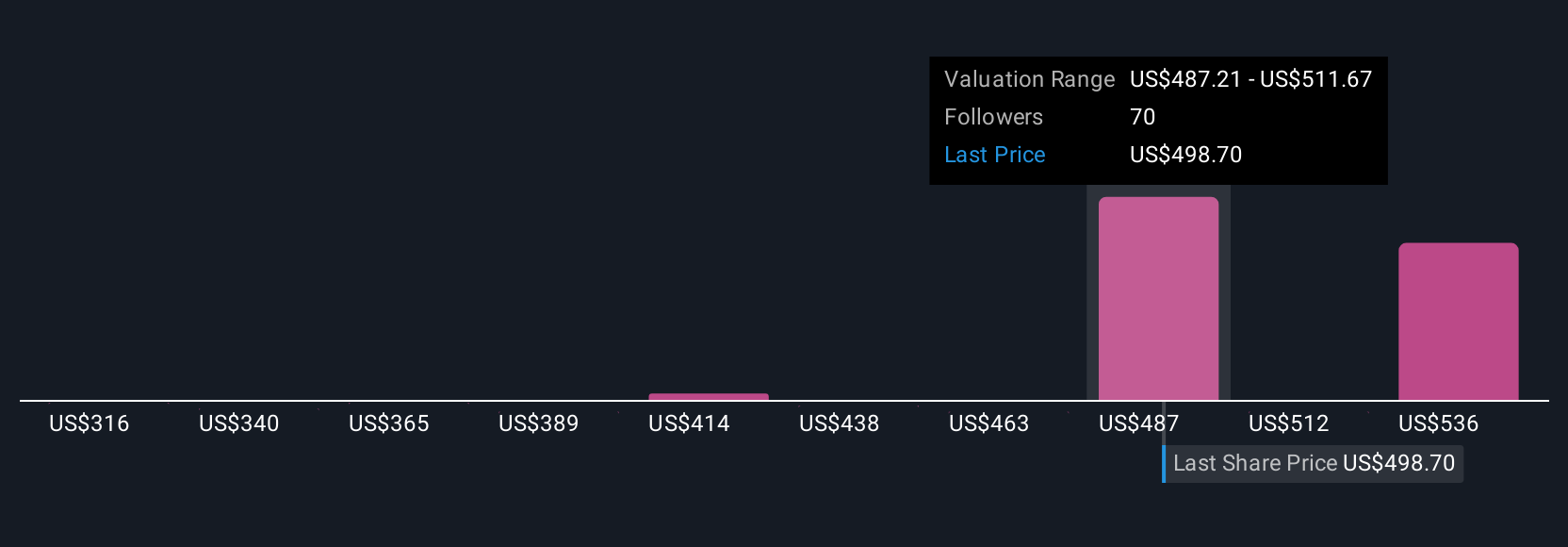

Upgrade Your Decision Making: Choose your Ulta Beauty Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story or perspective about a company, where you connect Ulta Beauty’s business outlook, such as revenue trends, profit margins, and industry catalysts, to your own forecast of fair value. Think of Narratives as your bridge between the numbers and the bigger picture; they help you articulate why you believe Ulta is a potential market leader or, conversely, at risk of slowing down. Available right on Simply Wall St’s Community page, Narratives empower millions of investors to document and share their views, tracking how their fair value changes instantly as news or earnings updates roll in. This means you do not just react to headlines; you lead with your own, evolving investment thesis. For instance, some investors, focusing on global wellness growth and digital expansion, see Ulta’s fair value as high as $680 per share, while others, more cautious about competition and margin risks, put it closer to $405. Narratives make this decision process accessible, visual, and actionable, helping you compare Ulta’s current share price against the story you believe in and know exactly when your view might need an update.

Do you think there's more to the story for Ulta Beauty? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULTA

Ulta Beauty

Operates as a specialty beauty retailer in the United States and Mexico.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives