- United States

- /

- Specialty Stores

- /

- NasdaqGS:ORLY

O’Reilly Automotive (ORLY): Profit Margin Slips, Challenging Growth Premium Narratives

Reviewed by Simply Wall St

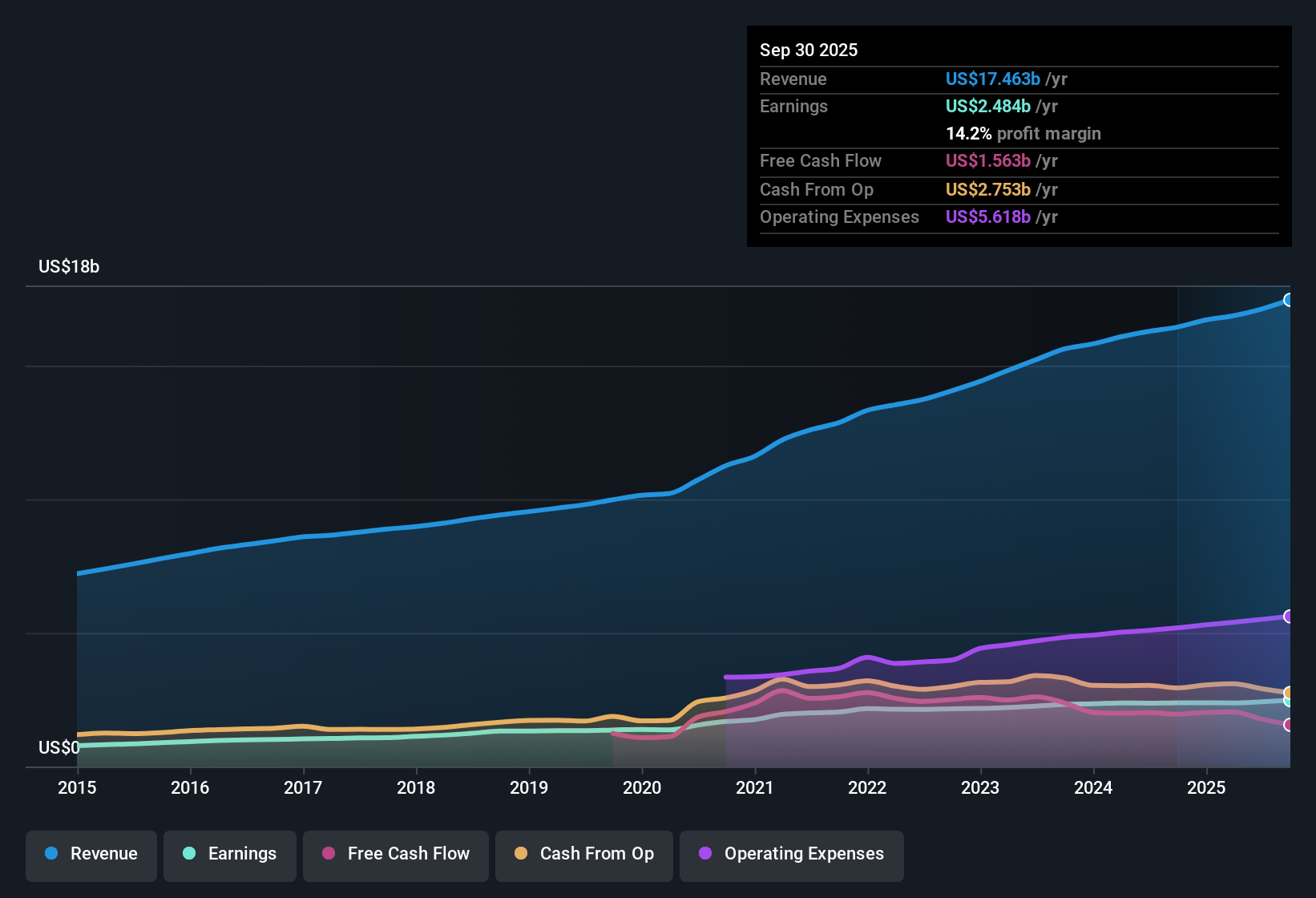

O'Reilly Automotive (ORLY) reported a 4% increase in earnings this year, building on its average annual growth rate of 6% over the past five years. Net profit margin came in at 14.2%, just below last year's 14.5%, with forward-looking estimates now calling for 6.5% annual earnings growth and 5.8% revenue expansion, both trailing the broader US market averages. While profits and sales continue to rise, the company’s growth momentum has softened compared to its industry peers and the wider market.

See our full analysis for O'Reilly Automotive.Next, we’ll see how these headline results compare with the community’s narrative and expectations for O’Reilly. We will look at what’s in line and where sentiment may shift.

See what the community is saying about O'Reilly Automotive

Store Expansion Lifts Revenue Visibility

- O’Reilly plans to add 38 net new stores across the U.S. and Mexico in the first quarter, directly increasing its footprint and supporting long-term revenue growth.

- Analysts' consensus view highlights that expanding store presence and improving customer retention are primary drivers expected to lift O’Reilly’s revenues by 6.2% annually over the next three years.

- With increased average inventory per store targeted for 2025, the narrative expects service levels and availability to stay high. This could enable the company to maintain or accelerate revenue momentum, even as industry peers face trade and sourcing headwinds.

- Opening new locations also positions O’Reilly to benefit from market share gains, especially if operational excellence and distribution strategies help keep ticket counts and net earnings aligned with consensus estimates.

- Consensus narrative points out that maintaining this growth pace is key to justifying the company’s current premium price-to-earnings multiple.

- If execution on expansion and diversification falters, it could challenge analyst targets despite recent revenue trends outpacing many competitors.

- Consensus estimates emphasize that only steady delivery can support the pricing currently expected by the market and analysts alike.

See how analysts’ forecasts stack up against current industry trends in the full consensus narrative for O'Reilly Automotive. 📊 Read the full O'Reilly Automotive Consensus Narrative.

Profit Margin Edges Up Against Cost Headwinds

- Analysts anticipate O’Reilly’s net profit margin rising from 14.2% to 14.5% in three years, a modest uptick despite ongoing global trade challenges and rising labor and occupancy expenses.

- According to the consensus narrative, the company’s focus on sourcing diversification and supplier negotiations aims to stabilize gross margins as tariff and inflationary pressures remain elevated.

- Mitigating reliance on Chinese products and negotiating cost increases help shield the company from potential margin contraction, keeping profitability in line with or above peers.

- Bears, however, highlight the risk that volatile SG&A costs or further trade disruptions could offset these defensive measures and pressure net margins below analyst expectations.

Valuation Premium Hinges on Delivery

- At a current share price of $98.27, O’Reilly trades at a price-to-earnings multiple above the US Specialty Retail industry’s 18.7x benchmark (with a projected PE of 36.4x for 2028). This demands sustained profit and revenue growth to justify the premium.

- Analysts' consensus view notes the gap between O’Reilly’s premium valuation and the industry average is defensible only if the projected uptick in earnings and margin materializes as predicted.

- If forecasts of earnings reaching $3.0 billion by 2028 are realized, O’Reilly’s higher multiple may appear warranted relative to competitors.

- Should profit margins lag or store growth slow, analysts warn that maintaining such a valuation premium will be challenging in a cooling sector.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for O'Reilly Automotive on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these results? Shape your personal outlook and create a unique narrative in just a few minutes: Do it your way

A great starting point for your O'Reilly Automotive research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

O'Reilly’s softer growth outlook and premium valuation expose investors to the risk that future expansion and profitability may not keep pace with sector leaders.

For those concerned about paying too much for projected growth, check out these 875 undervalued stocks based on cash flows to spot companies trading at more attractive valuations with potential for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ORLY

O'Reilly Automotive

Operates as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States, Puerto Rico, Mexico, and Canada.

Low risk with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion