- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:MELI

MercadoLibre (NasdaqGS:MELI): Assessing Valuation After Fintech-Fueled Growth in Latest Quarterly Results

Reviewed by Simply Wall St

MercadoLibre (MELI) recently reported quarterly results that caught investors’ attention, thanks to strong revenue gains fueled by its expanding fintech business. The company’s strategy to deepen its digital ecosystem appears to be resonating across Latin America.

See our latest analysis for MercadoLibre.

MercadoLibre’s momentum this year reflects a market recognizing its fintech expansion and strong execution. Despite a recent 1-month share price return of -10.91%, the stock remains up 15.2% year-to-date. Over the past three years, total shareholder return has climbed 118%, underscoring the company’s long-term growth potential as it scales across Latin America.

If MercadoLibre’s run has you wondering what other digital disruptors might be on the rise, you’ll want to discover See the full list for free.

Given MercadoLibre’s impressive growth rates and expanding digital footprint, the big question facing investors now is whether the current share price already reflects these future gains or if there is still meaningful upside from here.

Most Popular Narrative: 29% Undervalued

With MercadoLibre’s narrative fair value sitting at $2,861.96, well above the last close price of $2,033.32, there is a sharp gap between market sentiment and widely followed analyst assumptions. This raises a big question about how much future growth and margin expansion may already be priced in or overlooked.

Cross-platform integration of commerce, fintech, and advertising, demonstrated by accelerated ad revenue growth and enhanced tools for sellers, deepens ecosystem stickiness and reinforces customer lifetime value. This delivers operating leverage that can support above-consensus net income and earnings growth.

Want to find out what ambitious revenue and earnings targets drive this gap? The narrative builds its case on game-changing financial projections and future profit multiples that attract attention. The details behind this valuation might surprise you.

Result: Fair Value of $2,861.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as heightened competition in core markets and potential increases in credit losses could quickly challenge MercadoLibre’s robust growth assumptions.

Find out about the key risks to this MercadoLibre narrative.

Another View: Multiples May Tell a Different Story

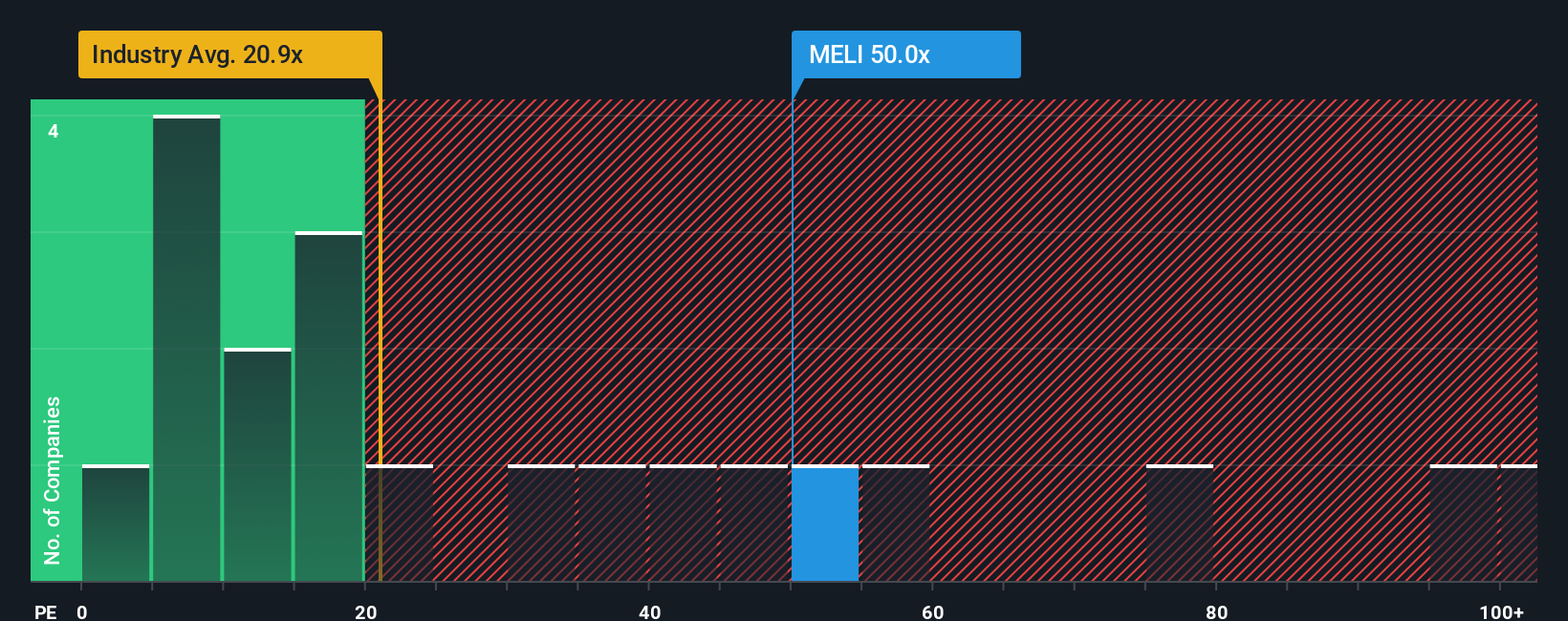

While the fair value model points to MercadoLibre being undervalued, a look at the price-to-earnings ratio paints a more cautious picture. MercadoLibre trades at 49.6x earnings, which is much higher than the global multiline retail industry’s 19.8x and its peer group’s 51.8x. This is also well above its fair ratio of 31.8x. As a result, the stock commands a significant premium that could limit future upside if growth falters. Are investors paying too much for growth, or will MercadoLibre’s momentum prove the valuation risk is worth it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MercadoLibre Narrative

If you see things differently or want to dive into the details yourself, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your MercadoLibre research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on the sidelines while others uncover promising opportunities. Put Simply Wall Street’s screeners to work and get ahead of tomorrow’s market moves.

- Boost your passive income by targeting these 15 dividend stocks with yields > 3% offering yields above 3% and steady financial strength.

- Tap into the artificial intelligence revolution by selecting these 25 AI penny stocks that are reshaping industries and driving rapid growth.

- Seize potential bargains with these 926 undervalued stocks based on cash flows based on powerful cash flow analysis before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MELI

MercadoLibre

Operates online commerce platforms in Brazil, Mexico, Argentina, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success