- United States

- /

- Specialty Stores

- /

- NasdaqGS:LESL

Leslie's, Inc.'s (NASDAQ:LESL) Earnings Haven't Escaped The Attention Of Investors

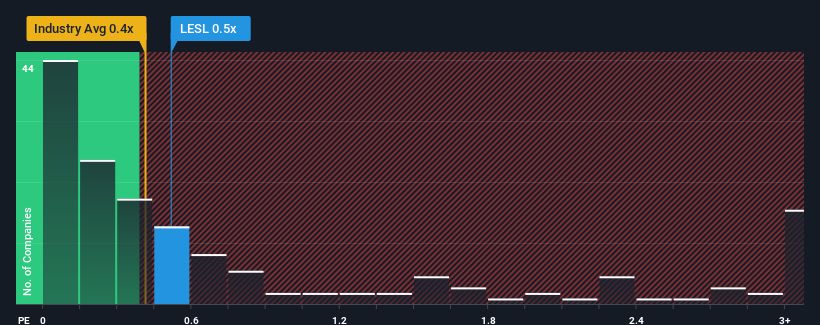

There wouldn't be many who think Leslie's, Inc.'s (NASDAQ:LESL) price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S for the Specialty Retail industry in the United States is similar at about 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Leslie's

What Does Leslie's' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Leslie's' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Leslie's.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Leslie's would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.7%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 17% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 3.5% over the next year. That's shaping up to be similar to the 3.6% growth forecast for the broader industry.

In light of this, it's understandable that Leslie's' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Leslie's' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Leslie's (of which 2 are a bit concerning!) you should know about.

If you're unsure about the strength of Leslie's' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LESL

Leslie's

Operates as a direct-to-consumer pool and spa care brand in the United States.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives