- United States

- /

- Specialty Stores

- /

- NasdaqGS:TSCO

Assessing Tractor Supply (TSCO) Valuation After Recent Share Price Weakness

Reviewed by Kshitija Bhandaru

Tractor Supply (TSCO) shares have seen slight movement recently, trading at $56.23 at the last close. While the stock is down 9% over the past month, its 5-year total return still stands at 104 percent.

See our latest analysis for Tractor Supply.

Tractor Supply’s share price has cooled recently, but when you look at the bigger picture, long-term shareholders remain well ahead. Over the last year, total shareholder return is slightly negative. However, the impressive 5-year total return of 104% shows the company’s growth trend is still intact, even as near-term momentum fades a bit.

If you’re interested in uncovering other compelling opportunities in the market, this could be the perfect moment to broaden your radar and discover fast growing stocks with high insider ownership

With the company’s share price trailing analyst targets and growth still evident in annual results, investors may be wondering if Tractor Supply is currently undervalued or if the market is already factoring in all future gains.

Most Popular Narrative: 10.2% Undervalued

Tractor Supply’s fair value according to the most widely followed narrative stands at $62.59, which is 10.2% higher than the last close of $56.23. This points to cautious optimism as analysts’ forecasts have priced in several strategic catalysts that could shape the company’s outlook in the coming years.

Tractor Supply's strategy to reduce reliance on Chinese imports and diversify its supply chain, from over 90% to closer to 50% by year-end, could mitigate tariff impacts and potentially improve net margins and earnings. Strong transaction growth, unit growth in consumable, usable, and edible categories, and record customer retention indicate sustained demand, likely bolstering future revenue.

Curious what bold financial projections underpin this price target? The narrative’s higher valuation is powered by expectations of healthy revenue gains and a profit margin boost. But what assumptions truly drive these forecasts? Unpack the numbers to see what’s fueling this market perspective.

Result: Fair Value of $62.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected declines in store sales or a weaker economy could quickly challenge these optimistic forecasts and put future revenue growth at risk.

Find out about the key risks to this Tractor Supply narrative.

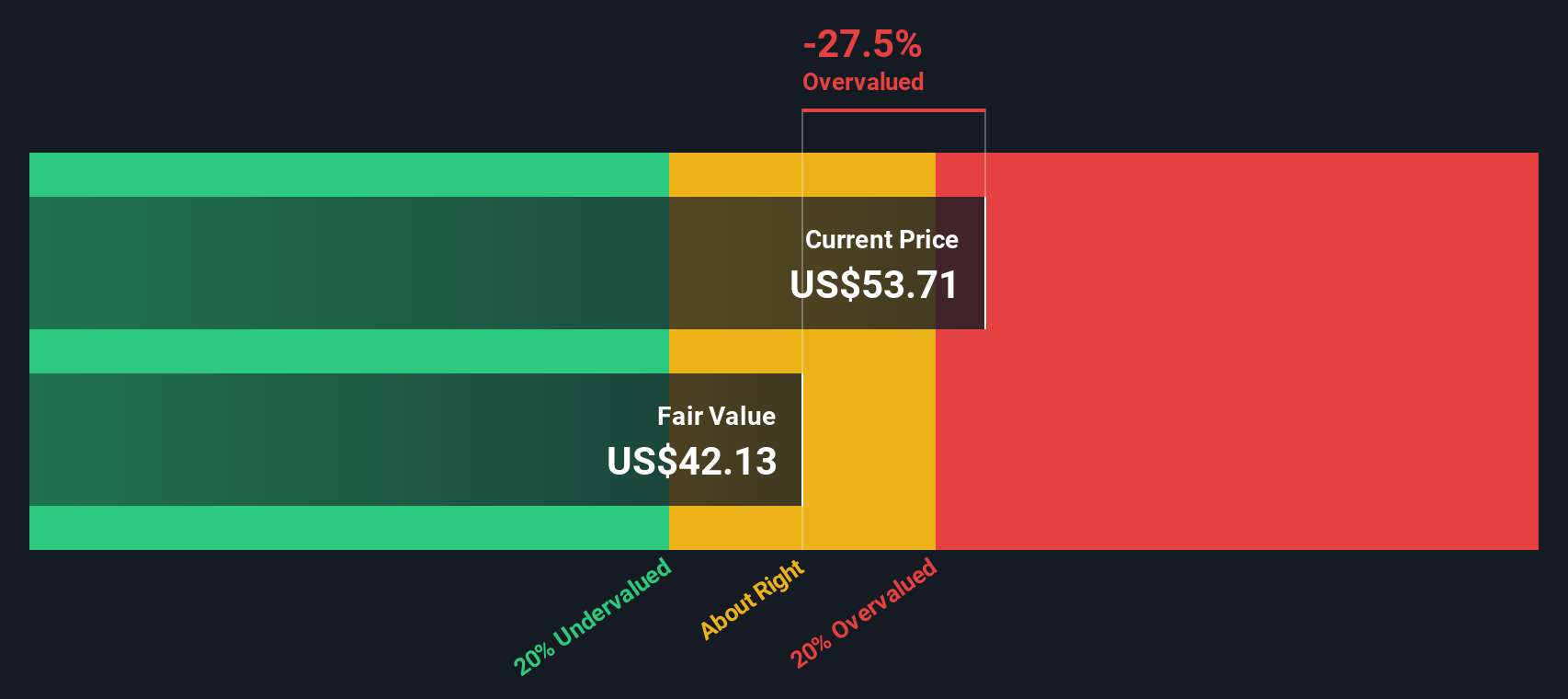

Another View: DCF Model Signals a Different Story

While analyst narratives suggest Tractor Supply is undervalued, our DCF model offers a more cautious perspective. According to this approach, TSCO is actually trading above its estimated fair value, suggesting the market may already be factoring in most future gains. Which method should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tractor Supply for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tractor Supply Narrative

If you’d rather dig into the fundamentals and form your own view, you can easily build an independent thesis in just a few minutes. Do it your way

A great starting point for your Tractor Supply research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t just stop at Tractor Supply. Unlock your chance to get ahead by finding stocks on the verge of a breakout with Simply Wall Street’s powerful Screener. There is a world of high-potential opportunities waiting for you, so consider making your move before the crowd catches on.

- Focus on stable returns by tapping into these 19 dividend stocks with yields > 3% offering consistently strong yields above 3 percent.

- Explore growth potential in healthcare by using these 31 healthcare AI stocks featuring the most promising innovations powered by artificial intelligence.

- Take advantage of the upside of emerging tech with these 26 quantum computing stocks and track companies transforming tomorrow’s computing landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tractor Supply might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSCO

Tractor Supply

Operates as a rural lifestyle retailer in the United States.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives