- United States

- /

- Specialty Stores

- /

- NasdaqGM:ONEW

More Unpleasant Surprises Could Be In Store For OneWater Marine Inc.'s (NASDAQ:ONEW) Shares After Tumbling 26%

OneWater Marine Inc. (NASDAQ:ONEW) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 19% in that time.

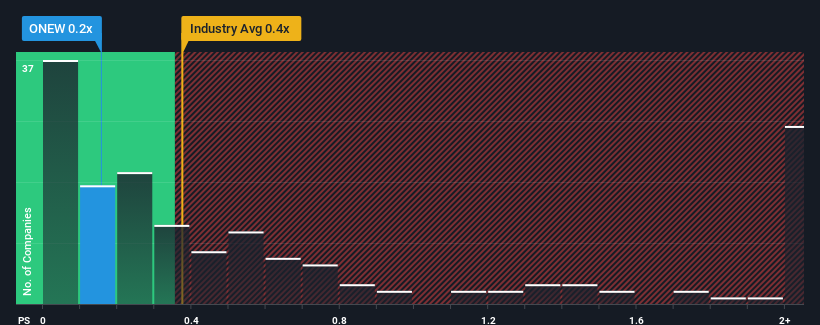

Although its price has dipped substantially, there still wouldn't be many who think OneWater Marine's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in the United States' Specialty Retail industry is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for OneWater Marine

What Does OneWater Marine's Recent Performance Look Like?

OneWater Marine certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on OneWater Marine will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For OneWater Marine?

The only time you'd be comfortable seeing a P/S like OneWater Marine's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 8.9% gain to the company's revenues. Pleasingly, revenue has also lifted 78% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 1.5% during the coming year according to the seven analysts following the company. With the industry predicted to deliver 3.6% growth, the company is positioned for a weaker revenue result.

With this information, we find it interesting that OneWater Marine is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On OneWater Marine's P/S

OneWater Marine's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that OneWater Marine's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for OneWater Marine that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ONEW

OneWater Marine

Operates as a recreational marine retailer in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives