- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:MELI

Will Rate Cut Hopes and Michael Burry’s Bet Shift MercadoLibre's (MELI) Investment Story?

Reviewed by Simply Wall St

- Following recent comments by Federal Reserve Chair Jerome Powell suggesting possible interest rate cuts, MercadoLibre was buoyed by increased investor confidence and significant institutional buying, including a large investment from Scion Asset Management led by Michael Burry.

- This wave of positive sentiment for growth and tech stocks has brought renewed attention to MercadoLibre's role as a leading e-commerce and fintech platform in Latin America.

- We'll explore how anticipation of lower interest rates and high-profile institutional investment could reshape MercadoLibre's investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

MercadoLibre Investment Narrative Recap

To be a MercadoLibre shareholder, you need to believe in the company's ability to sustain rapid e-commerce and fintech growth in Latin America, while managing the balance between profitability and user expansion. The recent surge in share price driven by expectations of lower US interest rates and Michael Burry’s institutional investment injects confidence, but doesn’t fundamentally alter the main short-term catalyst, continued user base and gross merchandise volume growth, or the key risk of potential credit losses in its fast-expanding fintech portfolio.

Among recent company announcements, MercadoLibre's planned BRL 34 billion (US$5.8 billion) investment in Brazil for 2025 stands out. This aggressive push into logistics and technology could support the company’s ambitions to solidify market leadership and accelerate user growth, particularly relevant as investor enthusiasm grows around possible tailwinds from policy shifts and institutional backing.

On the flip side, investors should be aware that faster growth in the credit portfolio can mean...

Read the full narrative on MercadoLibre (it's free!)

MercadoLibre's outlook suggests $45.9 billion in revenue and $5.2 billion in earnings by 2028. This scenario assumes annual revenue growth of 24.0% and a $3.1 billion increase in earnings from the current $2.1 billion level.

Uncover how MercadoLibre's forecasts yield a $2841 fair value, a 17% upside to its current price.

Exploring Other Perspectives

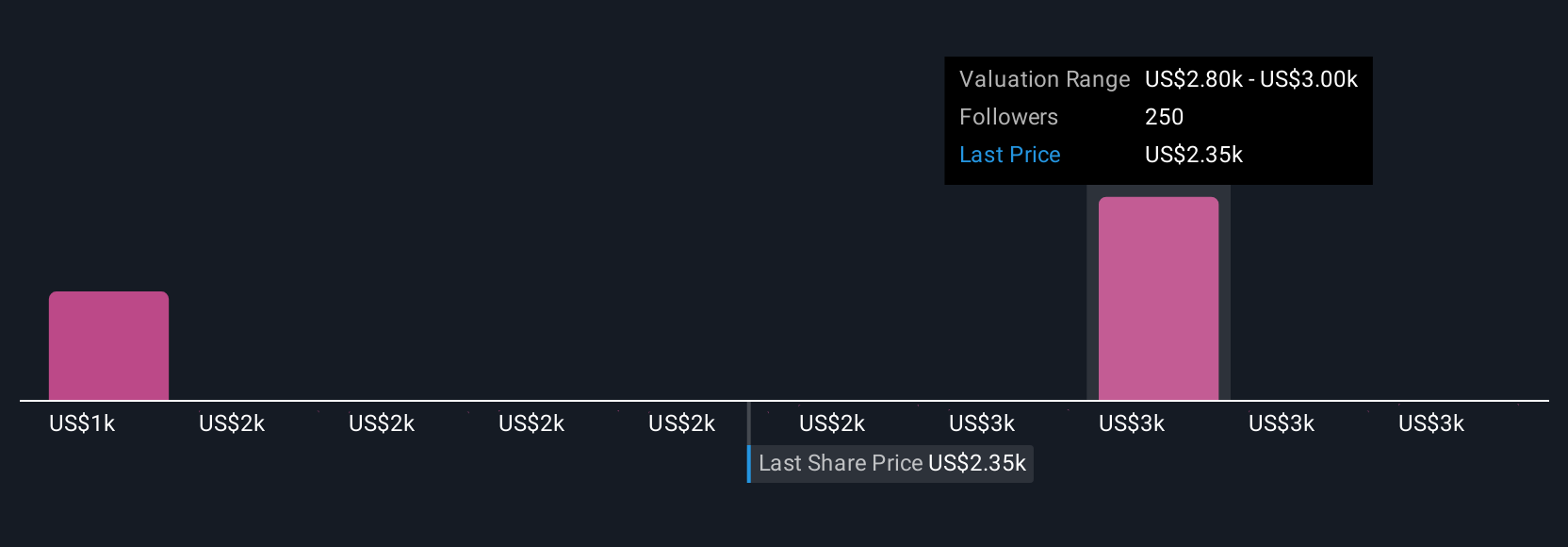

Fair value estimates from 30 Simply Wall St Community members range between US$1,401 and US$3,406 per share. While opinions vary widely, many are keeping a close eye on how MercadoLibre’s accelerating expansion in Brazil could influence both market share and risk exposure.

Explore 30 other fair value estimates on MercadoLibre - why the stock might be worth 42% less than the current price!

Build Your Own MercadoLibre Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MercadoLibre research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MercadoLibre research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MercadoLibre's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MELI

MercadoLibre

Operates online commerce platforms in Brazil, Mexico, Argentina, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives