- United States

- /

- Specialty Stores

- /

- NasdaqGS:ORLY

Did Strong Q2 Results and Upward Guidance Just Shift O'Reilly Automotive's (ORLY) Investment Narrative?

Reviewed by Simply Wall St

- O'Reilly Automotive recently reported its second quarter 2025 financial results, posting sales of US$4.53 billion and net income of US$669 million, alongside an upward revision of annual guidance and the completion of a US$777 million share buyback tranche.

- The combination of enhanced earnings, stronger outlook, and ongoing capital returns highlights management's focus on operational efficiency and shareholder value.

- We'll examine how the upward revision of annual earnings guidance could shape O'Reilly Automotive's investment narrative going forward.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

O'Reilly Automotive Investment Narrative Recap

O’Reilly Automotive appeals to investors who believe in the company's ability to drive steady sales and margin growth by leveraging its scale, inventory management, and customer service, despite industry-wide margin risks. The latest quarterly report delivered strong revenue and profit figures, and the increased annual guidance reinforces confidence in near-term earnings delivery, though immediate margin expansion still faces familiar challenges from input costs and competition. If the strength in execution persists, O’Reilly’s largest short-term opportunity remains capitalizing on robust consumer demand, while ongoing cost pressures and heightened rivalry are the key risks to watch; this news, while positive, doesn't materially change those dynamics.

Among recent announcements, the updated earnings guidance stands out: O’Reilly now expects total 2025 revenue between US$17.5 billion and US$17.8 billion and diluted EPS of US$2.85 to US$2.95. This move suggests management's optimism in the business’s core operations and aligns with the company's ongoing efforts to reinforce its competitive advantages, even as near-term catalysts like inventory investments and customer service improvements hold significant relevance to the outlook.

However, while short-term results look robust, investors should be aware that heightened competitive pressures could...

Read the full narrative on O'Reilly Automotive (it's free!)

O'Reilly Automotive's outlook forecasts $20.5 billion in revenue and $3.0 billion in earnings by 2028. This scenario assumes a 6.2% annual revenue growth rate and a $0.6 billion increase in earnings from the current $2.4 billion level.

Uncover how O'Reilly Automotive's forecasts yield a $106.09 fair value, a 7% upside to its current price.

Exploring Other Perspectives

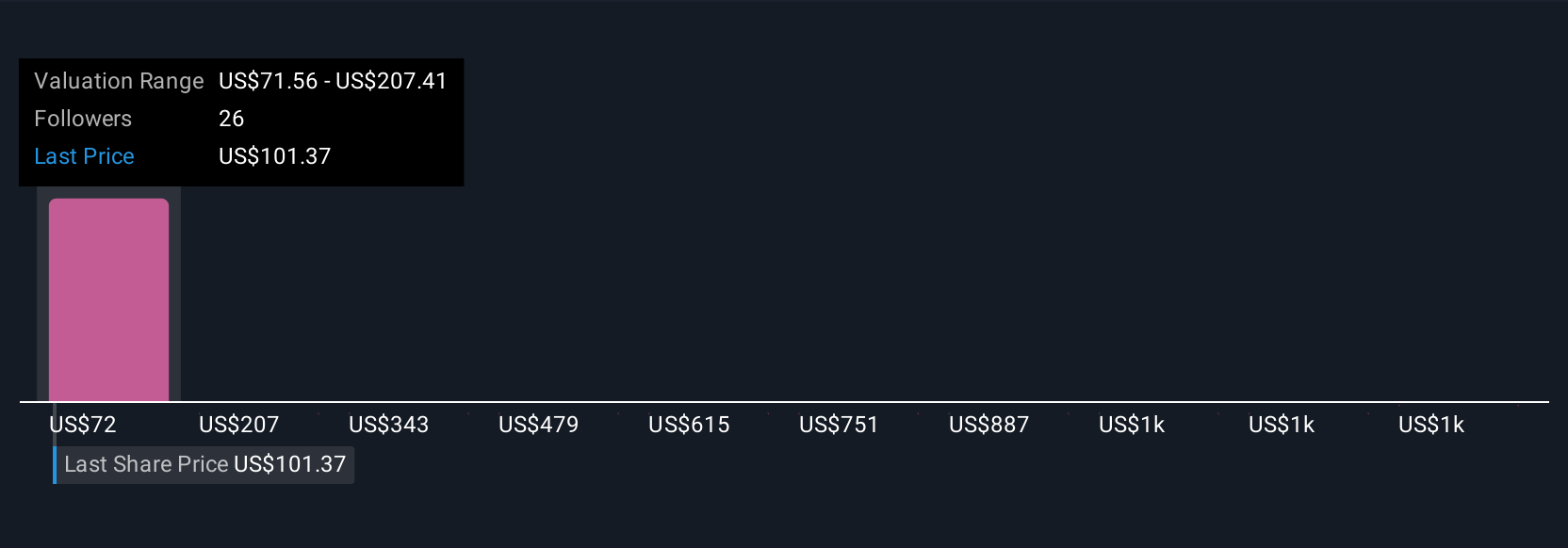

Five different private investor perspectives from the Simply Wall St Community estimate fair value for O’Reilly Automotive, ranging from US$71 to over US$1,430 per share. Yet, margin pressure from rising input and labor costs remains a crucial consideration that could impact performance in ways consensus views might not fully capture.

Explore 5 other fair value estimates on O'Reilly Automotive - why the stock might be worth 28% less than the current price!

Build Your Own O'Reilly Automotive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your O'Reilly Automotive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free O'Reilly Automotive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate O'Reilly Automotive's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ORLY

O'Reilly Automotive

Operates as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States, Puerto Rico, Mexico, and Canada.

Acceptable track record with limited growth.

Similar Companies

Market Insights

Community Narratives