Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies The ODP Corporation (NASDAQ:ODP) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for ODP

What Is ODP's Debt?

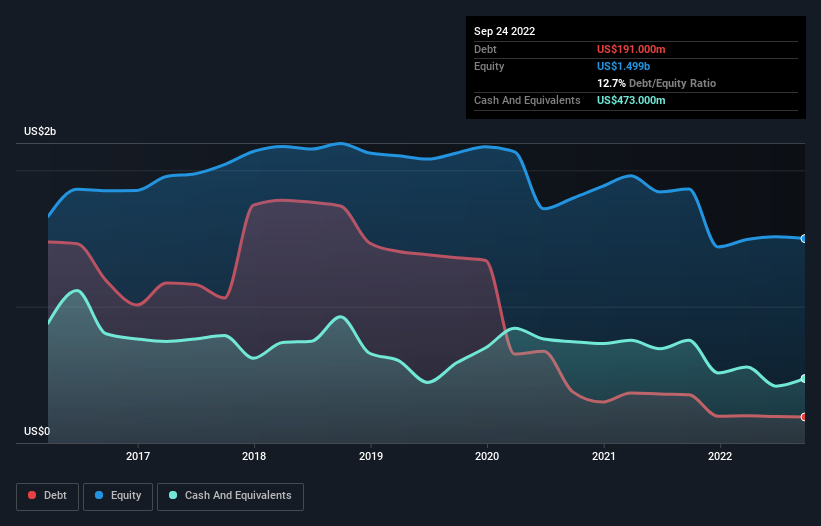

You can click the graphic below for the historical numbers, but it shows that ODP had US$191.0m of debt in September 2022, down from US$353.0m, one year before. However, it does have US$473.0m in cash offsetting this, leading to net cash of US$282.0m.

How Healthy Is ODP's Balance Sheet?

We can see from the most recent balance sheet that ODP had liabilities of US$1.89b falling due within a year, and liabilities of US$1.03b due beyond that. Offsetting these obligations, it had cash of US$473.0m as well as receivables valued at US$601.0m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$1.85b.

This is a mountain of leverage relative to its market capitalization of US$2.37b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. While it does have liabilities worth noting, ODP also has more cash than debt, so we're pretty confident it can manage its debt safely.

On the other hand, ODP saw its EBIT drop by 6.3% in the last twelve months. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine ODP's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While ODP has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, ODP generated free cash flow amounting to a very robust 89% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Summing Up

Although ODP's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of US$282.0m. And it impressed us with free cash flow of US$62m, being 89% of its EBIT. So we are not troubled with ODP's debt use. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 1 warning sign we've spotted with ODP .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ODP

ODP

Provides business products, services and supplies, and digital workplace technology solutions to small, medium, and enterprise-level businesses in the United States, Puerto Rico, the U.S.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives