Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Yoshitsu Co., Ltd (NASDAQ:TKLF) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Yoshitsu

What Is Yoshitsu's Net Debt?

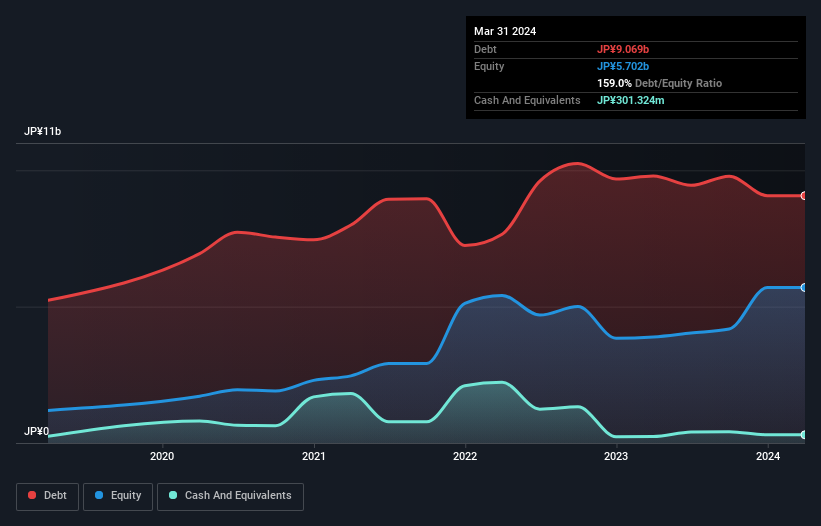

The image below, which you can click on for greater detail, shows that Yoshitsu had debt of JP¥9.07b at the end of March 2024, a reduction from JP¥9.79b over a year. However, it also had JP¥301.3m in cash, and so its net debt is JP¥8.77b.

How Strong Is Yoshitsu's Balance Sheet?

According to the last reported balance sheet, Yoshitsu had liabilities of JP¥13.8b due within 12 months, and liabilities of JP¥1.52b due beyond 12 months. Offsetting these obligations, it had cash of JP¥301.3m as well as receivables valued at JP¥16.2b due within 12 months. So it actually has JP¥1.13b more liquid assets than total liabilities.

This luscious liquidity implies that Yoshitsu's balance sheet is sturdy like a giant sequoia tree. On this view, lenders should feel as safe as the beloved of a black-belt karate master.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Yoshitsu has a rather high debt to EBITDA ratio of 17.9 which suggests a meaningful debt load. However, its interest coverage of 2.8 is reasonably strong, which is a good sign. However, the silver lining was that Yoshitsu achieved a positive EBIT of JP¥305m in the last twelve months, an improvement on the prior year's loss. When analysing debt levels, the balance sheet is the obvious place to start. But it is Yoshitsu's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. During the last year, Yoshitsu burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Yoshitsu's conversion of EBIT to free cash flow was a real negative on this analysis, as was its net debt to EBITDA. But its level of total liabilities was significantly redeeming. Looking at all this data makes us feel a little cautious about Yoshitsu's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 6 warning signs for Yoshitsu (2 don't sit too well with us!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Lifestyle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TKLF

Tokyo Lifestyle

Engages in the retail and wholesale of beauty, health, sundry, and other products in Japan, China, Hong Kong, the United States, Canada, Thailand, and the United Kingdom.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026