- United States

- /

- Hospitality

- /

- NasdaqGS:TCOM

What We Make Of Trip.com Group's (NASDAQ:TCOM) Returns On Capital

There are a few key trends to look for if we want to identify the next multi-bagger. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Speaking of which, we noticed some great changes in Trip.com Group's (NASDAQ:TCOM) returns on capital, so let's have a look.

What is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Trip.com Group:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0047 = CN¥625m ÷ (CN¥198b - CN¥67b) (Based on the trailing twelve months to June 2020).

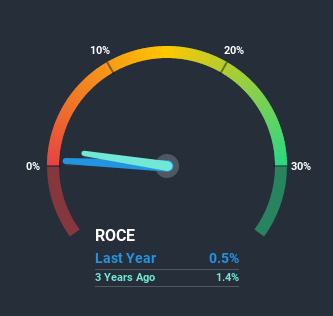

So, Trip.com Group has an ROCE of 0.5%. In absolute terms, that's a low return and it also under-performs the Online Retail industry average of 9.4%.

Check out our latest analysis for Trip.com Group

In the above chart we have measured Trip.com Group's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Trip.com Group here for free.

What Can We Tell From Trip.com Group's ROCE Trend?

The fact that Trip.com Group is now generating some pre-tax profits from its prior investments is very encouraging. About five years ago the company was generating losses but things have turned around because it's now earning 0.5% on its capital. Not only that, but the company is utilizing 369% more capital than before, but that's to be expected from a company trying to break into profitability. We like this trend, because it tells us the company has profitable reinvestment opportunities available to it, and if it continues going forward that can lead to a multi-bagger performance.

In Conclusion...

To the delight of most shareholders, Trip.com Group has now broken into profitability. Astute investors may have an opportunity here because the stock has declined 35% in the last five years. With that in mind, we believe the promising trends warrant this stock for further investigation.

If you want to continue researching Trip.com Group, you might be interested to know about the 1 warning sign that our analysis has discovered.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you decide to trade Trip.com Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Trip.com Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:TCOM

Trip.com Group

Through its subsidiaries, operates as a travel service provider for accommodation reservation, transportation ticketing, packaged tours, in-destination, corporate travel management, and other travel-related services in China and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives