- United States

- /

- Specialty Stores

- /

- NasdaqGS:PLCE

Children's Place (NASDAQ:PLCE) May Have Issues Allocating Its Capital

What financial metrics can indicate to us that a company is maturing or even in decline? Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. Basically the company is earning less on its investments and it is also reducing its total assets. And from a first read, things don't look too good at Children's Place (NASDAQ:PLCE), so let's see why.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Children's Place is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0051 = US$1.7m ÷ (US$986m - US$648m) (Based on the trailing twelve months to January 2023).

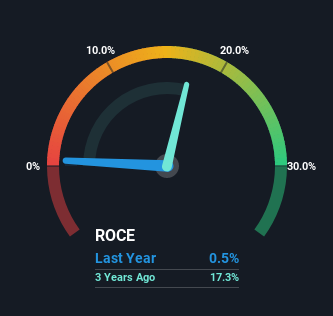

Therefore, Children's Place has an ROCE of 0.5%. Ultimately, that's a low return and it under-performs the Specialty Retail industry average of 15%.

View our latest analysis for Children's Place

Above you can see how the current ROCE for Children's Place compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Children's Place here for free.

SWOT Analysis for Children's Place

- Debt is well covered by .

- Interest payments on debt are not well covered.

- Expensive based on P/S ratio and estimated fair value.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Debt is not well covered by operating cash flow.

- Not expected to become profitable over the next 3 years.

So How Is Children's Place's ROCE Trending?

We are a bit anxious about the trends of ROCE at Children's Place. The company used to generate 29% on its capital five years ago but it has since fallen noticeably. What's equally concerning is that the amount of capital deployed in the business has shrunk by 42% over that same period. When you see both ROCE and capital employed diminishing, it can often be a sign of a mature and shrinking business that might be in structural decline. Typically businesses that exhibit these characteristics aren't the ones that tend to multiply over the long term, because statistically speaking, they've already gone through the growth phase of their life cycle.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 66%, which has impacted the ROCE. Without this increase, it's likely that ROCE would be even lower than 0.5%. And with current liabilities at these levels, suppliers or short-term creditors are effectively funding a large part of the business, which can introduce some risks.

The Bottom Line On Children's Place's ROCE

In summary, it's unfortunate that Children's Place is shrinking its capital base and also generating lower returns. This could explain why the stock has sunk a total of 81% in the last five years. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

One more thing to note, we've identified 1 warning sign with Children's Place and understanding this should be part of your investment process.

While Children's Place isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PLCE

Children's Place

Operates an omni-channel children’s specialty portfolio of brands in North America.

Moderate and fair value.

Similar Companies

Market Insights

Community Narratives