Tencent Shareholders may want to hold onto Unbundled JD.com (NASDAQ:JD) Stake

Shares of JD.com, Inc . ( NASDAQ:JD ) are trading 7% lower after Tencent announced that it would distribute most of its stake in the company to shareholders . Tencent will distribute more than 457 million shares via a special dividend. This will result in Tencent’s stake falling from around 17% to 2.3%.

The distribution will probably create an overhang in the short term as some Tencent shareholders decide to sell their JD.com shares. However, there are some reasons to believe the distribution is good for Tencent shareholders, and the weakness may be an opportunity to buy JD.com at a deeper discount.

We looked at our fair value models to see how the various valuations compare. These fair value estimates are based on analyst cash flow projections, and should only be viewed as estimates. However, they are useful as they can give us an idea of the relative valuations. For reference we have included the other Chinese e-commerce giants Alibaba and Pinduoduo.

| Fair Value | Discount/(Premium) at Current Price | |

| JD.com ( NASDAQ:JD ). | $147 | 54% discount |

| Tencent ( OTCPK:TCEH.Y ) | $49 | 22% premium |

| Alibaba ( NYSE:BABA ) | $178 | 35% discount |

| Pinduoduo ( NASDAQ:PDD ) | $269 |

78% discount |

Going by these estimates, Tencent shareholders may be able to realize more value from the JD.com stake by holding the shares directly, that they would have with the shares locked up within Tencent.

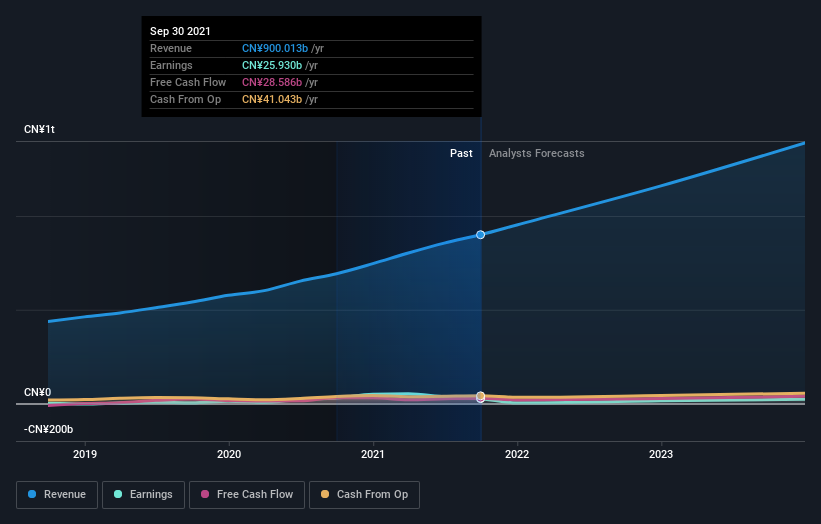

As mentioned these are only estimates, so we also need to look at JD.com's outlook and value based on the most recent financial data. JD.com may appear to be trading at a discount, but sentiment will change for the better or worse if the outlook changes.

View our latest analysis for JD.com

What kind of growth will JD.com generate?

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matters the most, a more compelling investment thesis would be high growth potential at a cheap price. Profits are now expected to grow by 32% over the next couple of years - but that comes off a very low base. The net income margin is very narrow, which means a slight improvement would lead to strong earnings growth. Earnings growth stalled dramatically over the last year, and a reacceleration could change sentiment dramatically.

What this means for you:

There’s no doubt that the distribution of JD.com shares by Tencent will increase supply in the short term. But looking further ahead, JD.com appears to be trading at a better valuation, and an uptick in earnings growth would lead to improved sentiment. Of course, regulatory issues in China are still a risk to keep in mind.

If you'd like to dive deeper into this stock,there are 2 additional warning signs that you should run your eye over to get a better picture of JD.com.

PS. The Simply Wall St app conducts a discounted cash flow valuation for every stock on the NYSE every day. If you want to find the calculation for other stocks just search here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:JD

JD.com

Operates as a supply chain-based technology and service provider in the People’s Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026