- United States

- /

- Specialty Stores

- /

- NasdaqGS:TSCO

Tractor Supply (TSCO): Assessing Valuation as Analysts Boost Ratings on Strong Sales and Growth Initiatives

Reviewed by Kshitija Bhandaru

Tractor Supply (TSCO) has been making moves that caught Wall Street’s attention this month, with analysts highlighting the company’s continued strength in comparable sales and a series of fresh product launches.

See our latest analysis for Tractor Supply.

Tractor Supply’s stock has quietly weathered recent market volatility, with steady long-term momentum supporting its story. While the share price has seen mild fluctuations this year, the company’s 3-year total shareholder return of nearly 48% reflects resilience and a focus on rewarding investors through both growth and dividends, even as it rolls out new expansion initiatives and invests further in rural retail essentials.

If you're looking for ideas beyond the usual names, now is the perfect time to explore fast growing stocks with high insider ownership and see what other fast-growing, high-conviction opportunities might be available.

With analysts reaffirming upbeat ratings and the company delivering resilient results and ongoing growth initiatives, the key question remains: is Tractor Supply still undervalued, or has the market already priced in its next leg of growth?

Most Popular Narrative: 10.2% Undervalued

With the most widely followed narrative targeting a fair value above the latest close, Tractor Supply is being valued for its forward momentum and ability to capitalize on new business drivers.

Tractor Supply's strategy to reduce reliance on Chinese imports and diversify its supply chain, from over 90% to closer to 50% by year-end, could mitigate tariff impacts and potentially improve net margins and earnings. Strong transaction growth, unit growth in consumable, usable, and edible categories, and record customer retention indicate sustained demand, likely bolstering future revenue.

Curious what hidden math powers this bullish price? A key financial lever here is a ramp-up in margins paired with ambitious revenue growth targets. Don’t miss the forecasted profit leap and the surprising premium placed on future earnings. Want to know exactly what’s fueling that higher price? The full narrative has the numbers.

Result: Fair Value of $62.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining store sales or a shift in consumer spending could quickly challenge analysts’ expectations and put this optimistic view to the test.

Find out about the key risks to this Tractor Supply narrative.

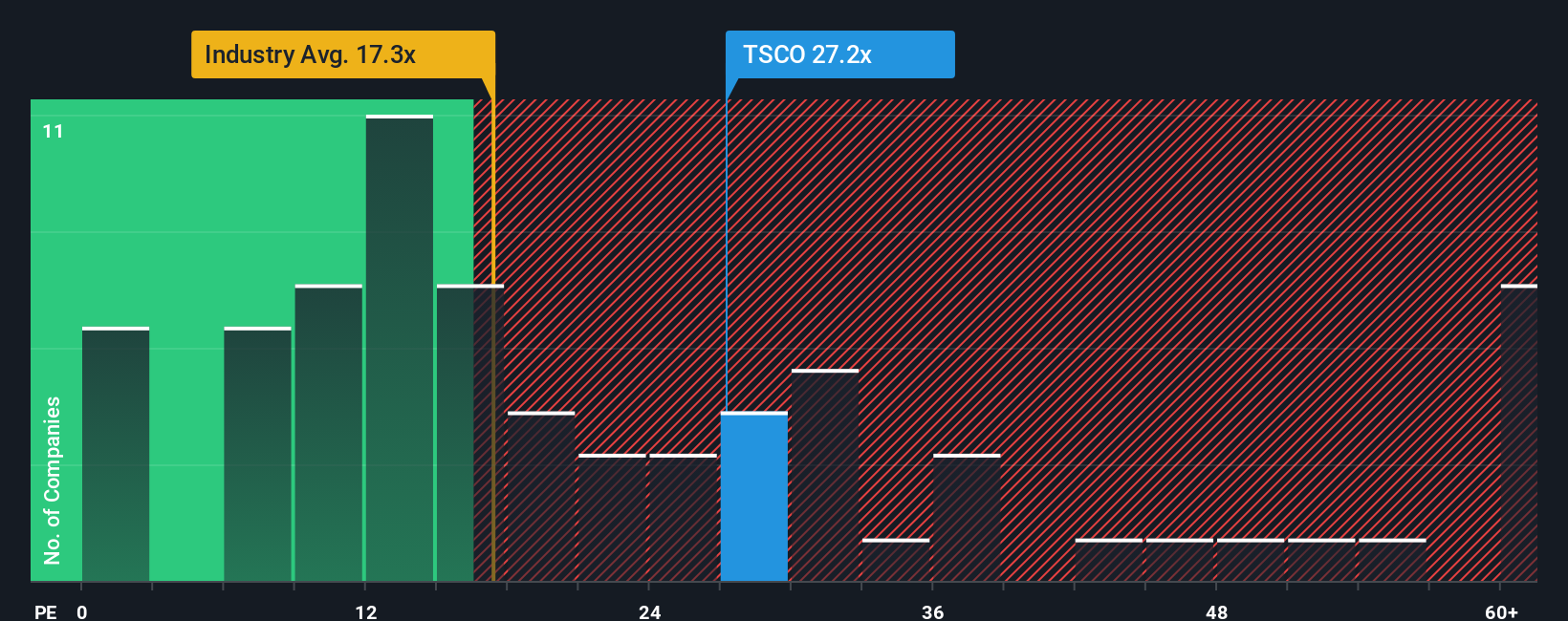

Another View: Multiples Paint a Pricier Picture

Looking from another angle, Tractor Supply's price-to-earnings ratio sits at 27.4x, well above the US Specialty Retail industry average of 17.3x and notably higher than its estimated fair ratio of 18.6x. This suggests investors are pricing in premium growth, but could this leave little margin for error if expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tractor Supply Narrative

If you'd like to dive deeper or bring your own perspective to the table, you can craft your own take in just a few minutes, too, and Do it your way.

A great starting point for your Tractor Supply research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Opportunities?

Take your next investing step with confidence. Use the Simply Wall Street Screener to spot hidden gems and timely ideas you won’t find anywhere else.

- Capture compelling yields by targeting income potential with these 19 dividend stocks with yields > 3%, delivering reliable returns above 3% from strong companies.

- Ride the AI momentum by checking out these 24 AI penny stocks, which are powering breakthroughs in automation and machine intelligence.

- Uncover tomorrow’s potential winners for less by hunting through these 904 undervalued stocks based on cash flows, reflecting real value that the market might be missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tractor Supply might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSCO

Tractor Supply

Operates as a rural lifestyle retailer in the United States.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives