- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:MELI

What MercadoLibre (MELI)'s B2B Launch and Pharmacy Push Could Mean for Shareholder Growth

Reviewed by Sasha Jovanovic

- In recent weeks, MercadoLibre has expanded its presence by launching a B2B e-commerce division across Brazil, Argentina, Mexico, and Chile, and by entering Brazil's online pharmacy market through a drugstore acquisition.

- An important insight is that the company's fintech arm, MercadoPago, has reported robust growth in both users and its credit portfolio, even amid tighter lending standards and macroeconomic headwinds.

- We'll look at how MercadoLibre’s entry into Brazil’s online pharmacy sector could reshape its broader growth and investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

MercadoLibre Investment Narrative Recap

To be a shareholder in MercadoLibre, you have to believe in its dual e-commerce and fintech engines, underpinned by continued growth in digital commerce and payments across Latin America. The recent launch of a B2B division and move into online pharmacy in Brazil may enhance long-term scale, but does not meaningfully change the near-term catalyst: MercadoPago’s rapid expansion. However, these headline moves do little to offset the most acute risk right now, rising credit exposure and potential bad debts as the lending book grows.

Of the recent announcements, MercadoLibre’s push into Brazil’s online pharmacy sector stands out for its potential to unlock new verticals. While it opens additional revenue streams, the most immediate catalyst for overall performance remains MercadoPago’s accelerating user growth and disciplined risk management, which are helping offset margin pressure tied to shipping and acquisition costs.

But despite the promise, investors should also weigh the mounting risk posed by fast-growing credit operations in volatile economies, especially if delinquency rates begin to...

Read the full narrative on MercadoLibre (it's free!)

MercadoLibre's narrative projects $46.9 billion revenue and $5.1 billion earnings by 2028. This requires 24.8% yearly revenue growth and a $3.0 billion earnings increase from $2.1 billion today.

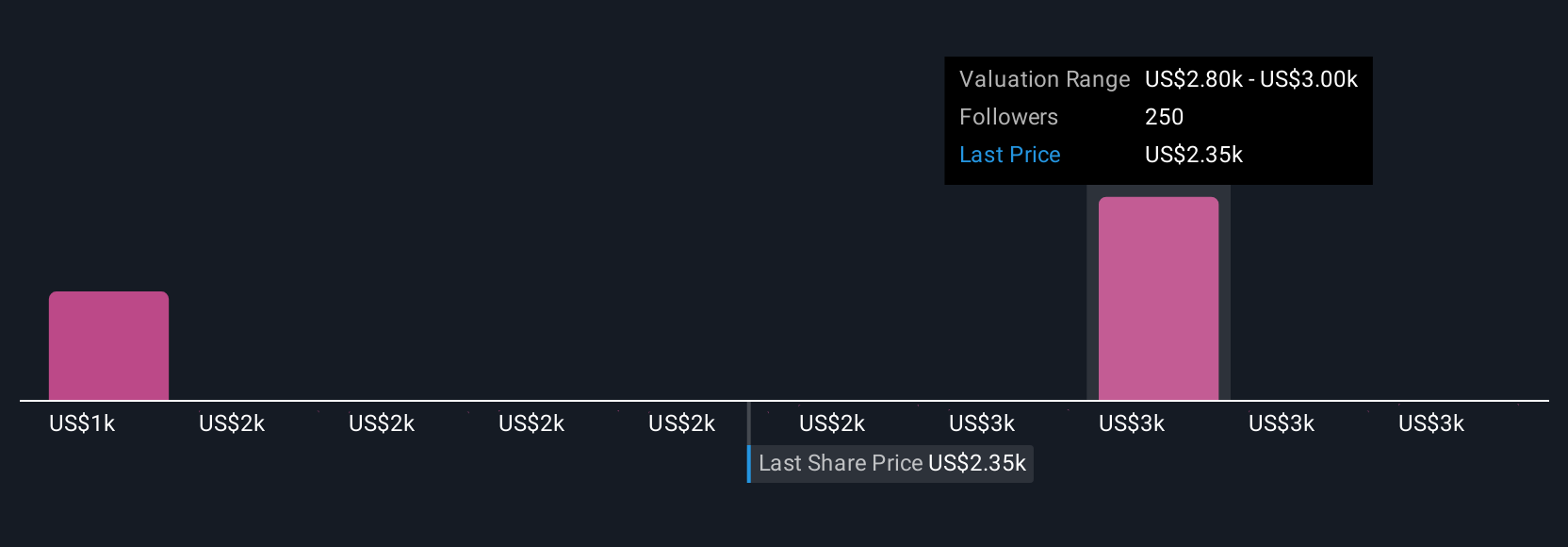

Uncover how MercadoLibre's forecasts yield a $2894 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Fair value estimates from 27 members of the Simply Wall St Community range from US$2,316 to US$3,406 per share, reflecting a broad spread of viewpoints. As you consider these, remember rapid credit portfolio expansion also brings higher risk, potentially impacting profitability if loan quality worsens, check out other views before forming your decision.

Explore 27 other fair value estimates on MercadoLibre - why the stock might be worth just $2316!

Build Your Own MercadoLibre Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MercadoLibre research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MercadoLibre research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MercadoLibre's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MELI

MercadoLibre

Operates online commerce platforms in Brazil, Mexico, Argentina, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives