- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:MELI

MercadoLibre Valuation After 127% Three Year Surge and Fintech Expansion News

Reviewed by Bailey Pemberton

- If you have ever wondered whether MercadoLibre at around $1,993 a share is still a smart buy or already priced for perfection, you are exactly who this breakdown is for.

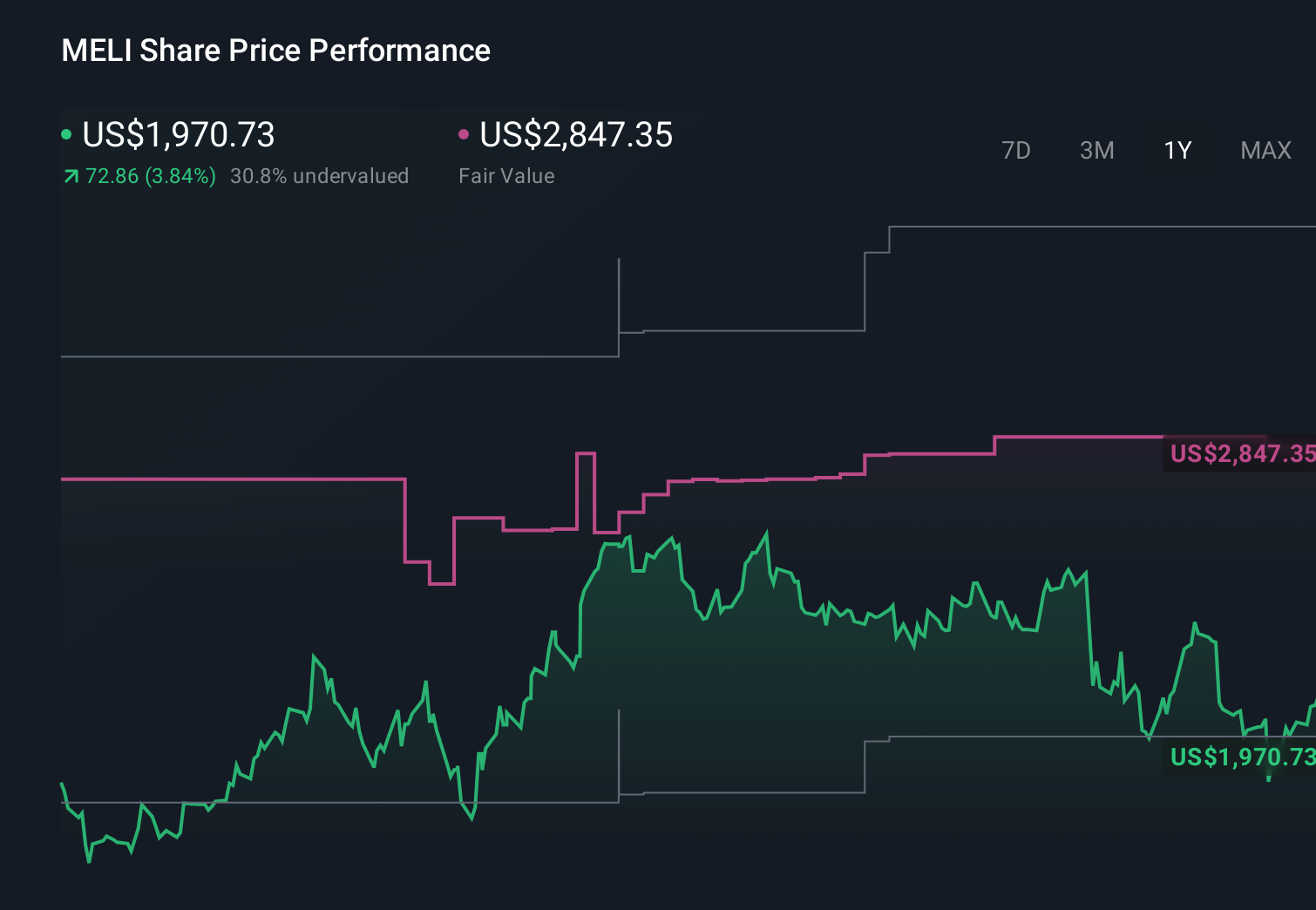

- The stock is up 1.4% over the last week, 2.1% in the past month, 13.0% year to date, and about 15.2% over the last year, with a 127.0% gain over three years that highlights how powerful the long term story has been despite a more modest 19.8% over five years.

- Recent headlines have focused on MercadoLibre steadily expanding its fintech ecosystem across Latin America and deepening its logistics network. These moves strengthen its moat as both an e commerce and payments leader. At the same time, ongoing regulatory and competitive developments in key markets like Brazil and Mexico have reminded investors that rapid growth in digital payments and online retail still comes with meaningful execution and policy risk.

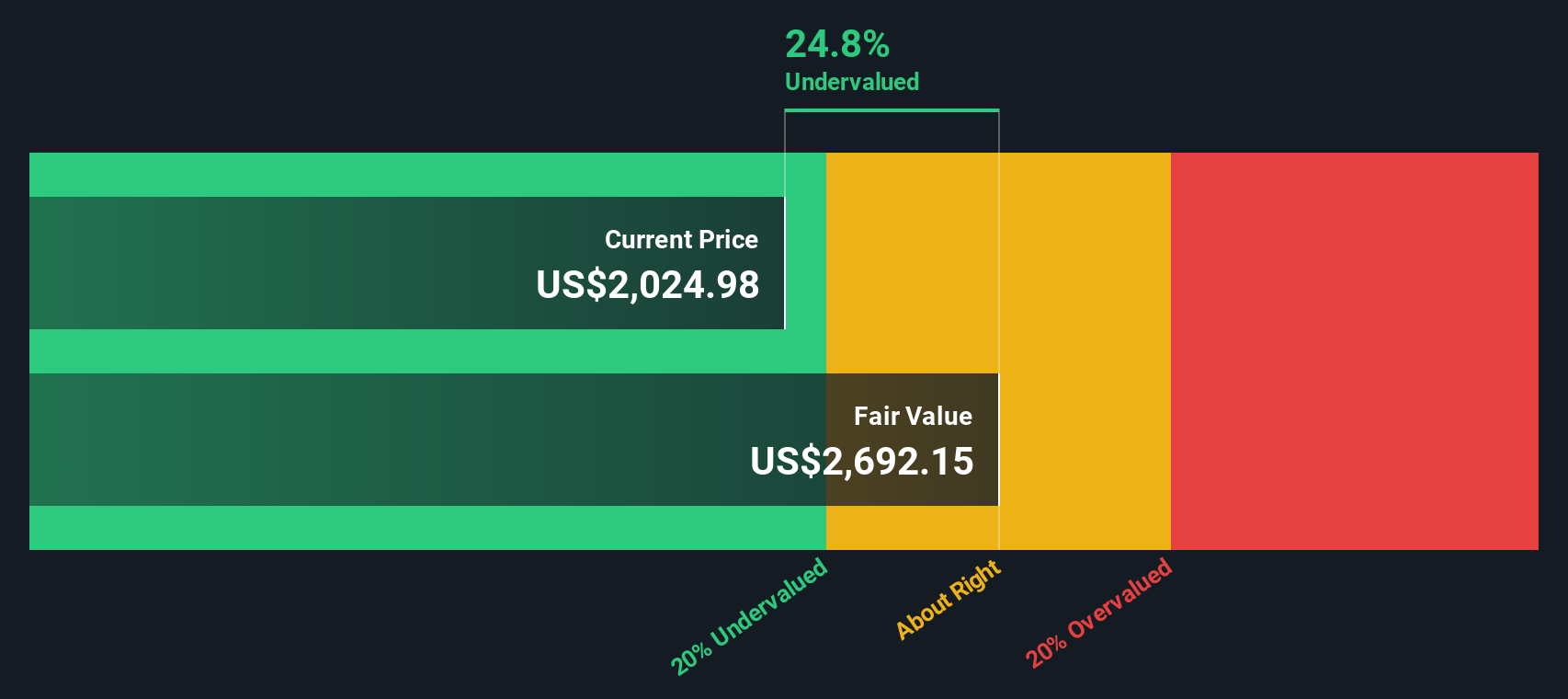

- Today, MercadoLibre scores a 3/6 valuation score, reflecting that it appears undervalued on three of our six key checks. In the next sections we will walk through what that means across different valuation methods, before finishing with a more intuitive way to think about what the market is really pricing in.

Approach 1: MercadoLibre Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today. For MercadoLibre, the model used is a 2 Stage Free Cash Flow to Equity approach, which captures a faster growth period followed by a more mature phase.

The company generated trailing twelve month free cash flow of about $8.8 billion, and analysts expect this to climb to roughly $10.7 billion by 2027. Beyond the explicit analyst horizon, Simply Wall St extrapolates cash flows out to 2035, with projected FCF in ten years of around $15.7 billion as MercadoLibre’s marketplace, fintech, and logistics operations scale further.

When all of those projected cash flows are discounted back to today, the model arrives at an intrinsic value of about $2,906.84 per share. Versus the current share price around $1,993, this implies the stock is roughly 31.4% undervalued on a DCF basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MercadoLibre is undervalued by 31.4%. Track this in your watchlist or portfolio, or discover 899 more undervalued stocks based on cash flows.

Approach 2: MercadoLibre Price vs Earnings

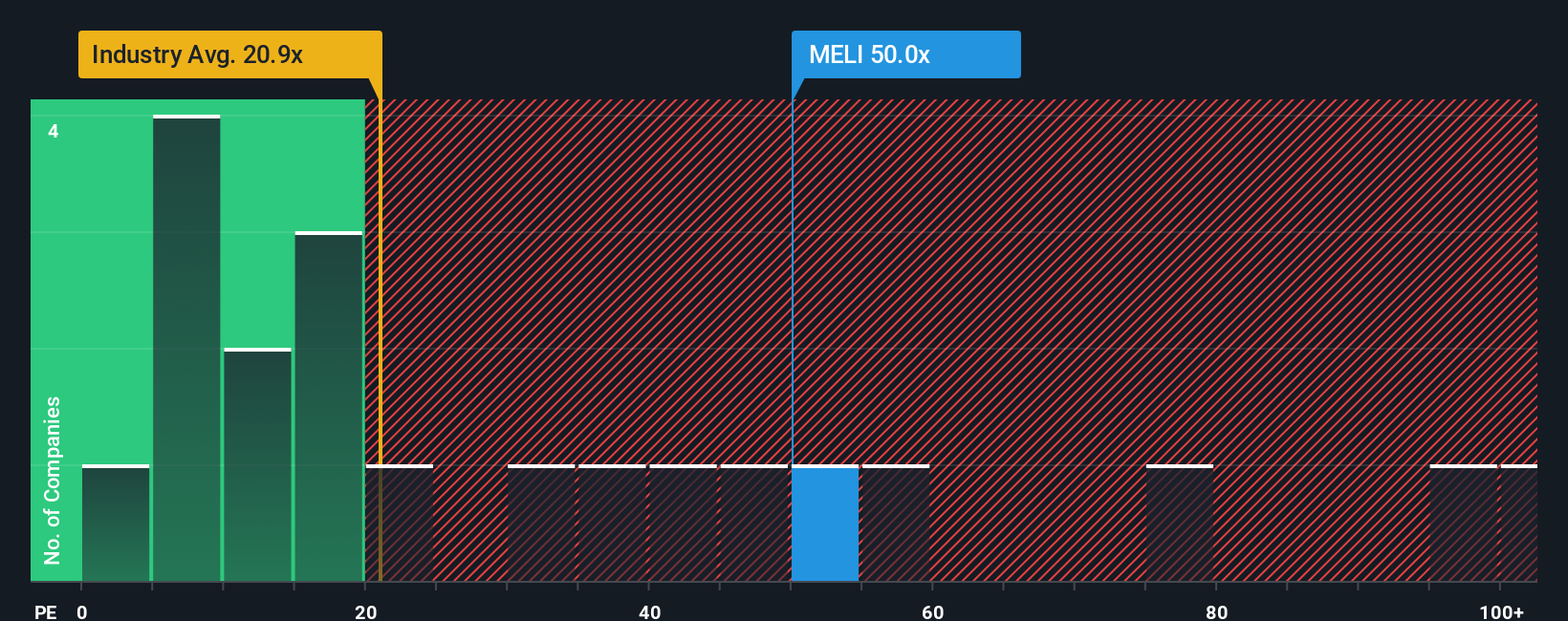

For a profitable company like MercadoLibre, the price to earnings ratio is a useful yardstick because it links what investors pay today to the profits the business is already generating. A higher PE can be justified when a company is growing quickly and has durable competitive advantages, while slower growth or higher risk usually calls for a lower, more conservative multiple.

MercadoLibre currently trades on a PE of about 48.7x. That is well above the broader Multiline Retail industry average of roughly 19.6x, and also sits higher than the peer group average around 44.3x, reflecting the market’s expectation for faster growth and stronger economics than a typical retailer.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE multiple would make sense, given MercadoLibre’s earnings growth profile, margins, risk factors, market cap and industry. On this basis, the stock’s Fair Ratio is a lower 34.7x, suggesting the present 48.7x valuation bakes in quite optimistic assumptions and points to the shares looking stretched on an earnings multiple basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1457 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MercadoLibre Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple stories that connect your view of a company with the numbers behind it, by turning your assumptions about future revenue, earnings and margins into a clear forecast and fair value. On Simply Wall St’s Community page, millions of investors build Narratives that spell out why they think a business like MercadoLibre deserves a certain multiple, how fast its commerce and fintech segments might grow, and what that means for profit margins and long term value. Each Narrative then compares its Fair Value to the live share price, making it easy to see whether your story suggests it is time to buy, hold or sell, and it automatically updates as fresh news or earnings arrive. For example, one investor might see MercadoLibre justifying a fair value closer to $3,500 on the back of strong ecosystem leverage and margin expansion, while another, more cautious Narrative might cap fair value around $2,170 due to competitive and credit risks. Both perspectives are transparently linked to their underlying forecasts rather than vague optimism or pessimism.

Do you think there's more to the story for MercadoLibre? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MELI

MercadoLibre

Operates online commerce platforms in Brazil, Mexico, Argentina, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion