- United States

- /

- Software

- /

- OTCPK:MARK

Earnings Update: Remark Holdings, Inc. (NASDAQ:MARK) Just Reported And Analysts Are Boosting Their Estimates

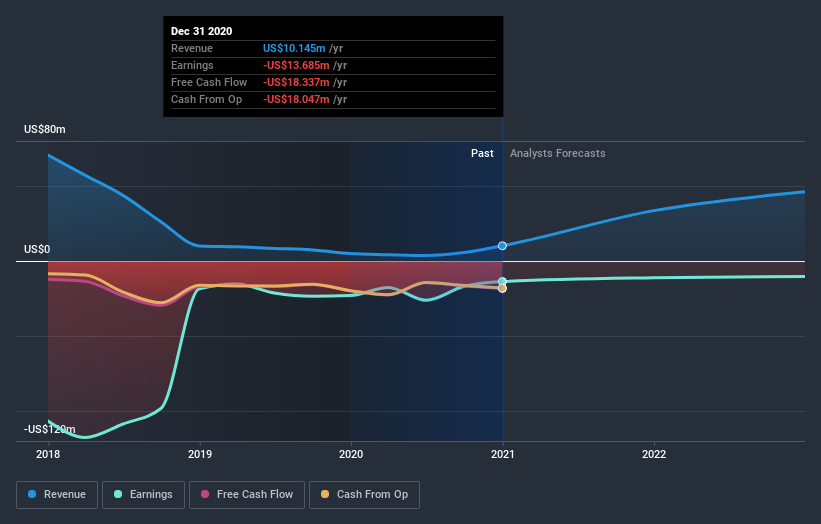

Investors in Remark Holdings, Inc. (NASDAQ:MARK) had a good week, as its shares rose 7.7% to close at US$2.39 following the release of its yearly results. The results don't look great, especially considering that statutory losses grew 23% toUS$0.16 per share. Revenues of US$10m did beat expectations by 3.7%, but it looks like a bit of a cold comfort. Following the result, the analyst has updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest statutory forecasts to see what the analyst is expecting for next year.

View our latest analysis for Remark Holdings

After the latest results, the lone analyst covering Remark Holdings are now predicting revenues of US$33.6m in 2021. If met, this would reflect a substantial 231% improvement in sales compared to the last 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 31% to US$0.11. Yet prior to the latest earnings, the analyst had been forecasting revenues of US$28.3m and losses of US$0.15 per share in 2021. So there's been quite a change-up of views after the recent consensus updates, with the analyst making a sizeable increase to their revenue forecasts while also reducing the estimated loss as the business grows towards breakeven.

The consensus price target rose 75% to US$10.50, with the analyst encouraged by the higher revenue and lower forecast losses for next year.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. One thing stands out from these estimates, which is that Remark Holdings is forecast to grow faster in the future than it has in the past, with revenues expected to display 231% annualised growth until the end of 2021. If achieved, this would be a much better result than the 34% annual decline over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 17% per year. Not only are Remark Holdings' revenues expected to improve, it seems that the analyst is also expecting it to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analyst reconfirmed their loss per share estimates for next year. Happily, they also upgraded their revenue estimates, and are forecasting revenues to grow faster than the wider industry. There was also a nice increase in the price target, with the analyst clearly feeling that the intrinsic value of the business is improving.

With that in mind, we wouldn't be too quick to come to a conclusion on Remark Holdings. Long-term earnings power is much more important than next year's profits. At least one analyst has provided forecasts out to 2022, which can be seen for free on our platform here.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Remark Holdings (3 are a bit concerning!) that you need to be mindful of.

If you decide to trade Remark Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:MARK

Remark Holdings

Provides AI-powered analytics, computer vision, and smart agent solutions.

Medium-low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success