- United States

- /

- Software

- /

- NasdaqCM:ABTS

This Is Why We Think Moxian, Inc.'s (NASDAQ:MOXC) CEO Might Get A Pay Rise Approved By Shareholders

Shareholders will be pleased by the robust performance of Moxian, Inc. (NASDAQ:MOXC) recently and this will be kept in mind in the upcoming AGM on 25 June 2021. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. In our analysis below, we discuss why we think the CEO compensation looks acceptable and the case for a raise.

See our latest analysis for Moxian

Comparing Moxian, Inc.'s CEO Compensation With the industry

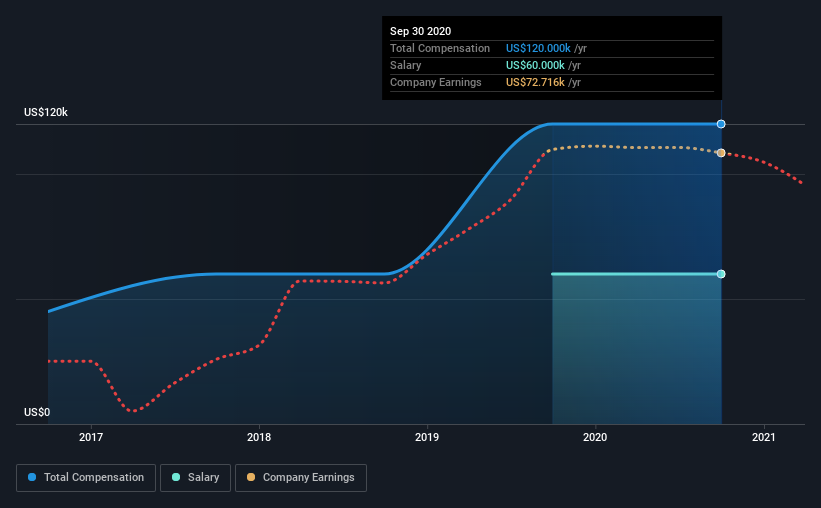

Our data indicates that Moxian, Inc. has a market capitalization of US$228m, and total annual CEO compensation was reported as US$120k for the year to September 2020. This was the same amount the CEO received in the prior year. In particular, the salary of US$60.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between US$100m and US$400m had a median total CEO compensation of US$232k. In other words, Moxian pays its CEO lower than the industry median. What's more, Qinghu Hao holds US$5.0m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$60k | US$60k | 50% |

| Other | US$60k | US$60k | 50% |

| Total Compensation | US$120k | US$120k | 100% |

Speaking on an industry level, nearly 25% of total compensation represents salary, while the remainder of 75% is other remuneration. Moxian pays out 50% of remuneration in the form of a salary, significantly higher than the industry average.

Moxian, Inc.'s Growth

Moxian, Inc. has seen its earnings per share (EPS) increase by 102% a year over the past three years. In the last year, its revenue is up 6.7%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Moxian, Inc. Been A Good Investment?

Moxian, Inc. has served shareholders reasonably well, with a total return of 18% over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

The company's overall performance, while not bad, could be better. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for Moxian (of which 1 is potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Important note: Moxian is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Moxian, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:ABTS

Abits Group

Through its subsidiary, operates in the bitcoin mining business in the United States.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion