- United States

- /

- Specialty Stores

- /

- NasdaqGS:REAL

Even With A 31% Surge, Cautious Investors Are Not Rewarding The RealReal, Inc.'s (NASDAQ:REAL) Performance Completely

The RealReal, Inc. (NASDAQ:REAL) shares have continued their recent momentum with a 31% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 78% in the last year.

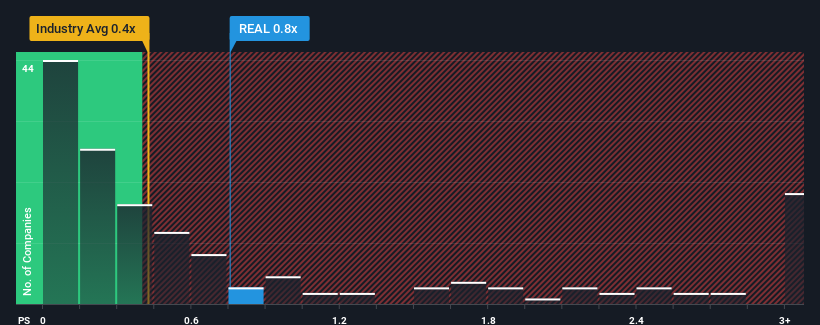

Although its price has surged higher, it's still not a stretch to say that RealReal's price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in the United States, where the median P/S ratio is around 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for RealReal

What Does RealReal's Recent Performance Look Like?

There hasn't been much to differentiate RealReal's and the industry's revenue growth lately. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on RealReal will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on RealReal.How Is RealReal's Revenue Growth Trending?

In order to justify its P/S ratio, RealReal would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 2.5%. This was backed up an excellent period prior to see revenue up by 42% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 12% per annum as estimated by the seven analysts watching the company. With the industry only predicted to deliver 5.4% per year, the company is positioned for a stronger revenue result.

With this information, we find it interesting that RealReal is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From RealReal's P/S?

RealReal appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at RealReal's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 5 warning signs for RealReal (1 shouldn't be ignored!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:REAL

RealReal

Operates an online marketplace for resale luxury goods worldwide.

Slight risk with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives