- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:MELI

MercadoLibre (NasdaqGS:MELI): Evaluating Valuation as Brazil Expansion and Casas Bahia Deal Drive Investor Optimism

Reviewed by Simply Wall St

MercadoLibre (NasdaqGS:MELI) is drawing attention ahead of its upcoming Q3 earnings release as investors weigh recent moves in fintech, strategic changes in Brazil, and a new partnership with retailer Casas Bahia.

See our latest analysis for MercadoLibre.

After a standout run earlier in the year, MercadoLibre’s 1-day and 7-day share price returns have been positive, reflecting buzz around its new Brazil partnership and fintech momentum. However, recent months saw some pullback. Even so, the 1-year total shareholder return of 5.6% and an impressive 145% return over three years show that long-term holders have been handsomely rewarded. Recent initiatives could set the stage for renewed momentum.

If MercadoLibre’s evolving strategy has you surveying the broader landscape for dynamic opportunities, consider exploring fast growing stocks with high insider ownership.

With MercadoLibre trading well below analyst price targets and expectations riding high on fintech and marketplace growth, the big question is whether the current valuation offers a compelling entry point or if optimism has already been fully priced in.

Most Popular Narrative: 25.3% Undervalued

Compared to the last close price of $2,161.11, the widely followed narrative suggests a significantly higher fair value, creating debate among investors ahead of earnings. Strong catalyst-driven projections in digital payments and platform integration highlight why market watchers are taking notice.

Cross-platform integration of commerce, fintech, and advertising, as demonstrated by accelerated ad revenue growth and enhanced tools for sellers, deepens ecosystem stickiness. This reinforces customer lifetime value and delivers operating leverage that can support above-consensus net income and earnings growth.

Want to uncover the bold financial assumptions powering this valuation? There’s a secret cocktail of double-digit growth rates and margin expansion embedded in this narrative. The real surprise might lie in just how optimistic the profit trajectory and future earnings multiple get. Dive in for the unfiltered story behind this standout fair value.

Result: Fair Value of $2,893.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, credit losses from rapid MercadoPago expansion or rising competition in Brazil could spark renewed doubts about whether this bullish case remains intact.

Find out about the key risks to this MercadoLibre narrative.

Another View: What Do Valuation Ratios Tell Us?

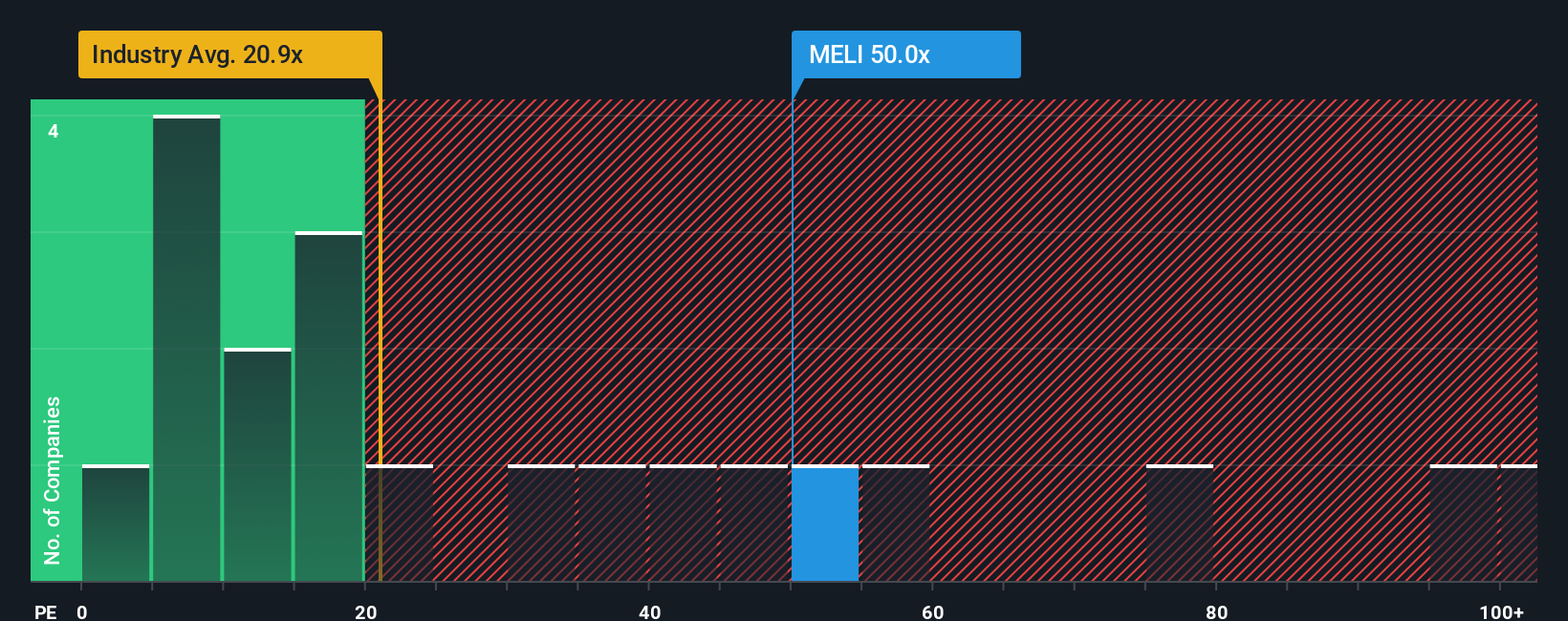

Looking at MercadoLibre’s price-to-earnings ratio of 53.4x, it sits far above the global industry average of 21.3x and even the fair ratio estimate of 34x. While this premium hints at confidence in future growth, it also means there is little room for disappointment if expectations shift. Could the market be overpaying for the story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MercadoLibre Narrative

If you see things differently or want to dive into the details yourself, it only takes a few minutes to build your own perspective. Do it your way.

A great starting point for your MercadoLibre research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let new opportunities pass you by. Make your next smart move and get ahead by tapping into investment ideas you might not have considered.

- Unlock strong income streams and grow your portfolio by checking out these 17 dividend stocks with yields > 3% with yields above 3% for reliable cash returns.

- Gain an edge in tomorrow's tech by finding these 27 AI penny stocks that are revolutionizing industries with artificial intelligence breakthroughs and visionary growth potential.

- Start building long-term value by targeting these 876 undervalued stocks based on cash flows and spot companies trading below their true potential before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MELI

MercadoLibre

Operates online commerce platforms in Brazil, Mexico, Argentina, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives