- United States

- /

- Specialty Stores

- /

- NasdaqGS:TDUP

ThredUp Inc.'s (NASDAQ:TDUP) 63% Share Price Plunge Could Signal Some Risk

ThredUp Inc. (NASDAQ:TDUP) shareholders that were waiting for something to happen have been dealt a blow with a 63% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 84% loss during that time.

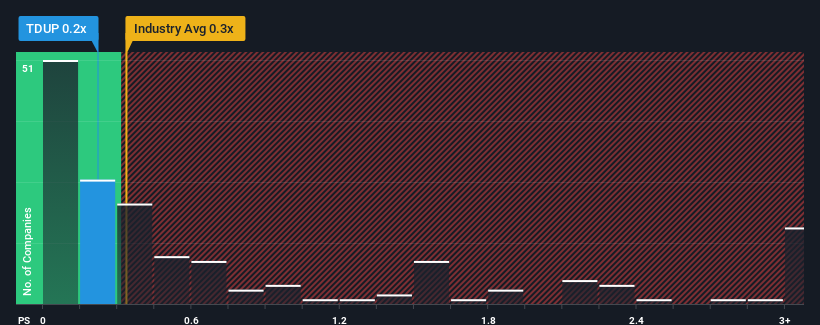

Although its price has dipped substantially, there still wouldn't be many who think ThredUp's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in the United States' Specialty Retail industry is similar at about 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for ThredUp

What Does ThredUp's Recent Performance Look Like?

Recent times have been advantageous for ThredUp as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on ThredUp will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like ThredUp's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 8.4% gain to the company's revenues. The latest three year period has also seen an excellent 57% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 6.8% during the coming year according to the five analysts following the company. With the industry predicted to deliver 3.6% growth, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that ThredUp's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Following ThredUp's share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

While ThredUp's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Before you take the next step, you should know about the 4 warning signs for ThredUp (1 is concerning!) that we have uncovered.

If you're unsure about the strength of ThredUp's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if ThredUp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TDUP

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.