- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

Take Care Before Jumping Onto PDD Holdings Inc. (NASDAQ:PDD) Even Though It's 25% Cheaper

PDD Holdings Inc. (NASDAQ:PDD) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 27% in that time.

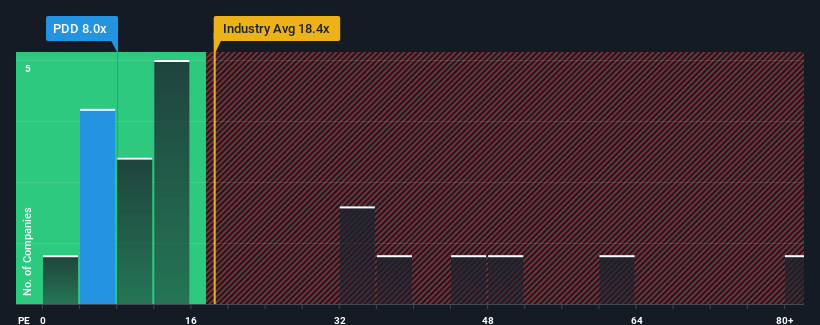

Even after such a large drop in price, PDD Holdings may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8x, since almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 30x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

PDD Holdings certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for PDD Holdings

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like PDD Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 83% last year. The latest three year period has also seen an excellent 1,206% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 11% per year as estimated by the analysts watching the company. With the market predicted to deliver 11% growth each year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that PDD Holdings' P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From PDD Holdings' P/E?

Shares in PDD Holdings have plummeted and its P/E is now low enough to touch the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of PDD Holdings' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for PDD Holdings with six simple checks on some of these key factors.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group that owns and operates a portfolio of businesses.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives